Crompton Greaves Consumer Electricals Ltd. (“Crompton”) has signed definitive agreements to acquire a controlling interest in Butterfly Gandhimathi Appliances Ltd. (“Butterfly”). Crompton was formed in 2016 because of the demerger of B2C Consumer Product Business of Crompton Greaves Limited which was later acquired by a Private Equity Advent International along with Temasek. Private Equities tried to give its Midas touch and was quite successful in turn around Crompton’s core business but were unable to mark its presence in Kitchen Appliances Business. Will Butterfly’s acquisition facilitate Crompton in establishing its footmark in the Appliances market?

Crompton is India’s market leader in the category of fans and residential pumps. The company manufactures various products such as water heaters, anti-dust fans, antibacterial LED bulbs and a range of other categories like air coolers, food processors like mixer grinders, electric kettles and garment care like irons.

Butterfly Gandhimathi Appliances Ltd has emerged as the largest manufacturer of domestic kitchen and electrical appliances in India. Company’s wide range of products marketed under the ‘BUTTERFLY’ brand includes LPG Stoves, Mixer Grinders, Tabletop Wet Grinders, Pressure Cookers, Stainless Steel Vacuum Flasks and Non-Stick Cookware. Other products comprise Juicers, Hand Blenders, Electric Irons, Power Hobs, Electric Rice Cookers, Water Heaters (Geysers), Air Coolers, Electric Water Kettle, Electric Sandwich Maker, Electric Bread Toaster, Fans and Washing Machine.

