In 2019-20, Reliance Industries Limited did multiple re-jigs to ready its telecom arm Reliance Jio Limited for massive fundraise. Recently, its competitor, Bharti Airtel Limited announced a new corporate structure which will enable the company to place its entire “Telecom Business” into an unlisted subsidiary most likely followed by entry of strategic/financial investors.

Bharti Airtel Limited (“BAL”) is a global communications solutions provider in 18 countries across South Asia and Africa. The company ranks amongst the top three mobile operators globally and its networks cover over two billion people. Airtel is India’s largest integrated communications solutions provider and the second-largest mobile operator in Africa. Airtel’s retail portfolio includes high speed 4G/4.5G mobile broadband, Airtel Xstream Fiber with convergence across linear and on‐demand entertainment, streaming services spanning music and video, digital payments, and financial services.

[rml_read_more]

Currently, BAL along with its subsidiaries is engaged in the business of:

- Indian Telecom Business

- International Telecom Business

- Telecom Infrastructure Business

- Digital Business (Wynk Music, Airtel X stream, Airtel Thanks etc)

- Payment Bank

To sharpen the focus of the company in driving the rapidly unfolding digital opportunity in India while enabling it to unlock value, BAL announced new structure which will envisage consolidation of all Digital Business into Bharti Airtel Limited followed by demerger of Telecom Business.

Airtel Payments Bank will remain a separate entity under Bharti Airtel and work closely with the growing customer base to play a pivotal role in realising the digital opportunity that payments and financial services provides.

All the company’s infrastructure businesses such as Nxtra and Indus Towers will continue to remain in separate entities as they are currently. So will international subsidiaries and affiliates.

Nettle Infrastructure Investments Limited (“Nettle”) is engaged in promoting, establishing and funding companies engaged in the business of providing telecom services and other companies engaged in the activities ancillary to the telecom industry.

Telesonic Networks Limited is engaged in designing, planning, deploying, optimizing and managing broadband and fixed telephone networks across India. Telesonic also holds a registration certificate for infrastructure provider category-I (IP-I) and is engaged in the business relating to optical fiber cable (including underground and over ground cables).

Airtel Digital Limited is engaged in procurement, aggregation, and provision of content services to its B2B and B2C customers and in the provision of OTT services which include ‘Airtel Thanks’ app for self-care, ‘Airtel Xstream’ app for video, ‘Wynk Music’ for entertainment and ‘Airtel BlueJeans’ for video conferencing.

Airtel Limited is a newly incorporated company incorporated to house Telecom Business undertaking.

The demerger intended to house all the telecom businesses in a newly created entity, Airtel Limited – a wholly-owned subsidiary of Bharti Airtel Limited. Bharti Telemedia, the 100% arm operating DTH services will sit alongside Airtel Limited for now. It is intended to eventually fold the DTH business into Airtel Limited to move towards the NDCP vision of converged services to customers. The company has moved the government to seek clarity on licensing policy given that carriage i.e., telecom and DTH is currently being regulated and managed under two separate ministries of Communications and I&B respectively.

