Future Retail Limited(FRL) is the flagship company of Future Group. Currently operates multiple retail formats hypermarket, supermarket and home segment of the Indian consumer market under different brand names: Big Bazaar(hypermarket), FBB (Fashion at Big Bazaar), Food Bazaar (supermarket); easyday (convenient stores), Foodhall (Premium lifestyle food destination), Home Town (Home Retail Business) and eZone (consumer electronic speciality store).

FRL operates in home solution segment through HomeTown offering include living room furniture, dining, bedroom furniture and furniture essentials, mattresses, modular kitchens, home furnishing, décor, households and bath luxury. As on March 2017 hometown has 37 stores in 22 cities having an operational space of 1.29 mn. Sqft.

Bluerock eService Private Limited (BSPL) is engaged in the business of operating a web portal for online sale of furniture & furnishing products and providing service for operation & maintenance of IT-enabled platforms.

Transaction

Composite scheme of demerger of the Home Retail Business undertaking of FRL and demerger of the e-commerce Home Retail Business undertaking of BSPL into Praxis Home Retail Private Limited (PHRPL) with the appointed date of 1st August,2017 for FRL and 15th April, 2016 for BSPL respectively or any other such date as may be approved by the any competent authority.

Consideration to the equity shareholders of FRL: 1 fully paid up equity share of Rs 5/- each of PHRPL to be issued for every 20 equity shares of Rs 2/- each of FRL.

Consideration to the equity shareholders of BSPL: 630,000 Preference shares of the face value of Rs 100 each to be issued on a proportionate basis to the members holding fully paid-up equity shares of the BSPL.

Term of issue – 9% Non-cumulative Redeemable preference shares, Face value Rs 100/- each, to be redeemed at the end of the 60 months from the date of allotment.

For any fractional shares: PHRPL shall not issue fractional shares certificate to such member but shall instead, at its absolute discretion, decide to take any or a combination of the action as mentioned below

- consolidate such fraction shares and issue consolidated shares to a trustee nominated by PHRPL who will sell such shares and distribute the net sales proceeds to the shareholders respectively in the proportion to their fractional entitlements.

- deal with such fractional entitlement in such other manner as they may deem to be in the best of the shareholders of FRL/BSPL and PHRPL.

Equity shares issued by PHRPL to the members of FRL will be listed on the BSE and NSE after taking required approvals.

Financials Details

In home retail undertaking of FRL, furniture contributes almost 2/3rd sales of Hometown and while its exclusive range of Duracucine Modular Kitchens contribute almost a tenth of the business and the rest comes from homeware and home improvement products (based on FY 15-16 Annual Report).

Percentage turnover and profitability of the Home Retail business division vis a vis other division of the FRL:

| Particulars | Financial Year | Turnover | % to total | Profit after Tax | % to total |

| Demerged Division | 2015-16* | 187.36 | 3% | 0.23 | 2% |

| 2014-15 | – | – | – | – | |

| Other Division | 2015-16 | 6,528.65 | 97% | 14.32 | 98% |

| 2014-15 | 1,775.47 | 100% | -379.21 | 100% | |

| Total | 2015-16 | 6,716.01 | 100% | 14.55 | 100% |

| 2014-15 | 1,775.47 | 100% | -379.21 | 100% |

*considered on the basis of five month’s turnovers of the demerged business (Retail business undertaking of Future Enterprise Limited) vested with the company during the Year 2015-16 with effect from 31st October 2015.

Net Worth

Table 1: Networth of the Companies (All Figures in Rs. Crores)

| Entity | Pre-Arrangement | Post Arrangement |

| Future Retail limited | 1731.32 | 1708.71 |

| Bluerock eservice Pvt Ltd | 6.52 | 0.66 |

| Praxis Home Retail Private Ltd | 0.02 | 28.51 |

Note: Net worth as provided for the scheme.

