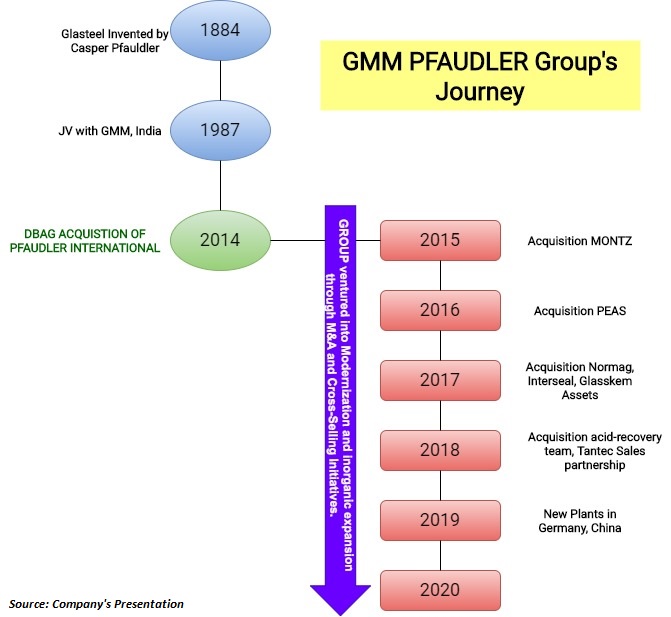

GMM Pfaudler Limited (GMM) announced on August 20, 2020 signing of definitive agreements in connection with the acquisition, by the Company, of a majority shareholding (54%) in the global business of its holding company. The stake hold by holding company in GMM Pfaudler will be carved out to a separate entity and will not be a part of the transaction. Soon after the announcement, stakeholders instead of cherishing started questioning the management for the intricate structuring.

GMM is a leading supplier of process equipment to the pharmaceutical and chemical industries. GMM is the market leader and has more than five decades’ experience in manufacturing Glass Lined Equipment. Over the years GMM has diversified its product portfolio to include Mixing Systems, Filtration & Drying Equipment, Engineered Systems and Heavy Engineering Equipment. Currently, GMM is jointly owned/controlled by Pfaudler group/DBAG and by the Indian group i.e. Patel Family.

