DCM LIMITED (DCM) is a public Company is engaged in the business of manufacturing/ sale of castings to the automotive industry and real estate development. The equity shares of the Company are listed on the Stock Exchanges.

DCM ENGINEERING LIMITED (DEL) is a public company, previously known as DCM Tools & Dies Ltd. Effective from October 2019. Currently, the company does not engage in any business, however, the memorandum of association of the Company inter alia permit the Company to undertake the engineering business including manufacturing and supply of grey iron casting. The Company is a wholly owned subsidiary of the DCM.

The Transaction:

The scheme is covered the arrangement of transfer of the “Engineering Division” of DCM into DEL and covers restructuring of debts to be transferred as a part of the Engineering Division.

Step 1: Transfer of Engineering division of DCM by way of slump sale to DEL.

Step 2: Restructuring of transferred debts (This deals with DEL and Term Lenders)

- DEL shall issue Optionally Convertible Debentures (OCD) to Term lender for an amount equivalent to 50% of Term Loan and remaining Term Loan shall be paid to the Term lender over period of 5 years from the effective date with 8% Interest on quarterly basis.

- Working capital outstanding shall be converted into Term Loan and paid by transferee company over a period of 5 years from the effective date.

- Arrangement with Sundry Creditors.

Appointed date for the transaction is October 1, 2019.

LOAN Details and Conversion Terms

Following loans shall be transferred from DCM Ltd. to DCM Engineering.

Table 1: Loans Details (All Figs in INR Lacs)

| Working Capital Loan (CC) | Amount |

| SBI | 1220.25 |

| ICICI | 511.17 |

| HDFC | 102.02 |

| Total (A) | 1833.24 |

| Term Loan | |

| SBI | 228.77 |

| ICICI | 621.39 |

| HDFC | 1265.15 |

| Total (B) | 2115.31 |

| Total (A+B) | 3948.55 |

Out of the above, 50% term loan shall be converted into Optionally Converted debentures (OCD) as per following conversion terms.

- From the expiry of 1 (One) year from the Effective Date and until the expiry of 4 (Four) years from the Effective Date (“Conversion Period”), each of the Term Lenders shall have a right to convert the outstanding OCDs held by such Term Lender into the equity shares of the Transferee Company at par value.

- 33.33% within 1 year from the commencement of conversion period.

- 33.33% immediately after the expiry of 1 year from the commencement of the Conversion Period until the expiry of 2 years from the commencement of the Conversion Period.

- 33.34% immediately after the expiry of 2 years from the commencement of the Conversion Period until the expiry of the Conversion Period.

- After the expiry of 5th year from the effective date each of the Term Lenders shall, have a right to require the Transferee Company to redeem the outstanding OCDs held by such Term Lender, at a price that provides a return to such Term Lender at the rate of 8% compounded quarterly for the period from the Effective Date until the date of redemption of such OCDs.

The restructuring of debts covers in this scheme because Transferor company having charge on Immovable property gets transfer to DEL as part of the arrangement.

Rationale as given by the management:

- Imparting better management focus, facilitating administrative convenience and ensuring optimum utilization of various resources of the Transferor Company and Transferee Company;

- increasing efficiencies in management, control and administration of the affairs of the Transferor Company and Transferee Company;

- creating and enhancing stakeholders’ value by unlocking the intrinsic value of the core businesses of the Transferor Company and Transferee Company;

- enabling each of the Transferor Company and the Transferee Company to raise necessary resources for their respective businesses independently;

- Induct financial/strategic partner(s) in the Business Undertaking.

