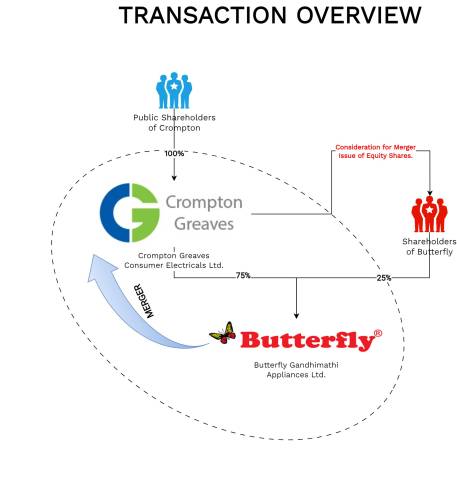

Board of Directors of Crompton Greaves Consumer Electricals Limited & its listed subsidiary Butterfly Gandhimathi Appliances Limited at their respective meeting held on March 25, 2023, have considered and approved the Scheme of Amalgamation of the Butterfly Gandhimathi Appliances Limited with Crompton Greaves Consumer Electricals Limited and their respective shareholders and creditors under Sections 230 to 232 and other applicable provisions of the Companies Act, 2013 read with rules made thereunder (“Scheme”).

Crompton Greaves Consumer Electricals Limited (“Transferee Company” or “Crompton”) is engaged in the business of manufacturing, trading, selling and distribution of fans, lighting, pumps and appliances. The equity shares of the Transferee Company are listed on the nationwide stock exchanges. The non-convertible debentures of the Transferee Company are listed on the debt segment of the National Stock Exchange of India Limited. Crompton holds 75% of the total issued and paid-up equity share capital of Gandhimathi.

Butterfly Gandhimathi Appliances Limited (“Transferor Company” or “Butterfly”) is involved in the manufacturing and trading of a wide range of domestic kitchen and electrical appliances under the brand ‘BUTTERFLY.’ The equity shares of Gandhimathi are listed on nationwide stock exchanges.

Acquisition of Butterfly by Crompton:

In February 2022, to add scale and extend the ‘Core Product Portfolio’ of Crompton’s existing range of kitchen products and accelerate its long-term strategic goal of becoming a leading player in the small domestic appliances segment, Crompton acquired controlling interest (55% equity shareholding) in Butterfly from the that time promoters (which continue to be joint promoters) followed by open offer. Post-acquisition, Crompton changed the majority of the Board of Directors of Butterfly including the Managing Director.

Pursuant to the Open Offer, the stake of Crompton in Butterfly increased to Circa 81%. Immediately in September 2022, Crompton sold circa 6% stake to various Mutual Funds & others making its own stake as 75% in compliance of SEBI’s LODR regulations. Currently, Crompton along with erstwhile management, owns about 82% stake in Butterfly. Erstwhile management is continuing to be classified as a promoter in Butterfly however, as disclosed during the acquisition, they will take exit as shareholders & promoters from Gandhimathi.

Crompton funded Gandhimathi’s acquisition majorly through issue of listed commercial papers and part amount through internal accruals. However, in September 2022, the entire commercial papers were replaced by the listed non-convertible debentures.

Total Cost of Acquisition for Crompton for purchase of 75% stake in Butterfly:

| Particulars | Amount (₹ in Crore) |

| Purchase of 55% stake in Butterfly (INR 1434 per equity share) | 1380 |

| Additional consideration for Land & Trademark | 125 |

| Acquisition of 26% stake in Butterfly through Open Offer | 666 |

| Less: Selling of `6% stake in September 2022 (INR 1501 per equity share) | (161) |

| Total cost of Acquisition | 2010 |

The Proposed Transaction:

Crompton board members along with promoters of Butterfly after waiting for a year post acquisition decided to merge Butterfly with itself to accelerate crystallisation of synergies as envisaged during the acquisition. The management believes that merger will bring revenue & cost synergies for the merged company. It can effectively use the manufacturing facilities of Butterfly to produce kitchen appliances of Crompton with optimal operational & no intercompany direct & indirect taxes.