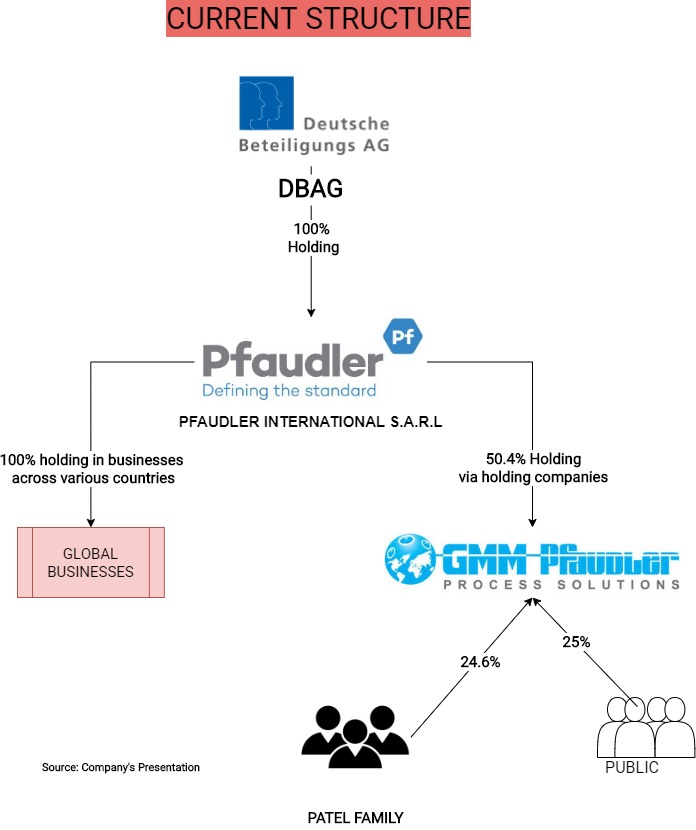

Pfaudler International S.a.r.l (Pfaudler group) through its multiple subsidiaries has manufacturing facilities on four continents. Pfaudler is present on the market with several branded product lines covering a broad portfolio that includes fluoropolymers, filtration & drying, engineered column systems, lab & process glass, sealing technology and glass-lined & alloy systems. Its Systems and Services capabilities allow them to support their Customers from the lab to the full-scale production plant, including optimizing and improving the whole life cycle of any process equipment normally used in the chemical, pharmaceutical and food industries. Pfaudler group owns (before Offer For Sale) 50.44% stake in GMM. Pfaudler International S.a.r.l is ultimately owned and controlled by Deutsche Beteiligungs AG (DBAG) Fund VI (Guernsey) LP.

Deutsche Beteiligungs AG (DBAG), a listed private equity company, invests alongside those funds predominantly in well-positioned mid-market companies with development potential. Pfaudler group is currently owned by DBAG.

The Transaction

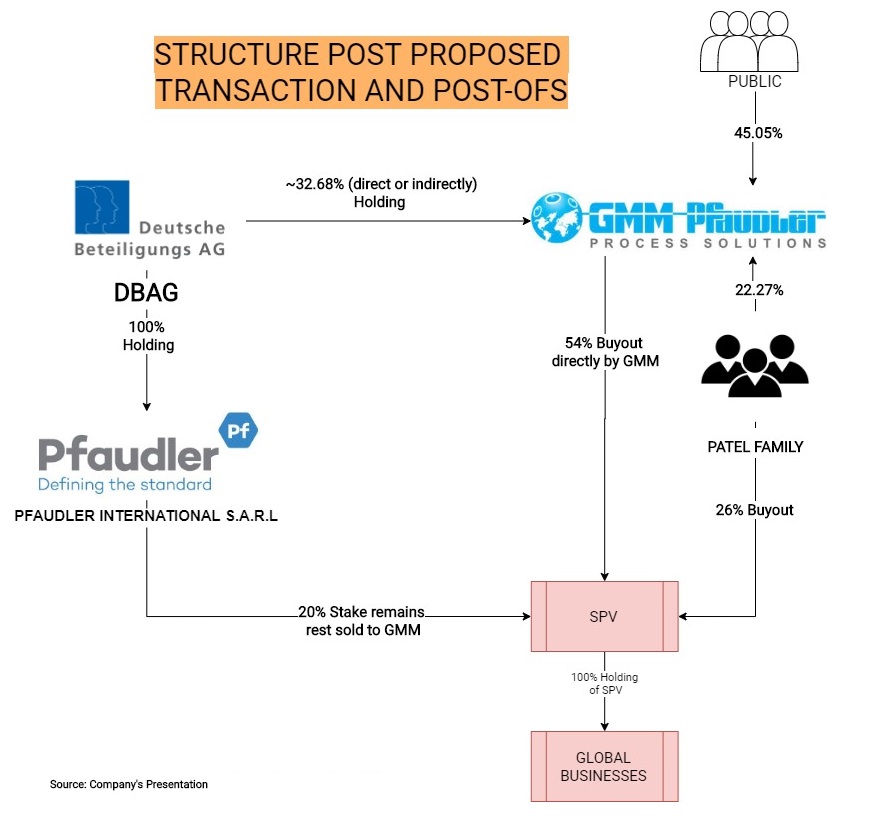

GMM will acquire 34.4% of the global business of Holding Company by itself and 19.6% of the Pfaudler Group through its wholly-owned subsidiary, Mavag AG. As part of the transaction, Promotors of GMM (Patel Family), will also acquire 26% of the shareholding in the Holding Company.

The balance 20% of the Holding Company will continue to be held by DBAG, the existing ultimate shareholders of the Pfaudler Group.

