Alembic Ltd (Alembic), incorporated in 1907, is part of Alembic group and it is engaged in the business of manufacturing and trading active pharmaceutical ingredients (API) and Real Estate Developments. It also has investment in Alembic Pharmaceuticals Limited (APL).

Shreno Limited (Shreno), incorporated in 1944, is engaged in the business of manufacturing and trading of glassware items, machinery and equipments (engineering) required for various industries, making investments and real estate developments.

Nirayu Pvt. Ltd. (Nirayu), incorporated in 1971, is currently holding investment in shares and securities of various entities.

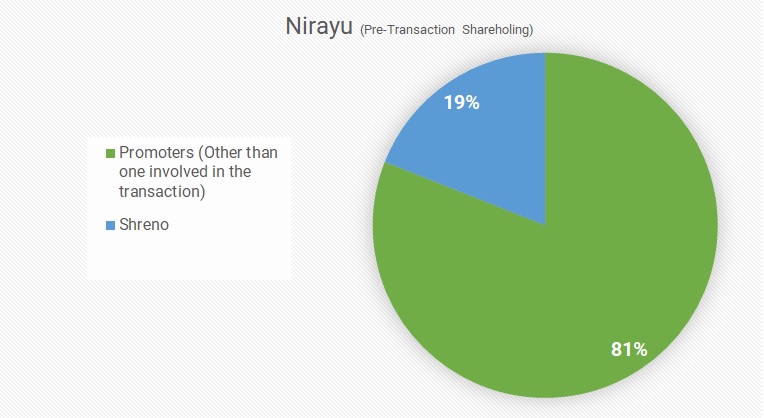

Current Shareholding of the companies

Please Note:

- 1% OCPS of Shreno limited of book value Rs. 8.71 crores were converted in equity shares by alembic Limited in FY 2018 Therefore the final total investment by Alembic in equity is Rs. 35.13 crores.

- Alembic acquired 55% stake in Alembic City Limited resulting into WOS of the company with Total investment of Rs. 07 Lakhs

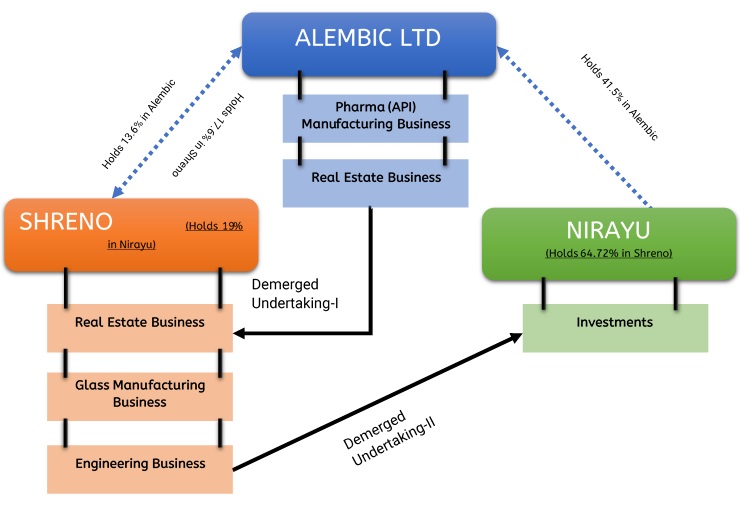

Pre-Transaction

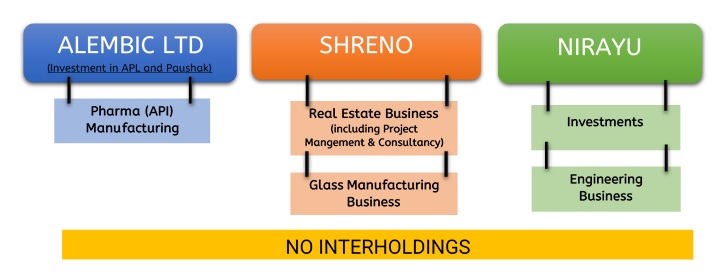

Post Transaction

Transaction Details

Demerger 1:

Demerger of Demerged undertaking 1 consists of current residential real estate project on land bearing survey no. 256/2 part admeasuring approx. 4500 square meters comprised in town planning scheme no. 13, by final plot no. 78, plot no 2, Vadodara 390024 along with real estate interest held through investment in Shreno and project management consultancy of Alembic limited into Shreno Limited with appointed date 1st November 2018 with swap ratio for every 1 equity share in alembic 1, 7% non-convertible cumulative Redeemable preference shares issued by Shreno limited.