Some of the Rationale for the merger as provided by the management:

- Achieve synergies in revenue

- e, costs, faster Go-To-Market strategy stronger base for future growth across all parts of India and to enable greater focus on product innovation.

- An integrated and coordinated approach to business and focus on product innovation will allow for a more efficient allocation of capital and resources for growth opportunities.

- Ability to cross-sell products through the respective distribution channels in the high growth appliances segment with premium offering across product categories.

- Efficient materials management, warehouse rationalization and unified approach on customer engagement.

The Appointed Date for the merger will be 1st April 2023. For further optimalisation of financials & interest cost incurred by Crompton for FY 2022.

Key Personnel Changes

On 25th April 2023, Crompton did couple of major changes in top management including the appointment of Mr. Promeet Gosh as Managing Director & CEO of the company. Earlier Managing Director Mr. Shantanu Khosla elevated as the Executive Vice Chairman of the Board for a period of 1 (one) year from May 1, 2023, to April 30, 2024, and thereafter he shall assume the position of Non-Executive Vice Chairman till December 31, 2025. Earlier CEO, Mr. Mathew Job resigned to pursue other career interest. Mr. Promeet Gosh is associated with Crompton & on its board as Temasek’s representative since change of control post-demerger in 2016. The role of KMP of Butterfly in the merged Crompton is not yet clear.

Swap Ratio for the transaction:

Crompton will issue 22 (Twenty-Two) fully paid-up equity shares of INR 2 (Two) each for every 5 (Five) fully paid-up equity shares of INR 10 (Ten) of the Butterfly. The existing shareholding of Crompton in Butterfly will get cancelled & shares will be issued only to other shareholders (except Crompton). Pursuant to this, circa 1.96 crore shares will get issued to the remaining 25% shareholders.

Share capital of Crompton:

| Particulars | Pre-Merger | Post-Merger |

| No. of Equity Shares | 63,59,86,199 | 65,56,53,707 |

| Face Value | 2 | 2 |

In 2016, Crompton was formed pursuant to the demerged of Consumer Product Division from Crompton Greaves Limited. Post-demerger, the promoter stake was purchased by Advent & Temasek jointly. After running the company, Advent took complete exit while Temasek still holds 2.54% stake but has been classified as public shareholder. Majority of the shares of Crompton are being owned by Mutual Funds (33.18%), Insurance Companies (9.37) and Foreign Portfolio Investors (38.98%) while the company is completely professionally managed.

Pursuant to the merger, there will be circa 3% dilution to the existing shareholding of Crompton. Butterfly public shareholders will own circa 2.1% of the merged entity & butterfly erstwhile management will own circa 0.9% shares of the merged entity. They will be classified as public shareholders in merged Crompton.

Impact of Scheme on debenture holders:

Clause 13 of the Scheme provides for impact of the scheme on non-convertible debenture holders of Crompton which provides for no adverse impact on holders of the debentures, and they shall continue to enjoy same terms & preferences in the company.

Financials

Assigned Valuation for Merger

The appointed joint valuers have arrived at a fair relative valuation of Crompton & Butterfly by assigning equal weights to Discounted Cash Flow method, Market Multiple methods, and market price method.

| Particulars | Per Share Value (₹) | Total Value (₹ crores) |

| Butterfly | 1365.6 | 2442 |

| Crompton | 310.4 | 19,738 |

Interestingly, the assigned relative valuation to Butterfly for the proposed merger is lower by circa 5% & 9% respectively than the valuation at which Crompton bought controlling stake & valuation at which it offloaded circa 6% stake.

Conclusion

Post-advent exit, Crompton announced the acquisition of controlling stake in South-based Butterfly. While the acquisitions seemed to be a perfect strategic fit for Crompton, it also comes with integration challenges. To reap the synergies fully, the management announced the merger plan.

After announcing the inevitable merger, Crompton also announced its key managerial rejig as Crompton enters its next growth phase. Next phase, may likely, focus on the successful integration of Butterfly with Crompton followed by strategic sale/merger of Crompton with bigger players.