Global Businesses owned by the Holding Company

| Pfaudler GmbH | Germany |

| Pfaudler S.r.l | Italy |

| Pfaudler Limited | UK |

| Pfaudler Services Benelux B.V | Netherlands |

| Pfaudler Private Limited | Singapore |

| Pfaudler Ltda | Brazil |

| Pfaudler S.A de C.V | Mexico |

| Suzhou-Pfaudler Glass-Lined Equip. Co.Ltd | China |

| New Entity | USA |

Before GMM & Patel family buys stake in the global business, Pfaudler International S.a.r.l will transfer its entire global business to special purpose vehicles (SPV) and later will divest 80% stake in SPV to GMM & Patel family. The stake hold by Pfaudler group in GMM Pfaudler will be carved out to a separate entity and will not form a part of this transaction i.e. Pfaudler group’s entire stake in GMM will continue to be hold by them.

Structuring of the Group (Current and Post-Transaction)

Before recent Offer for Sale (OFS), DBAG (through subsidiaries) owned 50.44% stake in GMM while Patel Family stake was 24.56% in GMM.

Offer for Sale (OFS)

After announcing the acquisition of a global business, in a surprise move, promoters (both Pfaudler & Patel family) of GMM on 21st September announced an offer for the sale of equity shares of the company by representing 17.6% plus in case of oversubscription, an option of additional sale up to 10.4%. Accordingly, the promoters sold 20.52% of total equity capital through an offer for sale. Post-OFS, DBAG now owns ~32.68% and Patel Family owns 22.27% stake in GMM. Details of OFS are as follow: –

Table 2: Offer for Sale Details

| Particulars | Amount |

| Total no. of Shares | 1,46,17,500 |

| Shares Sold by DBAG | 17.8% |

| Shares Sold by Patel Family | 2.3% |

| Avg. Price Realised (₹) Assumed | 3850 |

| Estimated Money Realised by DBAG (₹ crores) | 1000 |

| Estimated Money Realised by Promoters (₹ crores) | 129 |

OFS has given a partial exit to DBAG and for Indian promotors will have

- Cashflow to fund its stake purchase in the global business,

- Dividend from the global business and

- Possibility of increasing their stake in the GMM by reverse merger.

Consideration

Table 1: Valuation & Consideration Required for Buyout (All Figs in ₹ Crores)

| Particulars | Amount |

| Equity Valuation given to Pfaudler’s Global Businesses | 381 |

| Funds required by GMM for 54% Stake | 206 |

| Funds required by Patel Family for 26% stake | 99 |

GMM will arrange INR 75-80 crores from its internal accruals and remaining funds will be raised through borrowings.

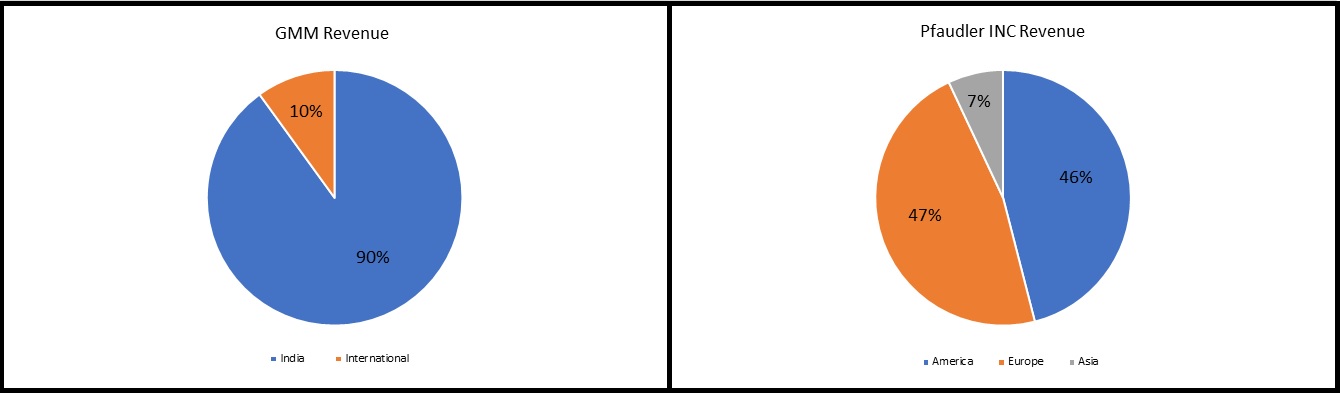

The Rationale

The proposed acquisition will give GMM Pfaudler excess to the international markets having 12-well invested and modern production facilities in 8 countries across 4 continents and likely to transform GMM Pfaudler into an undisputed global leader. Pfaudler INC also sells more products than GMM which will give a lot of cross-selling opportunity for them. Significant revenue of Pfaudler comes through servicing which will give GMM stability. In the future, there could be re-allocation of production to India to take advantage of low cost which will improve margins. The transaction will also uplift restrictions on GMM for selling its products abroad.