Demerger 2:

Demerger of Demerged undertaking 2 consists of engineering and investment division along with interest held through investment in Nirayu of Shreno limited into Nirayu Limited with appointed date 1st November 2018 with swap ratio for every 1 equity share in alembic 1, 7% non-convertible cumulative Redeemable preference shares issued by Nirayu.

Pointer to be noted:

- Small shareholders have been defined as shareholders other than promoters who holding at the time of redemption is of amount less than 2 lakhs.

- Terms of Preference Shares

| Terms | Issued by Shreno | Issued by Nirayu |

| Coupon Rate | 7% | |

| Voting rights | in accordance with section 47(2) of the companies Act 2013 | |

| Face Value | Rs. 2 per share | Rs. 100 per share |

| No. of share allotted | 25,67,81,828 shares | 59,48,298 shares |

| Valuation | Approx. 424 crores | Approx. 1,874 crores |

| Issue price and redemption price | Rs. 16.50 per share | Rs. 3,150 per share |

| Redemption terms | Redeemed in one or more tranche anytime on or before expiry of 5 years from the date of allotment | |

| Please Note:

o Small shareholders shall be redeemed at any time at the discretion of Shreno on or before expiry of 2years from the date of allotment. o They will be given first preference in redemption o If no redeemed by the company then Nirayu holding company will purchase from them |

||

- Non-Resident will be allotted preference shares if allowed as per FEMA regulations and RBI and if not then cash consideration directly or through merchant banker escrow account after deduction of withholding tax

- Inter Company Holding (Alembic Holding in Shreno and Shreno holding in Nirayu) will be cancelled

- Remaining Nirayu will hold investment and engineering division and will be converted in public limited company

- Remaining Shreno will hold Real Estate development and project management consultancy

- Remaining Alembic is major investment in Alembic Pharmaceuticals Limited and Paushak Limited and business of API.

- Allotment by Shreno to the shareholders of alembic will excluding it shareholding in alembic

Rationale of the Transaction

- Exit to shareholders other than promoters in real estate and project management consultancy division of Alembic

- Consolidation of promoters group companies in to one promoter entity i.e. Nirayu limited, holding Alembic stake of approx. 54.74%. Previously amalgamation of Sierra Investments Private Limited and Whitefield Chemtech Private Limited with Nirayu Private Limited lead to 41.11 % stake in Alembic limited.

- Creation of additional liquidity for the shareholders of Alembic

- Elimination of intercompany cross holdings

- Enhancing shareholders value by creating leaner and focused organisations

Accounting

Taxation

Income tax neutral as in compliance of section 2(19AA) of the Income Tax Act. However, there will be stamp duty implication of the Transaction.

Valuation

The Valuation has been arrived as follows:

- Unlisted cash generating unit has been valued applying DCF method (Reals Estate Division and Project management)

- Investment in unlisted non-operating companies has been valued at net realisable value

- Investment in listed securities valued under SEBI (ICDR) Regulations

- Valuation of Land and building Fair market value based on expert’s report

- Investment in holding company sump of parts method

Even though Valuation is done at fair value it seems Shreno has been valued at discount for holding investment as exit given to public shareholders.

Conclusion

The demerger will create three entities for the group one with Active pharmaceutical ingredient business including investment in APL and Paushak as Alembic listed entity and another with real estate, project management and glass into Shreno into unlisted entity and final Nirayu which will be holding company for Alembic including investment in APL and Paushak. Exit to the public shareholders from Real Estate and Project management considering this business smaller in size and also cancellation of intercompany holding as this was not captured in market cap. of Alembic holding company. However, going forward management may further simply structure with consultation of alembic into APL and create for all the shareholders.

Add comment