- FRL net worth as at 31st Dec 2016

- BSPL net worth as at 15th April 2016

- PHRPL net worth as at 31st March 2017

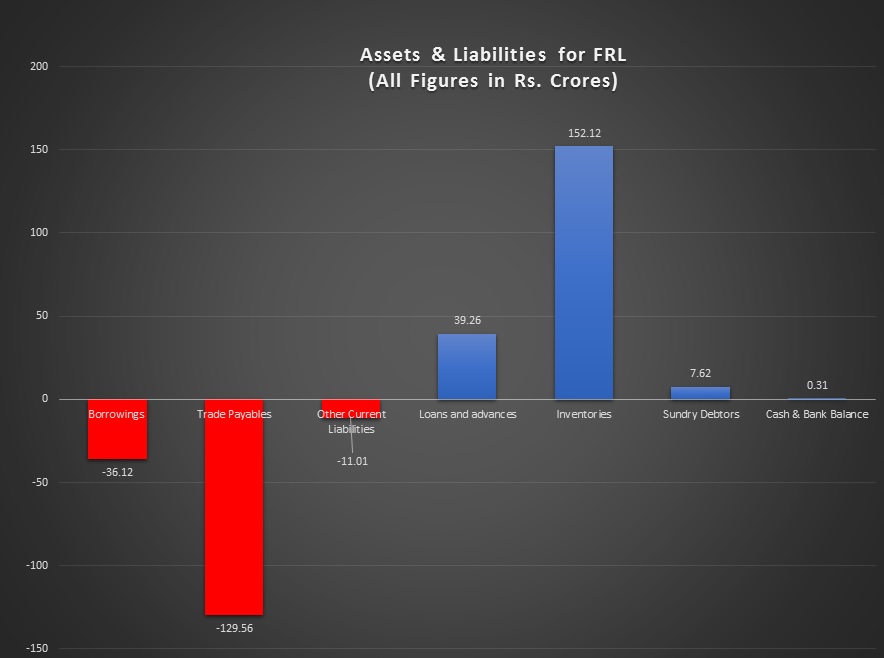

- Net-worth Transferred as part of Demerged Undertaking from FRL Rs. 22.62 crores. Details bifurcation of Assets and Liabilities as below

Shareholding Pattern

Table 2: Shareholding Pattern Pre and Post Transaction as on Mar’17

| Particulars | PHPRL | FRL | BSPL | |||

| No. of shares | % of shares | No. of shares | % of shares | No. of shares | % of shares | |

| Promoter | 50,000* | 100 | 23,37,40,436 | 49.54 | 2,24,54,099 | 100 |

| Public | – | – | 23,80,72,303 | 50.46 | – | – |

| 50,000 | 100 | 47,18,12,739 | 100 | 2,24,54,099 | 100 | |

| Post-Arrangement | ||||||

| Promoter | 1,16,87,022 | 49.54 | 23,37,40,436 | 49.54 | 2,24,54,099 | 100 |

| Public | 1,19,03,615 | 50.46 | 23,80,72,303 | 50.46 | – | – |

| Equity shares | 2,35,90,637 | 100 | 47,18,12,739 | 100 | 2,24,54,099 | 100 |

| Preference Share | 6,30,000 | 100 | – | – | – | – |

*Upon the scheme becoming effective, the shares held by the existing shareholders of PHPRL would get cancelled and the shareholders of FRL would get the equity shares of the PHPRL. Upon such issue of equity shares, the shareholding pattern of PHPRL shall be the identical to that of FRL.

Note: Preference shares are issued to the shareholders of BSPL pursuant to the scheme. There were no preference shares in any of the company prior to the scheme of arrangement.

Valuation

In case of BSPL: Valuation of eCommerce business undertaking is carried out based on estimated future cash flow to be generated by the company that are available to all providers of the company’s capital – both debt and equity. Projected financial statement for the period from 1st April 2017 to 31st March 2022 along with the other key items such as capital expenditure and working capital have been used to derive future cash flow. The Net Equity Value of eCommerce Home Retail Business Undertaking is thus arrived at Rs. 63 Million (Rs 6.3 Crores) as on the valuation date.

Demerger Impact

- FRL will concentrate on core format of small store and big store retail which contributes almost 97% of the turnover.

- The merger will have “consolidation of offline and online home retail business under a single entity” and would have “more focused leadership and dedicated management”.

- Currently, BSPL is having a cash loss of Rs 42.12 crores (Mar 17), how the additional funding will be raised to continue the online business will be the matter of concern for PHRPL.

- Valuation of BSPL home undertaking is arrived after considering discounted cash flow from 1st April 2017 to 31st March 2022. DCF valuation is a moving target: If any company expectations change, the fair value will change accordingly.

Exit of Future Enterprise Limited (FEL)

FEL which holds 100% shares in BSPL are given exit from eCommerce retail business undertaking of BSPL by way of allocating 630,000 9% Redeemable Preference Shares of Rs 100 each in PHRPL, this exit will help them to focus on their non-retail business.

CONCLUSION

From the point of view of Future Retail proposed demerger will allow them to concentrate on their core business. Growing usage of home furnishing products in residential as well as non-residential sectors is expected to drive demand for home furnishing products and there are many players in the market such as Godrej Lifestyle, Pepperfry, Urban Ladder, and other small players which will give stiff competition to PHRPL. Future Retails should evaluate the strategy to stand in the market.