Increase portfolio and territories will likely give GMM cutting edge technology & production facilities, global customers, global access but debt on the balance sheet and funding for complete exit to DBAG will remain key concerns.

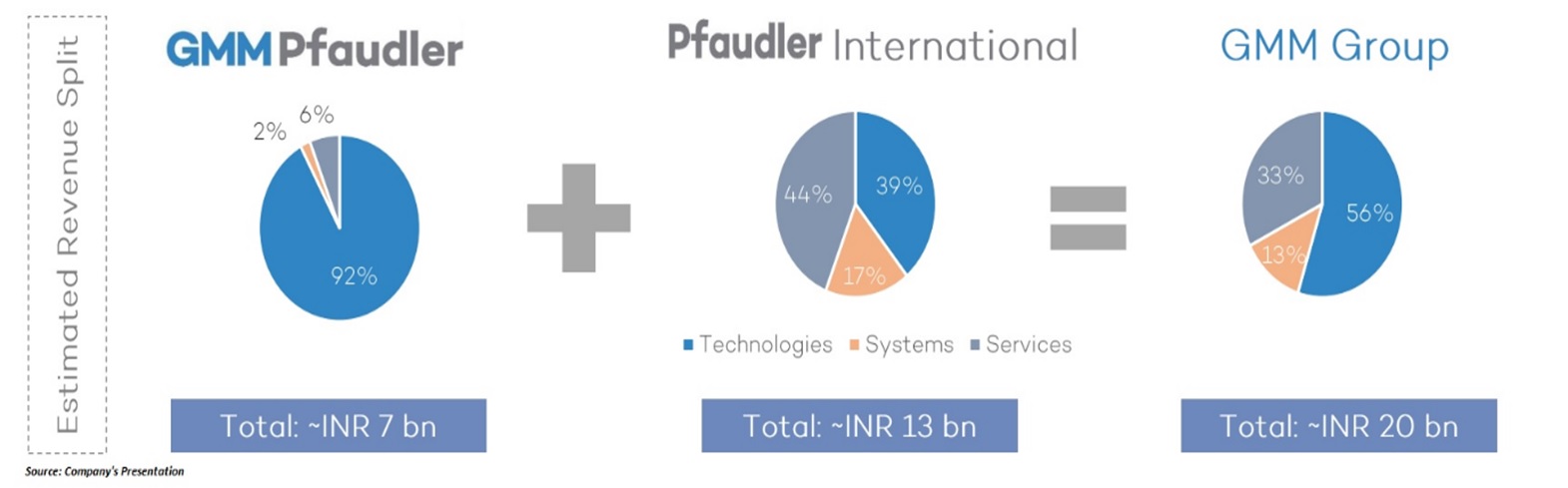

Revenues (Standalone, Bifurcations & Combined)

Financials

Table 3: Financials of Pfaudler INC

| Particulars | FY 18 | FY 19 | 9m-FY20 | FY 20E |

| Revenue (US$ mln) | 174 | 176 | 127 | 175 |

| Gross margins | 23.2% | 22.9% | 27.1% | 25.3% |

| EBITDA Margins | 5.2% | 4.7% | 8.6% | 8.2% |

Table 4: Pfaudler Inc’ financials (converted into INR) for 9M ended on 31st May 2020 (All Figs in ₹ Million)

| Particulars | Amount* |

| Revenue | 9,525 |

| Adj. EBITDA | 825 |

| Net Income | 375 |

| Fixed Assets | 7,875 |

| Debt | 4,125 |

| Provisions (incl. Pension Liability) | 5,850 |

| Networth | 4,275 |

*: Average conversion rate assumed to be INR 75/$.