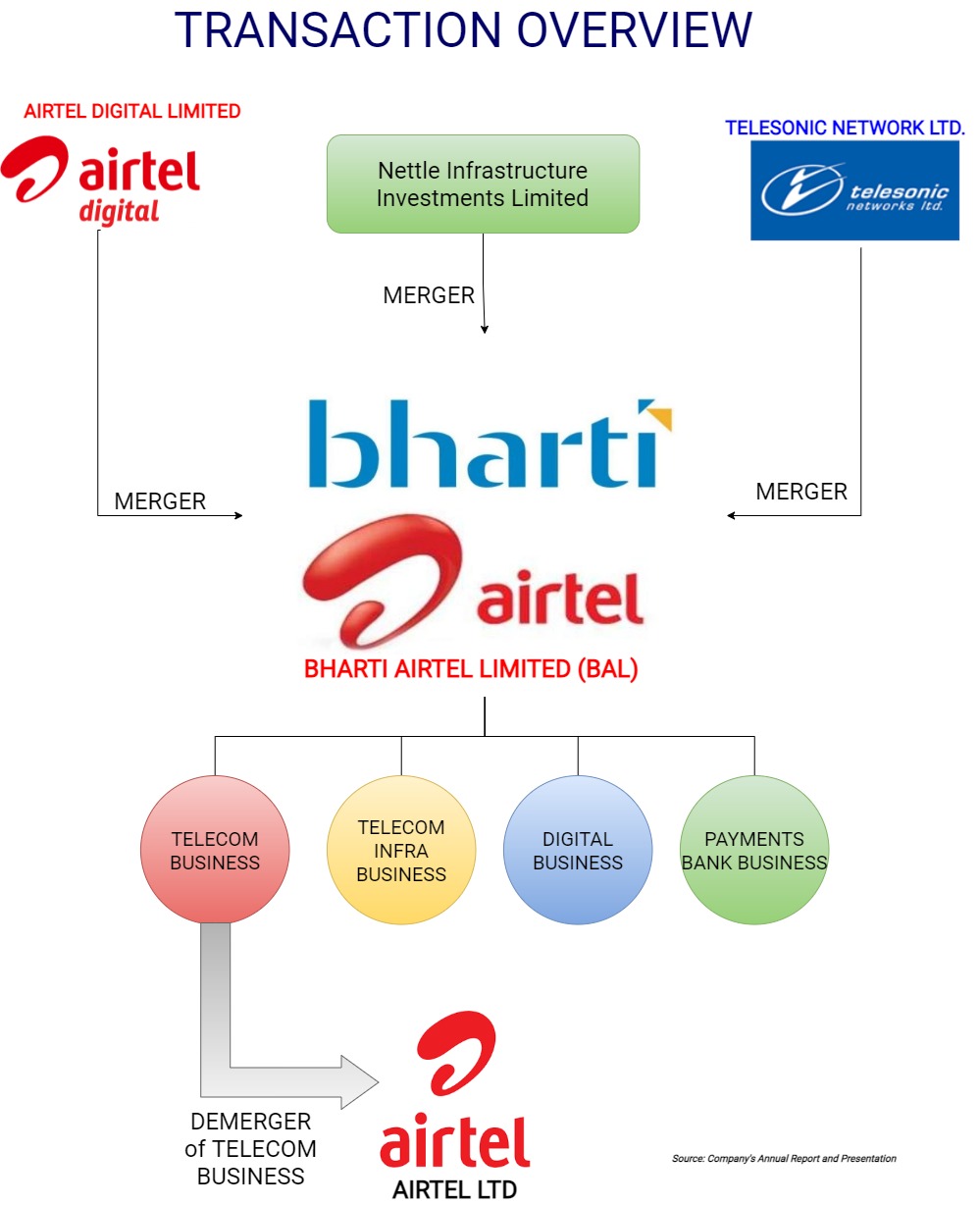

TRANSACTION OVERVIEW

The above-mentioned structuring will be achieved through a scheme of arrangement whereby:

- Amalgamation of Nettle Infrastructure Investments Limited, Airtel Digital Limited, and Telesonic Networks Limited, wholly-owned subsidiaries with and into Bharti Airtel Limited; and

- Demerger of the Telecom Business Undertaking of Bharti Airtel Limited and vesting of the same with Airtel Limited, its wholly-owned subsidiary on a going concern basis subsequent to the completion of the aforesaid amalgamations.

“Telecom Business Undertaking” means entire telecom business carried out by BAL including mobile. Fixed-line telecommunication, broadband services, spectrums, Licenses etc. Remaining Business will its international telecom business, Digital Business such as content services to its B2B and B2C customers and also in the provision of OTT services which include ‘Airtel Thanks’ app for self-care, ‘Airtel Xstream’ app for video, ‘Wynk Music’ for entertainment and ‘Airtel BlueJeans’ for video conferencing, Fiber optic, payment business, Tower infrastructure business etc.

Currently, Nettle Infrastructure Investments Limited, Airtel Digital Limited, Telesonic Networks Limited, and Airtel Limited, are directly/indirectly wholly-owned subsidiaries of BAL.

The Appointed Date for the transaction is Effective Date i.e., on following order sanctioning the scheme with Registrar of companies post-approval by all government authorities.

Scheme also clarifies that the ‘Airtel’ brand shall continue to be owned by BAL. As part of the demerger of the Telecom Business Undertaking, Airtel Limited shall have the right to use the ‘Airtel’ brand for a period of 5 (five) years from the Appointed Date without payment of any royalty or fees to BAL. BAL and Airtel Limited may enter into agreements in relation to the aforementioned arrangements for the ‘Airtel’ brand. Further, the Telecom Business Undertaking has various inter-dependencies with the Residual Business of BAL and, therefore, under Scheme, BAL proposes to undertake various business relationships with Airtel Limited, on an arms’ length basis including indefeasible right to use the optical fiber network of BAL. All the existing arrangement with various group companies will continue in future.

