The Aarti Industries Limited announced to separate its small business vertical and to merge one of its subsidiaries’ tiny manufacturing unit with itself. The move seems in the direction of concentrating on its core business verticals and to develop other “Strategically unfit” business verticals separately.

Aarti Industries Limited (AIL) is one of the most competitive benzene-based speciality chemical companies in the world. AIL has 125+ products, 500+ domestic customers, 150+ export customers spread across the globe in 60 countries with a major presence in USA, Europe, Japan. AIL serves leading consumers across the globe of Speciality Chemicals and Intermediate for Pharmaceuticals, Agro Chemicals, Polymers, Pigments, Printing Inks, Dyes, Fuel additives, Aromatics, Surfactants and various other speciality chemicals.

Currently, the company has three main divisions. Speciality Chemicals, Pharmaceuticals and Home & Personal Care.

Past-Transactions

The Transaction

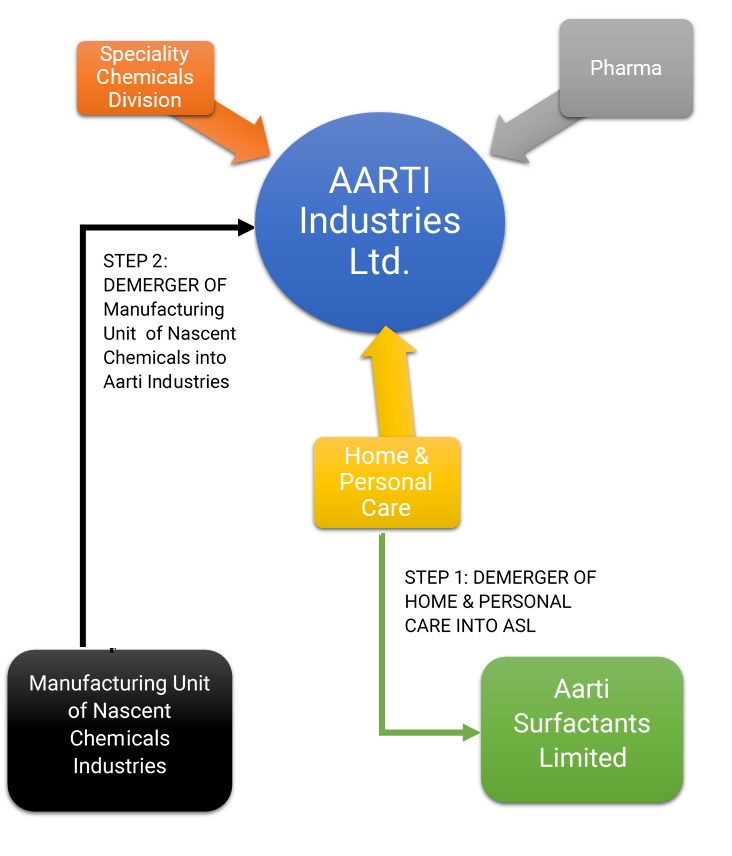

The Company announced a scheme of arrangement pertaining to Demerger of Home and Personal Care segment of the Company and merger of the manufacturing operations of Nascent Chemicals Industries Limited into the Company.

Step 1: The demerger of the home and personal care undertaking of Aarti Industries into Arti Surfactants Limited (ASL).

Step 2: The demerger of the manufacturing undertaking of Nascent Chemical Industries Limited (NCIL) into AIL.

ASL, a wholly owned subsidiary of AIL, has been newly incorporated by AIL for the proposed demerger. NCIL is engaged in the business of manufacturing and trading of speciality chemicals. Currently, AIL holds 50.49% of NCIL through its wholly owned subsidiary. The rest stake is held by Mashruwala Family.

Appointed Date:

- Appointed date for demerger of Home & Care Undertaking is the opening of the business hours on 1st April, 2018.

- Appointed date for demerger of Manufacturing Undertaking is the opening of the business hours on 2nd April, 2018.

Swap Ratio

- For the demerger of Home & Personal Care Undertaking:

- For every 10 equity shares of AIL, the holders of such equity shares shall have the option to subscribe to the following:The move seems in the direction of concentrating on its core business verticals and to develop other “Strategically unfit” business verticals separately.

(a) 1 equity share of the ASL; or

(b) 1 Redeemable Preference Share of the ASL.

Note: Default option being the equity shares.

- For the demerger of Manufacturing Undertaking:

- 151 equity Shares of AIL for every 100 equity shares of NCIL.