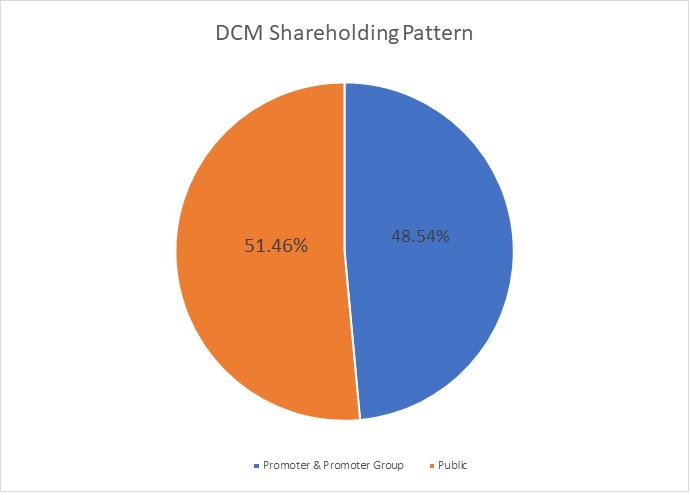

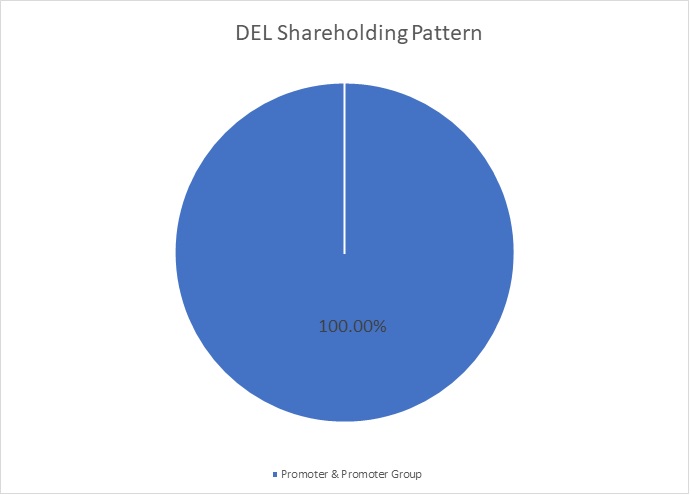

Shareholding pattern:

Post transaction, there is no change in the shareholding pattern of both the companies as in the transaction no shares are issued to any person.

However, as covered under the Scheme, Transferee company may invite fresh investment from New Investor (Other than DCM and promotors of DCM) by way of subscription of equity shares or any other instruments.

Consideration:

Consideration for the transaction is nil as mentioned in valuation report the net-worth of the manufacturing undertaking is nil or negative.

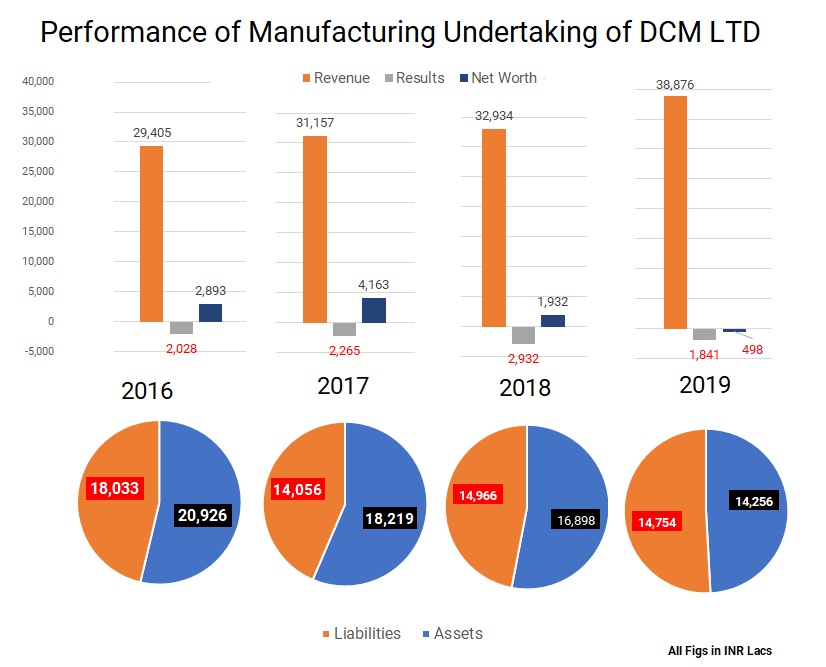

Financials:

Table 2: Segmental Financial statement of DCM as on 31st March 2019. (All figs in INR Lacs)

| Particulars | Real Estate | Grey Iron Casting |

| Revenue | – | 38,876 |

| Results | – | -1,841 |

| Assets | 25 | 14,256 |

| Liabilities | 23.6 | 14,754 |

| Net-Worth | 1.4 | -498 |

Manufacturing undertaking is continuously incurring losses and after acquisition, DCM incurred capital expenditure of Rs.3901.78 Lakh.