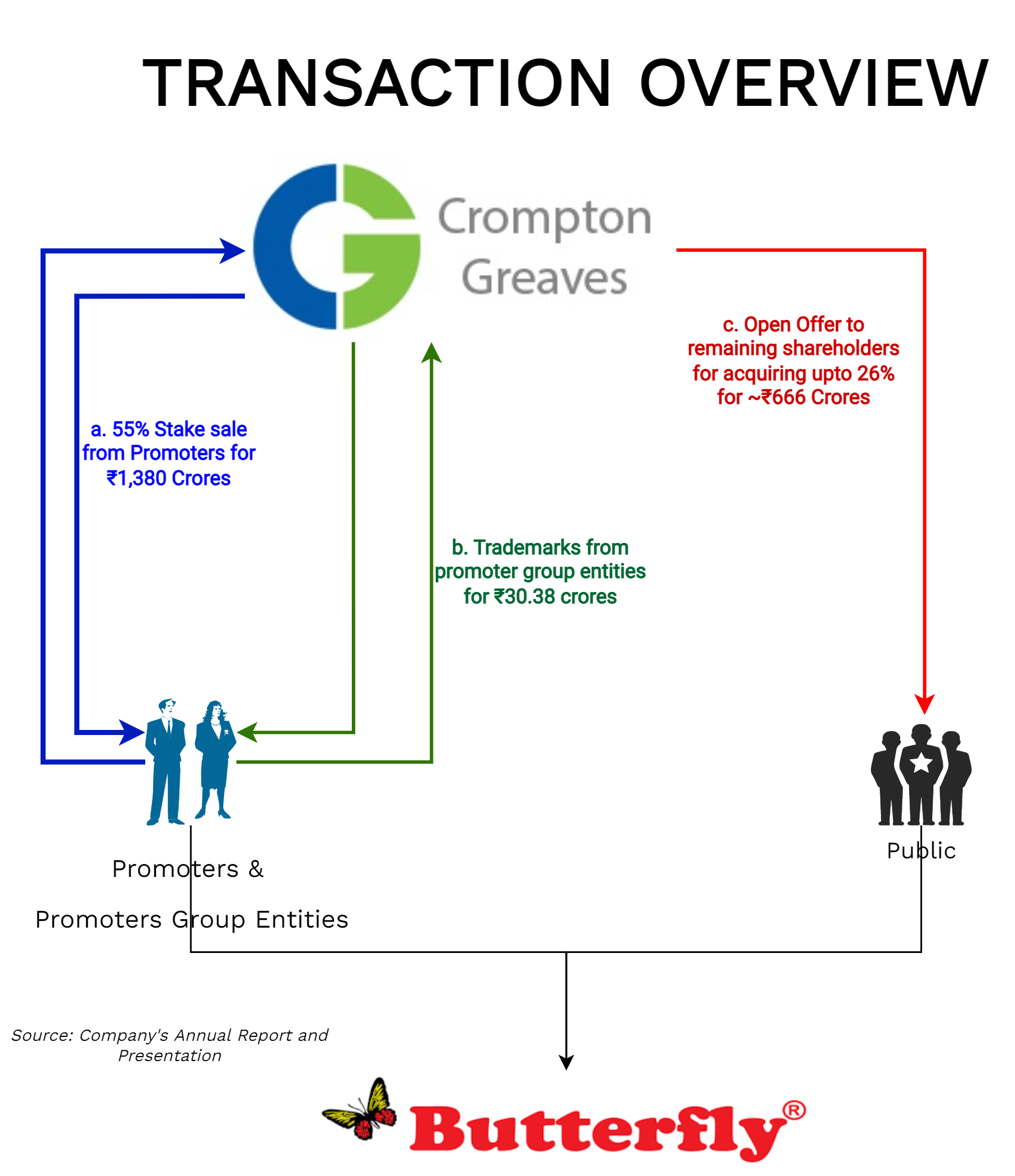

The Proposed Transaction

Crompton has entered into a share purchase agreement dated February 22, 2022 with the existing promoters of butterfly which entails Crompton to acquire (a) up to 55% stake from the existing promoters of Butterfly, aggregating up to INR 1,380 crore, and (b) certain Butterfly trademarks in allied and cognate classes from promoter group entities (“Trademarks”) aggregating INR 30.38 crore.

Pursuant to the acquisition, Crompton will give the mandatory open offer to the public shareholders of Butterfly, for acquiring up to 26% stake in Butterfly, aggregating up to INR 666 crore. Thus, if open offer fully subscribed, Crompton will buy circa 81% stake in Butterfly for an aggregate total consideration of unto INR 2,076 crore.

Post-transaction, the existing promoters of Butterfly will continue to hold 9.58% stake in the company. The stake may change slightly on account of various clauses such as liquidity shares, slippage shares etc in share purchase agreement. However, post-acquisition, the existing promoters will be classified as “public shareholders,” they will ensure to hold lessor than 10% stake in Butterfly. As per the interview given by the existing shareholders of Butterfly, eventually, the existing promoters will completely exit Butterfly and will focus on some other export-oriented business.

Crompton has also executed a non-compete agreement with the existing promoters of Butterfly.

Rationale for the Acquisition:

This acquisition is a transformational step towards Crompton’s long-term strategic goal of becoming a leading pan-India player in small domestic appliances. As one of the few integrated manufacturers in this space, Butterfly offers immediate scale in kitchen appliances with its diverse portfolio, increasing the share of SDA in Crompton’s offering. This diverse portfolio spans a complementary set of segments, including mixer grinders, stoves and cooktops, table-top wet grinders, pressure cookers, etc.

Backed by a ready manufacturing and R&D infrastructure, along with Company’s key capabilities and pan-India reach, Butterfly creates a strong opportunity for innovation and expansion in core and adjacent categories and is expected to unlock synergies for both companies.

