Mortgage lender HDFC Ltd has completed the acquisition of a majority stake in Chennai-based Apollo Munich Health Insurance Company Ltd for Rs 1,495.81 crore. Last year, TTK Group had exited from the Cigna TTK Health Insurance joint venture by selling its 31.5% stake to Manipal Group for Rs 500 crore. Similarly, Max India has sold its 51 per cent stake in Max Bupa Health Insurance Company to private equity firm True North.

The consolidation in the health insurance business is perking up. Four out of six standalone health insurance companies in the country have seen either full buyouts or stake sale being bought by private equity investors or strategic players. There were actually seven standalone health insurance companies, but the Insurance Regulatory and Development Authority of India (IRDA) had directed Reliance Health Insurance in November last year to transfer its entire portfolio to Reliance General Insurance and stopped it from selling new policies as the company’s solvency ratio dropped below the regulatory norm. Private equity deals are gaining momentum which is helping in consolidation in the Indian health insurance sector.

While the health insurance sector is steadily gaining momentum, the gross direct premium income underwritten by health insurance grew 15% year-on-year (y-o-y) to $4.5 billion till November 2019. The country is grossly under-penetrated when it comes to health insurance. As per the National Family Health Survey, less than one-third (29%) of the households have at least one member covered under health insurance. Two-third of the total health care expenses are financed from own sources and the rest is through insurance and public spending.

The market of health insurance is gradually growing across the country. Deepak Parekh, chairman of HDFC had underlined that in the general insurance space, it is expected that the share of accidents and health insurance will rise from 30% currently to 39% in the next five years. So, this growth means that premium collected from health and accident insurance will be more than motor insurance, which accounts for the largest component in general insurance.

HDFC completes acquisition of Apollo Munich

On June 19, 2019, HDFC had announced the acquisition of 51.16% equity stake of Apollo Munich Health Insurance for Rs 1,495.81 crore (includes 0.36% of employees stake for Rs 10.67 crore). Munich will hold 49% stake in the merged entity. The German insurer will pay Rs 294 crore to Apollo Hospitals Enterprise and Apollo Energy for terminating their joint venture.

It has recently received all requisite approvals from Competition Commission of India, Reserve Bank of India and IRDA. After receiving the approval, the company has been named as HDFC ERGO Health Insurance Ltd and will operate as a subsidiary of HDFC Ltd. The acquisition will help the company to expand its agency network and premium book in health insurance segment.

The combined entity will be the second-largest private insurer in health segment in the country. The combined gross direct premium will be over Rs 10,800 crore and the market size will be around 6.4% in India’s non-life insurance market. Before the merger, HDFC ERGO had 5% market share and Apollo Munich Health Insurance was the second-largest standalone health insurer after Star Health and Allied Insurance.

In 2016, in order to widen its all-India footprint, HDFC ERGO General Insurance had acquired 100% of the equity of Larsen & Toubro Ltd’s general and health insurance firm for Rs 551 crore. The acquisition helped HDFC ERGO to expand its distribution network and non-health product portfolio.

For Apollo Munich, the transaction will help it’s promotors to reduce its saddling debt. At present, according to Bloomberg, Apollo Hospitals have a debt of Rs 3,430 crore. The deal will also help Apollo’s promoters to free up part of their pledged shareholding of listed entity Apollo Hospitals Enterprises.

True North buys Max Bupa

In February 2019, True North bought Max India’s 51% stake in Max Bupa Health Insurance for Rs 510 crore. Max Bupa was a 51:49 joint venture between Max India and Bupa Finance Plc of United Kingdom. The stake sale has been a part of restructuring of the MAX group announced last year. Post completion of the stake sale process, the use of name and brand of Max will be discontinued within two years and the entity will keep a different name.

Established in 1999, True North (formerly known as India Value Fund Advisors) focuses on investing in mid-sized businesses. In fact, in 2017, True North was in discussion to buy 80% stake in Religare Health Insurance, another standalone health insurer. But the deal fell through after few months of negotiations.