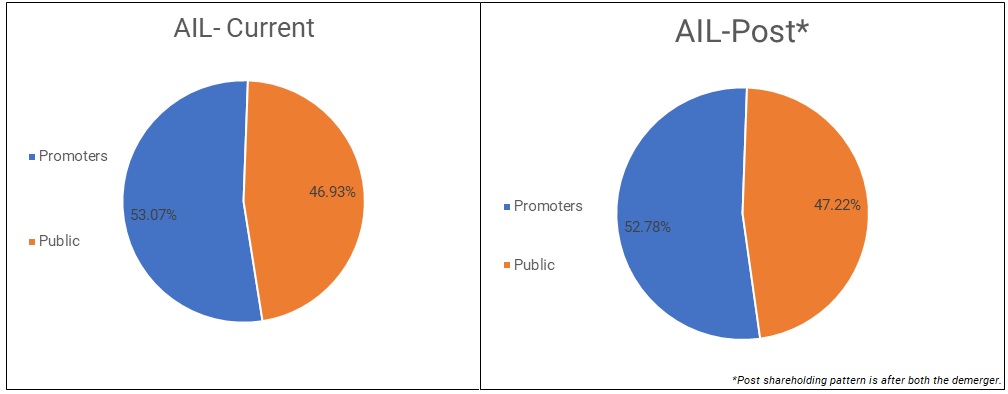

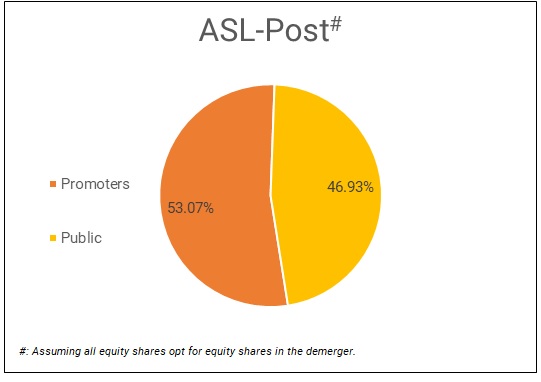

Changes in Shareholding pattern

*Post shareholding pattern is after both the demerger.

#: Assuming all equity shares opt for equity shares in the demerger.

Currently, various Institutions hold ~18% stake in AIL. Considering the post-demerger size of ASL, it is likely that these institutions opt for the preference shares. If all the shareholders excluding institutions opt for the equity shares, the promoters holding in the ASL will become ~65%.

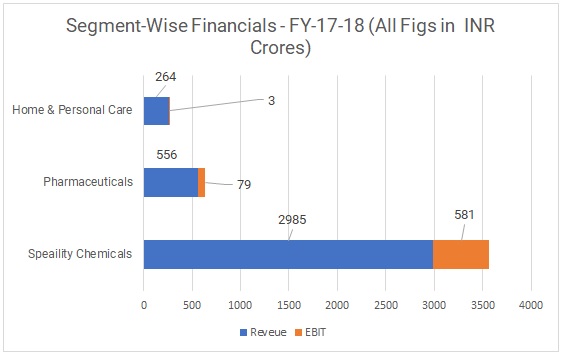

Financials

Table 1: Segment-Wise Financials for Q1 of FY-19 (All Figs in ₹ Crores)

| Particulars | Speciality Chemicals | Pharmaceuticals | Home & Personal Care |

| Revenue | 848 | 150 | 80 |

| EBIT | 148 | 26 | 2 |

| Segment Assets | 2928 | 817 | 242 |

| Segment Liabilities | 393 | 66 | 43 |

Home & Personal Care business vertical is too small compared to the other two business verticals of AIL. The business contributed ~7% of the total revenue of AIL.

Manufacturing Undertaking

Table 2: Financials of Manufacturing Unit (All Figs in ₹ Crores)

| Particulars | Amount |

| Turnover (FY18) | 12 |

| Networth of the undertaking | 11 |

Valuation

Table 3: Valuation of the businesses getting demerged (All Figs in INR Crores)

| Particulars | Amount |

| Home & Personal Care | 136 |

| Manufacturing Undertaking | 112 |

End Note

The Home & Personal Care unit is too small in terms of margins compared to the other two business verticals of AIL. The Home & Personal Care business has a different level of competition & different marketing strategies. The Home & Personal Care unit might be not being “strategically fit” with the current product portfolio of AIL & required to nurture it. In the coming period, promoters could bring a strategic investor on board to develop this business further in future or might sell to the big fish in the similar business.

The manufacturing division of NCIL manufactures chemicals on behalf of AIL. The reasons could be consolidation whilst to provide an option for a part exit from the business to the other shareholders of NCIL.