The Engineering Division incurring capital expenditure on R&D as this division has got approval from the Department of Scientific & Industrial Research, Ministry of Science and Technology, Delhi for Recognition of in-house R&D Unit for the period from 28.05.2015 to 31.03.2018.

Taxation:

Taxation in the case of Slump sale is calculated according to section 50B of Income Tax 1961. If net-worth is negative, then sale consideration is taken as NIL. (Reference: Zuari Industries V/s ACIT).

Past Restructuring Transactions:

In the last 15 years, DCM has executed various restructuring schemes.

2015: Merger of DCM Engineering Limited with DCM Limited

In 2015 DCM Limited files application for the merger of DCM Engineering with itself for this scheme approval from the Delhi High Court is received in May 2016.

Rational mentioned in this scheme:

- Creation of single entity with better financial strength which would results in improving the competitive position of the business of the combined entity.

- Consolidation of the businesses carried out by both the companies would help in diversification of business risks and would also help in cost optimization in the system.

- Combined entity would be able to optimize the manpower resources.

Merger of DCM Engineering with DCM Limited was executed to avail the above mentioned rational/benefits, now DCM Limited is demerging the same undertaking which raises the doubt why the merger was carried out at the first place.

2017: Scheme of arrangement to segregate various Business Undertakings

In 2017 DCM Limited filed Scheme of Arrangement in this scheme following transaction covers:

- Demerger its textile division into DCM Nouevelle Limited,

- Demerger Reality division into DCM Real & Infrastructure Limited and

- Merger of Tiara Investment Holdings Limited with Purearth Infrastructure Limited

- Merger of Purearth with DCM Real & Infrastructure Limited

We covered this article in July 2017 Issue

On February 11, 2019 BOD of DCM Limited withdraw the following parts of composite scheme of Arrangement:

- Amalgamation of Tiara Investment Holdings Limited into Purearth Infrastructure Limited, a joint venture company with effect from December 31, 2016;

- Demerger of the Real Estate Undertaking of DCM Limited into DCM Realty and Infrastructure Limited, on a going concern basis with effect from January 1, 2017; and

- Following amalgamation as referred to in (a) and demerger as referred to in (b) above, amalgamation of the Amalgamated Purearth into the Resulting DCM Realty leading to Amalgamated DCM Realty, with effect from January 1, 2017.

Demerger of textile division into DCM Nouevelle Limited was sanctioned by NCLT on May 01, 2019.

The Scheme was withdrawn because, it was not in compliance with clause (I)(A)(3)(b) of Annexure I of circular CFD/DIL3/CIR/2017/21 of SEBI. This clause provides that Shareholding of Public and QIB Post scheme in merged company should not be less than 25%.

2017: Merger of Crescita Enterprise

Amalgamation of Crescita Enterprise Private limited with DCM Limited was sanctioned by NCLT on 8th January 2019.

2019: Slump sale of IT Division of DCM Infotech

Board of Directors have approved the slump sale of the “IT Division” business undertaking to DCM Infotech Limited, a wholly owned subsidiary on a going concern basis with effect from September 16, 2019 on the carrying value appearing as on 15.09.2019 by way of Business Transfer Agreement.

Conclusion:

The scheme seems to be a last-ditch effort to survive, even after multiple restructuring schemes in last decade, in continuous under performance of the main business and still having no strategy to revive the said business. Meanwhile, out of no choice, secured creditors are agreeing for restructuring plan and keeping hope alive to recover whatever little amount with almost no return. The scheme will facilitate Joint venture partners to invest in real estate business, though cash flow this business also should go to repay and settle dues of creditors i.e. secured and unsecured of manufacturing business. The success of the scheme depends only on success of real estate division to generate enough cash flow.

Add comment