Consideration

Upon demerger of “Telecom Business undertaking” into Airtel Limited, the scheme envisages issuance of non-participating, Compulsorily Convertible Preference Shares (“CCPS”) to the equity shares of BAL as a consideration. Further, based on the management decision, it is proposed that the number of CCPS shall not exceed 1,25,000 and thus, accordingly swap ratio has been arrived by the valuer.

Considering the current equity shares of BAL, swap ratio is:

1 (one) paid-up CCPS (Compulsorily Convertible Preference Shares) of Face Value of INR 100 each of Airtel Limited for every 43,936 (Forty-Three Thousand Nine Hundred and Thirty-Six) equity shares of BAL.

Key Terms of CCPS:

| Face Value | INR 100 per share |

| Dividend Rate | 0.01% |

| Conversion Time | Each of the outstanding CCPS shall automatically and mandatorily be converted into equity shares on the Mandatory Conversion Date.

|

| Conversion Ratio | 10 (Ten) equity shares of Rs. 10 (Indian Rupees Ten) each against 1 (One) CCPS of Rs. 100 (Indian Rupees One Hundred) each. |

Any shareholder entitled to fractional CCPS shall receive cash in lieu of CCPS on the basis of fair market value as on the Effective Date. CCPS issued by Airtel Limited will not be listed on any exchanges.

The Scheme also provides for certain threshold for issuance of CCPS. Any shareholder entitled to CCPS less than 10 (or a lower number as per threshold to be determined later) shall receive cash in lieu of CCPS based on fair market value as on the Effective Date to be computed by the registered valuer. Thus effectively, shareholder holding less than 4,39,360 shares of BAL may not receive any CCPS.

The said swap ratio & Threshold may undergo change depending upon:

Foreign Currency Convertible Bonds (‘FCCBs’) issued by BAL, which if converted into equity shares before the record date then the share entitlement ratio will be modified such that the total number of CCPS to be issued as per revised ratio does not exceed the total number of CCPS that BAL’s shareholders might be entitled to as per the present entitlement ratio, as if no dilution would have happened because of FCCB (Foreign Currency Convertible Bonds) holders.

Further, to comply with the definition of demerger as per section 2(19AA) of Income Tax Act, 1961 it is also proposed that if the equity shareholders of BAL entitled to receive cash consideration under hold more than one-fourth in value of the equity share capital of BAL, then the threshold number shall stand reduced to the nearest whole number such that equity shareholders holding not less than three-fourths in value of the equity share capital in BAL become CCPS holders of Airtel Limited.