Star Health Insurance goes the PE way

In August 2018, Star Health and Allied Insurance, the largest standalone health insurance company with premium collections of Rs 5,401 crore in 2018-19, got into a deal where private equity firms WestBridge Capital and Madison Capital and ace stock market investor Rakesh Jhunjhunwala had jointly bought the company. The Competition Commission of India has cleared the acquisition by the private equity players and Rakesh Jhunjhunwala of 90% equity share capital in Star Health Insurance.

Axis Partners, which had invested in Star Health in 2016, will retain a minority stake in the company.

The Chennai-based Star health insurance company was set up in 2006 and has grown its distribution network in a short span of time.

Manipal acquires Cigna TTK Health Insurance

The Manipal Group, led by Ranjan Pai, after entering the health insurance business in a joint venture with Cigna TTK, has finally acquired a controlling stake of 51% in the joint venture. The Manipal Group, which operates hospitals and educational institutions has bought additional stake from the TTK Group. The TTK Group, which had set up the joint venture with Cigna Corporation, an American insurance company, in 2014 had exited the joint venture after the stake sale.

Manipal Group and TTK Group together held 51% and the rest 49% was held by Cigna. In 2019, the Manipal group increased their stake and bought 31.48% of TTK Group’s stake and ended the joint venture. The newly formed joint venture is called Manipal Cigna Health Insurance.\

Why consolidation in health insurance?

The retail health insurance sector will grow at a healthy pace in the years to come driven by increasing penetration. The factors driving growth are increasing numbers of people suffering from lifestyle diseases, high medical costs, rising life expectancy, high out-of-pocket expenses and rising income.