Expansion of Product Portfolio:

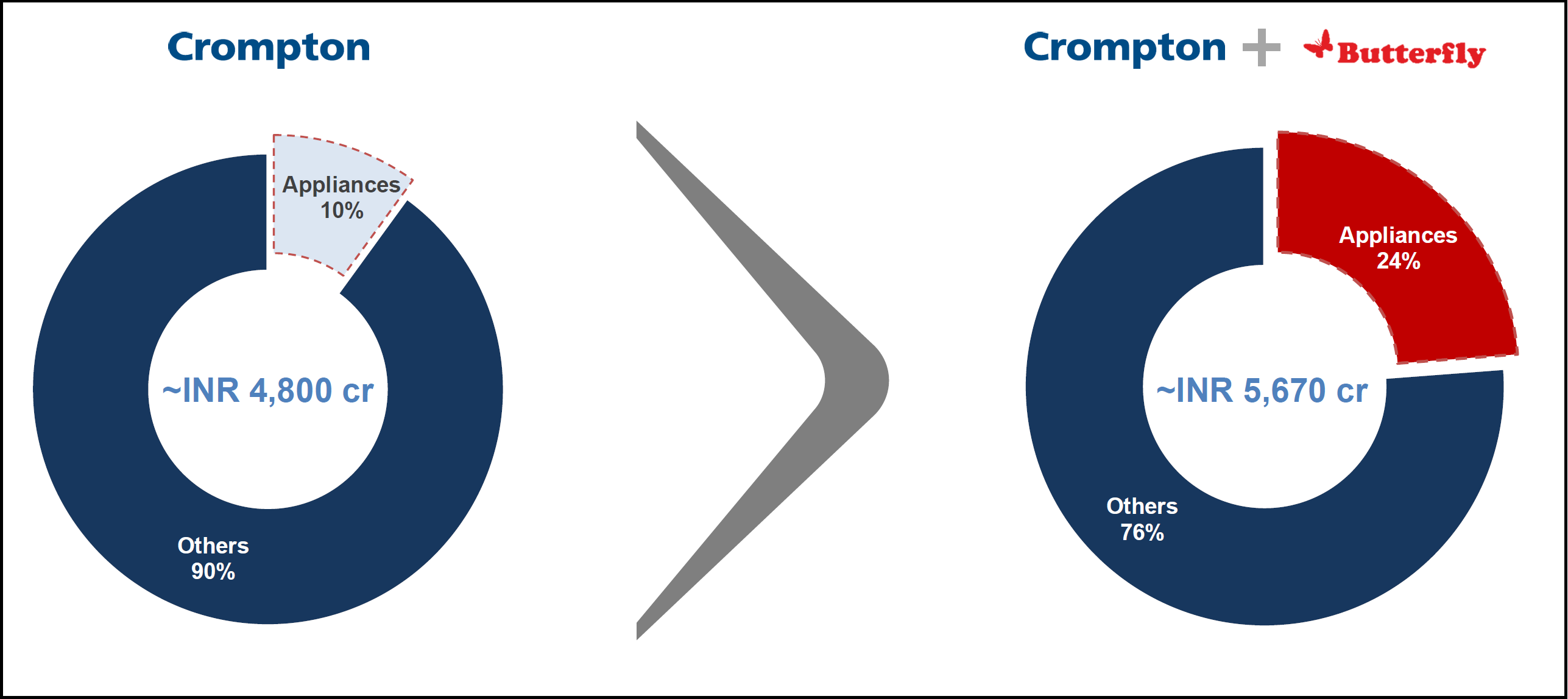

Crompton is a leader in fans & pump market but has a small presence in kitchen appliances. For a couple of years, Crompton was trying to expand its appliances segment, however, was not that successful vis-à-vis Butterfly is extremely strong in Kitchen Appliances Segment.

Crompton operates mainly in 2 segments Lightning Products and Electrical Consumer Durable (which includes appliances). For FY 2021, around 22% revenue came from Lightning while the remaining 78% from and Electrical Consumer Durable. In Electrical Consumer Durable, major revenue comes from Fans, Pumps. Even the Appliances segment of Crompton is dominated by Water heaters and Air Coolers. Thus, Butterfly acquisition provides opportunity for Crompton to significantly scale its Small domestic appliances category.

Geographical Expansion

Crompton is a pan-India brand while Butterfly has significant domination in Southern India. In the south, Butterfly is no 1 brand in stoves and wet grinders while it ranks in top 3 in wet grinders across other regions. Almost 76% of Butterfly’s sales come from the Southern side.