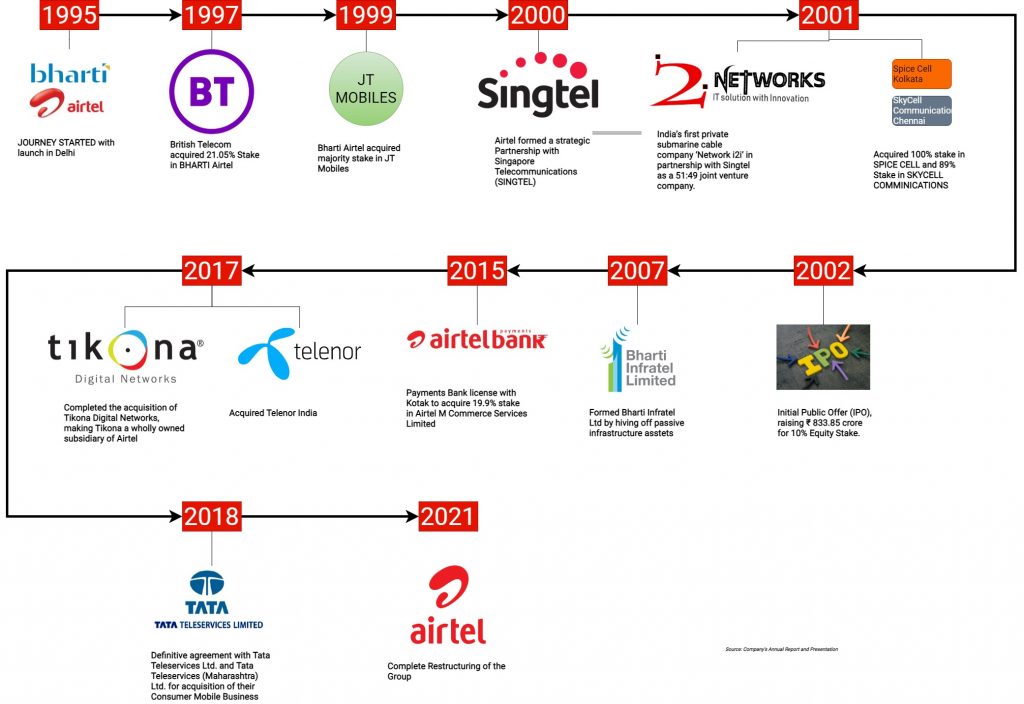

M&A Highlights of Bharti Airtel from inception

Few articles we covered

- Indus Towers: World’s largest tower company: Forced Exit by Idea & Providence?

- AIRTEL acquires Telenor

- TATA TELESERVICES TO SELL CONSUMER MOBILE BUSINESS TO BHARTI AIRTEL

- Airtel: Creating Numero Uno position in VSAT Business

Post-transaction Structure

The proposed scheme also provides for Airtel Limited shall issue to BAL and/ or its (direct or indirect) wholly-owned subsidiaries 49,87,40,000 equity shares at Rs. 10/- per equity share, fully paid, at any time on or prior to the Effective Date. BAL will continue to hold the entire equity share capital of Airtel Limited. The allotment could be considering the required minimum NetWorth/capital for a Telecommunication company in India.

So immediately after the Effective Date, the capital structure of Airtel Ltd will be as follow: –

| Particulars | Number |

| Existing Equity Shares of Airtel Limited | 10,000 |

| Proposed Issue of equity shares to BAL and/or its WoS (Wholly Owned Subsidiary) | 49,87,40,000 |

| Total Equity Shares after issue | 49,87,50,000 |

| Issue of CCPS | 1,25,000 |

| Conversion Ratio | 10 |

| Equity shares to be issued on conversion | 12,50,000 |

Post conversion Likely capital structure and shareholding of Airtel Limited will be as follow:

| Particulars | Number | % |

| BAL | 49,87,50,000 | 99.75% |

| CCPS holder (after conversion) | 12,50,000 | 0.25% |

| Total | 50,00,00,000 | 100% |

Above shareholding is assuming that no shares were tendered during Exit Mechanism.

Interestingly, the consideration has been designed in such a way that CCPS will be issued only promoters along with other institutional shareholders and almost entire holding along with control shall continue to remain with BAL. Effectively, BAL has taken its entire Telecom Business into an unlisted company which will paw the way for strategic investors who are waiting to invest only in telecom business of BAL.

The structure opted by other Companies including Reliance Jio may not be optimal due to recent changes in taxation of Slump Sale. However, by designing consideration, this structuring will entail BAL to achieve its commercial objectives in a tax neutral way.

The beneficial interest of shareholders of BAL will continue to remain same even after the transaction, till conversion of CCPS though change will not be significant.

Exit Mechanism

The CCPS issued by Airtel Limited will not be listed on any exchanges. An exit mechanism will be provided to all the CCPS holders for 3 years from the effective date based on periodic valuations (with a validity of 6 months) to be done. Each CCPS holder shall have the right to tender the CCPS issued to them to BAL and/or its (direct or indirect) wholly owned subsidiaries, at any time on or prior to 3 (three) years from the Effective Date.

Since CCPS will be unlisted, the dividend rate on CCPS and time taken for conversion, most of the CCPS holder likely to tender their shares under Exit Mechanism.

Valuation of Telecom Business & CCPS

| Particulars | Amount |

| Existing Market Cap of BAL (as on 5.5.21) | 3,07,500 crores |

| Assigned Equity Valuation of Telecom Business | 1,79,670 crores |

| Estimated Assigned Enterprise Valuation to Telecom Business | 2,94,083 crores |

| % Of CCPS (after conversion) | 0.25% |

| Total estimated value of CCPS | 449.2 crore |

| Number of CCPS | 1,25,000 |

| Value per CCPS | 36,034 per share |

Estimated Valuation given to Reliance Jio (RJIO) by at a time of Fundraise by Facebook

| Particulars | Amount |

| Enterprise Value | 4,61,632 crores |

| Equity Value | 4,21,000 crores |

| Reliance “Digital” Business segment Revenue for FY 2020 | 54,316 crores |

One must note that the valuation given to Reliance Jio was cumulative to its Telecom Business as well as Digital Business and in valuation of INR 179,670 crores is only pertaining to telecommunication business of BAL. Further, with current structure, BAL will place its entire digital business with itself which is currently placed in a subsidiary while its core business will be placed in subsidiary. This arrangement could initially result in change in overall valuation of BAL on account of holding company discount while the long-term valuation will depend on action taken by BAL post-rejig and entry of strategic partner and amount infused by them.