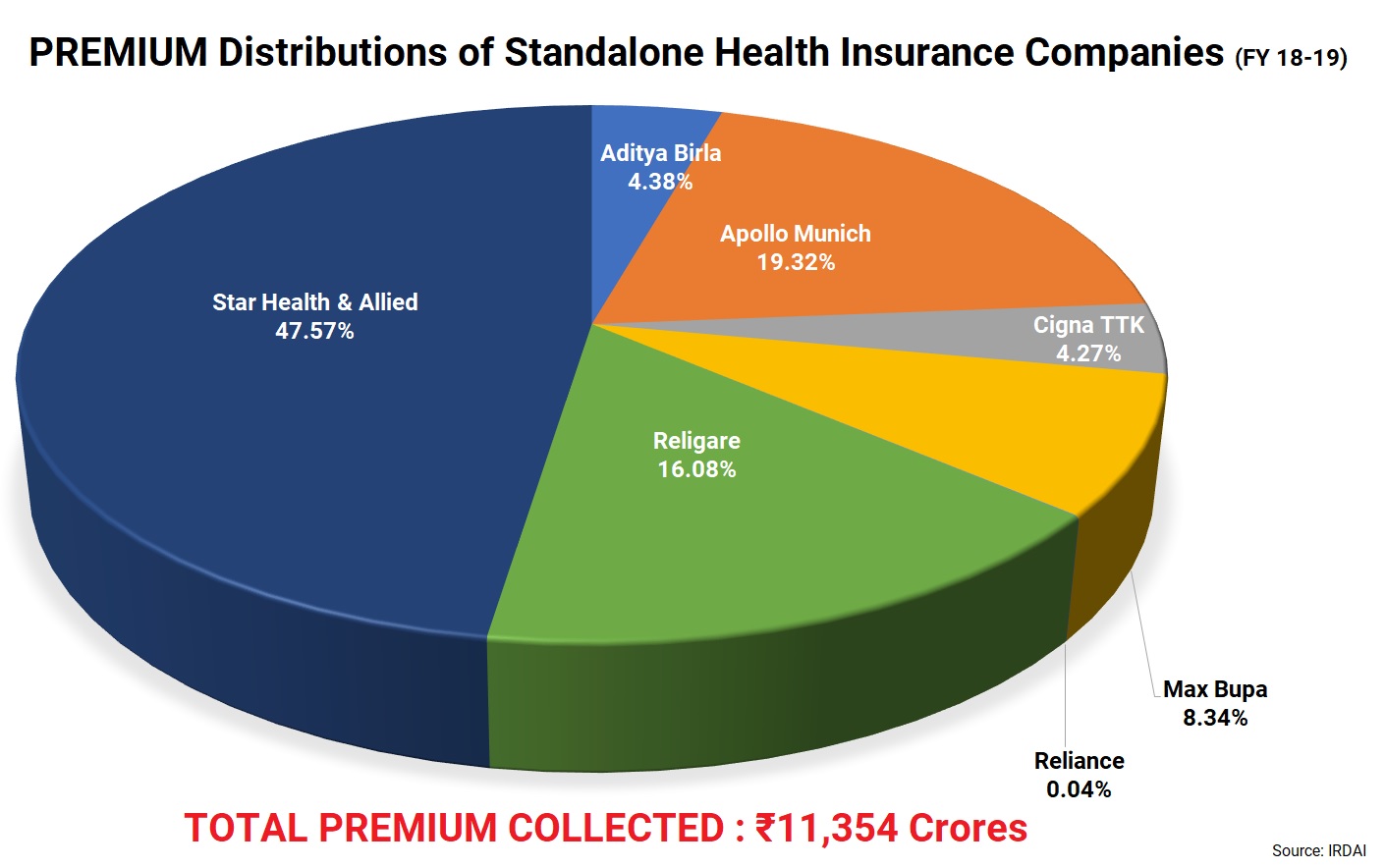

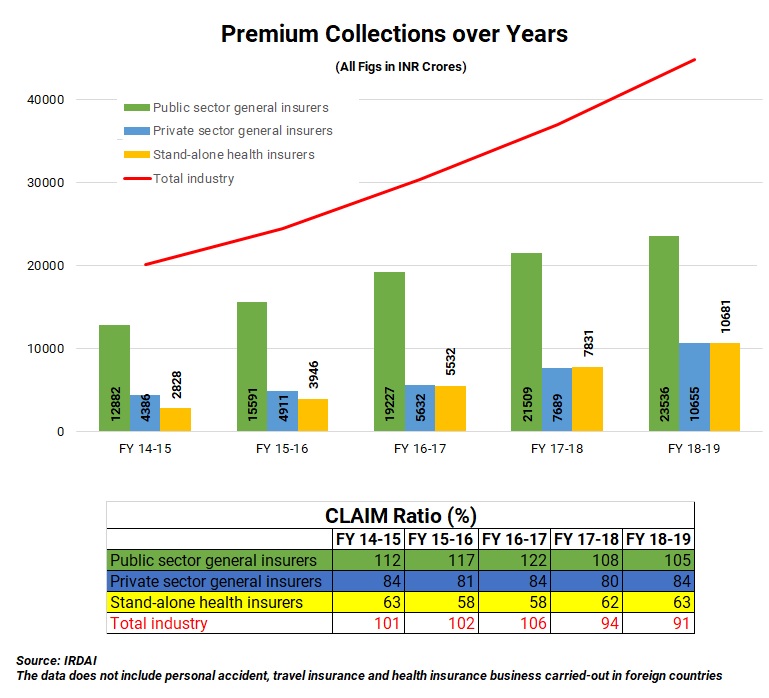

The share of standalone insurance companies in health insurance premium has grown from 14% in FY15 to 25% in FY19.

While around 47 crore people are covered under a health insurance scheme in the country, most of them would be under the government and corporate schemes. However, data as given in the enclosed table shows, in all the years, claims ratio for policies under government scheme and group insurance is above 100% resulting in loss for the companies and only in the case of individual policies, there is a positive contribution. The number of individuals with retail policies is still small which gives enough headroom to health insurance companies to grow their top-line and make the sector an attractive investment proposition. As the health insurance sector is highly competitive, to stay in the business companies will have to do fresh investments and modernize their existing technology. These trends will bring in more consolidation in the industry, especially now in the non-life insurance segment as the consolidation in the standalone health insurance segment is mostly done.

Add comment