Table 5: Consolidated financials of GMM after acquisition (All Figs in ₹ Million)

| Particulars | Pre* | Post** |

| Revenue | 5,910 | 13,161 |

| EBITDA | 1,168 | 1,569 |

| PAT | 711 | 643 |

| Networth | 3,429 | 5,689 |

| Borrowings | 112 | 4,175 |

| Fixed Assets | 871 | 9,443 |

| Cash & Cash Eq | 932 | 3,714 |

*For 9months ended on 31st May 2020. **for the year ended on 31st March 2020.

For the complete year, the consolidated revenues likely to be around INR 2000 crores with EBITDA close to around INR 260 crores. Further, as a result of the acquisition, debt level likely to further increased by INR 130-140 crores most likely to be in the books of Mavag A.G due to lower interest rates prevailing in Europe.

The management guided to achieve consolidated revenue of circa INR 2800 crores by the year 2024. However, as mentioned in Annual Report-FY 2020, GMM revenue (without Pfaudler) under UDAN can reach circa INR 1300+ cr. Considering the current revenue of GMM, and projected revenue for the combined entity, it is likely that all growth will come through the Indian entity and Pfaudler’s operations will remain stable. Further, the guided margins of 16% is much lower than the current Indian operations margin.

Valuation

| Particulars | GMM Pfaudler (₹ Million) | Pfaudler INC (US$ Million) | Pfaudler INC (₹ Million) |

| Equity Value | 69,849 | 50.8 | 3,810 |

| Debt | 112 | 133 | 9,975 |

| Cash & Cash Equivalent | 932 | 32 | 2,400 |

| Enterprise Value | 69,029 | 152 | 11,385 |

| EV/EBITDA Multiple | 59 | 10 | 10 |

| PE Multiple | 98 | NA | NA |

The conversion rate assumed to be INR 75/$. Further, Pfaudler Inc’s EBITDA has been assumed to be USD 15 mln (pro-rata basis).

The valuation multiple given to Pfaudler INC is much lower than of GMM Pfaudler for a variety of reasons like different cost of capital, lower margins and leveraged balance sheet and may be DBAG keen to exit. As one can observe pension liability recorded in books is a reasonable estimate of real liability because even on the date of transaction it is in excess of net worth,

Our Take:

Primary purpose for the acquisition may be to give business in the hands of entrepreneurs, though the structure of the deal and subsequent OFS seems to suggest that it is a win-win for both i.e. planned exit for DBAG and operational control in the hands of Indian Promotors. Though it needs to be seen how this will create value for public shareholders of GMM. it is expected to generate significant synergies and integration of service and manufacturing business. At the same time, few questions also arise. As told by management, Pfaudler has done significant expansion/modifications to its facilities recently., it is not how post-acquisition clear management will be to utilise and squeeze those facilities to generate better returns on assets. To reap the benefits from the acquisition, if labour intensive jobs which are currently done by Pfaudler group will shift to India and If it happens, the requirement of those new facilities to GMM need to be evaluated. Further, it looks that the revenues from global business likely to remain muted. Though the Patel family and Pfaudler group has long standing relations and they know about the workings of global business, they still need to work thoroughly towards integration as it will remain one of the key aspects for reaping benefits.

For DBAG, being private equity, this acquisition is much required and they will be actively looking for a complete exit in the next couple of years. Interestingly, the whole value for them will be derived through exiting Indian entity than global business. Recent Offer for Sale again was to encash some of its investment and interestingly amount gain from selling a partial stake in India operations is much above what they are getting through exiting 80% from the global business.

The intricate transaction structure followed by offer for sale is a puzzle for most of the minority shareholders. Management clarified that they will work on some mechanism to consolidate 100% of global business in GMM. Clearly, either they must merge the global entity into GMM or GMM will buyout remaining 46% from Patel Family & DBAG. Offer for sale initially reduced Patel family holding however, through a merger or preferential allotment (depending on way opted to consolidate) they will increase their stake in GMM. It is likely that the valuation given to global entity during consolidation will likely to be different than currently given as synergies likely to kicked in by that time.

Overall, considering the past growth and future of the industry in which Pfaudler/GMM operates, the acquisition could create value for stakeholders but at the same time they have to cautiously manage the integration and future consolidation should be done in a way that, it creates similar value for all stakeholders.

Add comment