Assuming an investor holds 1000 shares of BAL, the consideration to be received by him as a result of demerger:

| Particulars | Amount |

| Number of Shares | 1000 |

| CCPS entitled | 0.0023 |

| Value per CCPS | 36,034 |

| Cash consideration to be received | INR 820 |

| Cash Per Share | INR 0.82 |

The above value may change subject to valuation of CCPS on effective date.

Financials

Financials of BAL/Telecom Business of BAL

INR in million

| Particulars | 9M ended on 31st December 2020 | 31st March 2020 |

| Standalone Revenue of BAL | 490,749 | 565,596 |

| Consolidated Revenue of BAL | 754,274 | 862,122 |

| Revenue of Telecom Business getting transferred | 483,366 | Not Available |

| % Of Telecom Business Revenue to standalone Revenue of BAL | 98.5% | Not Available |

| % Of Telecom Business Revenue to consolidated Revenue of BAL | 64.1% | Not Available |

| Standalone Debt* | Not Available | 7,77,804 |

| Net Consolidated Debt | 14,74,382 | 12,45,209 |

*: Excluding current maturities of long-term debt.

Movement of Debt as on 31st December 2020:

INR in Million

| Particulars | BAL-Consolidated | Telecom Business |

| Total Debt (Net of current portion for BAL) | 12,54,557 | 8,56,304 |

| Lease Liabilities | 3,24,529 | 3,00,160 |

| Cash & Cash Equivalent | 98,344 | 4,975 |

| Investments | 6,360 | 4,664 |

| Net Debt including Lease Obligation | 14,74,382 | 11,46,725 |

Conclusion

Bharti Airtel Limited, has become a conglomerate having portfolio ranging from physical assets including tower infrastructure, telecommunication business and new age digital business and having vale added digital services. Telecom Business risks and returns and type of investors who could be interested are quite different as compared to other businesses. It needs large funds for paying past revenue sharing dues to be paid to government as per the Honorable Supreme Court decision and to acquire spectrum for 5G rollout for its customers.

For BAL, it is difficult to raise huge funds at holding company level because of present debt-equity ratio, cash flow and present promoters’ stake. To raise huge funds required, it has very few options other than diluting stake in its Telecommunication Business. Thus, present scheme is to facilitate such massive fundraise by demerging Telecommunication Business while consolidating Digital Business into BAL.

Going ahead, with sea changes in technology space, valuation of digital business going to be higher as compared to the asset heavy infrastructure business. BAL’s digital business is still in nascent stage and may require further nurturing. Thus, it seems BAL do not want to put any value to it at this stage and want all institutional and public shareholders and even foreign promotors to get full economic value out of the same in its future growth. Indian promoters may not like to dilute its stake by offering shares of present listed company.

The new tax-efficient structure will enable BAL to dilute a substantial stake in Telecom Business and at the same time reduce its leverage. Massive amount of capital expenditure will be required by BAL to roll out 5G services in the coming days. Considering the staggering debt, it currently has, carving out telecom business and then inviting some strategic partner looks essential for BAL. The Company has already announced various restructuring initiatives like MoU for the potential sale of its tower assets in Chad and Gabon to Helios Towers for USD 108 million; MasterCard investment of USD 100 million in Mobile Money Africa; USD 200 million investment in Mobile Money by TPG’s Rise Fund; and Sale of spectrum in 800 MHz to RJio to reduce its debt by monetising its asset. Most of the funds infused by strategic investor in future likely to be used for expansion while BAL may also seek to reduce some of the debt it will have after demerger.

As an unlisted company, the new structure will involve lessor regulatory compliances /challenges including SEBI (Securities and Exchange Board of India) Takeover Code and ease introducing both strategic and financial partner. In future, BAL may or may not list its telecom business.

Add comment