Manufacturing Facilities:

Most of the revenues for Butterfly comes from its own manufacturing vs Crompton who significantly outsource. While Crompton has several plants, all are located either in Western of Northern India while all plants of Butterfly are located in Southern India. Further, Crompton has also separately acquired circa 12.49 acres of land near Chennai from the existing promoters of Butterfly for INR 95 crore. This land is adjacent to the existing facility of Butterfly. This provides a significant opportunity for Crompton not only to scale the existing operations of Butterfly but also to start manufacturing its own products from southern region.

Access to a strong Network & Brand

Butterfly has a strong network of 500+dealers and more than 25,000 retailers which will get added to Crompton’s existing retail network of 130,000 outlets. It has more than 700 SKU’s which will give a strong support for Crompton to cross-sell its existing products mainly into southern India. More than 94% of total sales of Butterfly comes from Branded Retail Sales. Further, going ahead, Crompton & Butterfly can share the brand with each other such that in other side Butterfly products can be sold in the name of “Crompton” and in Southern side, Crompton can sell its product through Butterfly Branding. Similarly, Butterfly can use the dealer’s network of Crompton to improve its sales.

Professional Management

While Butterfly is currently run by a family, Crompton is run by professional management. Post-acquisition in 2016, a couple of changes were done in Crompton to improve scale and efficiency of the business. In last couple of years, Crompton focused on low-cost innovation, value-added products etc. Going ahead, same changes can be observed in Butterfly to increase its sales & efficiency.

Other Operational Efficiencies

Efficiencies in sourcing of raw materials, rationalization of logistics, integrating the human resource, synergies in distribution and media sourcing are expected to improve the profitability of Butterfly

The Number Game

Valuations, Financials, Financing of Transaction

Despite having a strong name in southern region, Butterfly had a roller-coaster ride. Till FY16, almost 50% of its sales were used to come through Government orders which stopped suddenly. Thereafter, Butterfly focused on branded sales and non-southern sales and to a great extent it was successful. It increased it branded sales from INR 468 crore in FY 16 to INR 870 crore in FY 21. During the same period, Butterfly’s sales from the Non-South region increased from 15% to 24%. With intense competition in small domestic appliances, now butterfly needs cutting edge technology and pan-India presence which Crompton can bring on the table.

Some of the other important matrix from Crompton & Butterfly for FY21

Going Ahead, Professional management can work on various things such as mix of trading & own productions, working capital, fixed asset turnover, Advertising etc. which are far better for Crompton than Butterfly. Simultaneously, effective utilisation of the manufacturing and distribution chain will bring strong efficiencies for both companies.

Estimated Cost of Acquisition for Crompton:

| Particulars | Amount(INR in Crore) |

| Promoter Stake up to 55% | 1380 |

| Open Offer up to 26% | 666 |

| Trademark | 30 |

| Land | 95 |

| Total | 2170 |

As on 31st December 2021, Crompton had surplus & cash equivalent in excess of INR 1000 crores. As on 30th September 2021, Crompton’s Net-worth was INR 2058 crore. The acquisition is expected to be financed via a mix of internal accruals and debt.

Conclusion

Both Butterfly & Crompton has a roller-coaster journey in the past. While Crompton which came out from Crompton Greaves Limited turned its fortune after acquisition by a private equity consortium, Butterfly’s sales from government suddenly stopped in 2016. Today, Butterfly has market leading positions in key kitchen appliance categories, and strong brand equity. With the help of Crompton, Butterfly will get an opportunity to grow the business in non-south regions

Crompton which is desperately looking to grow into the small domestic appliances business will get much-needed wings which will take its appliances business share in total revenue from 10% to 24%. In addition, it will get strong manufacturing capabilities and brand having a strong penetration in southern market which can be efficiently used to cross-sale its own products.

Initial Crompton may look for keeping both entities separate & positioning two brands separately. Eventually, it may merge Butterfly with Crompton to optimise marketing and manufacturing synergies.

Add comment