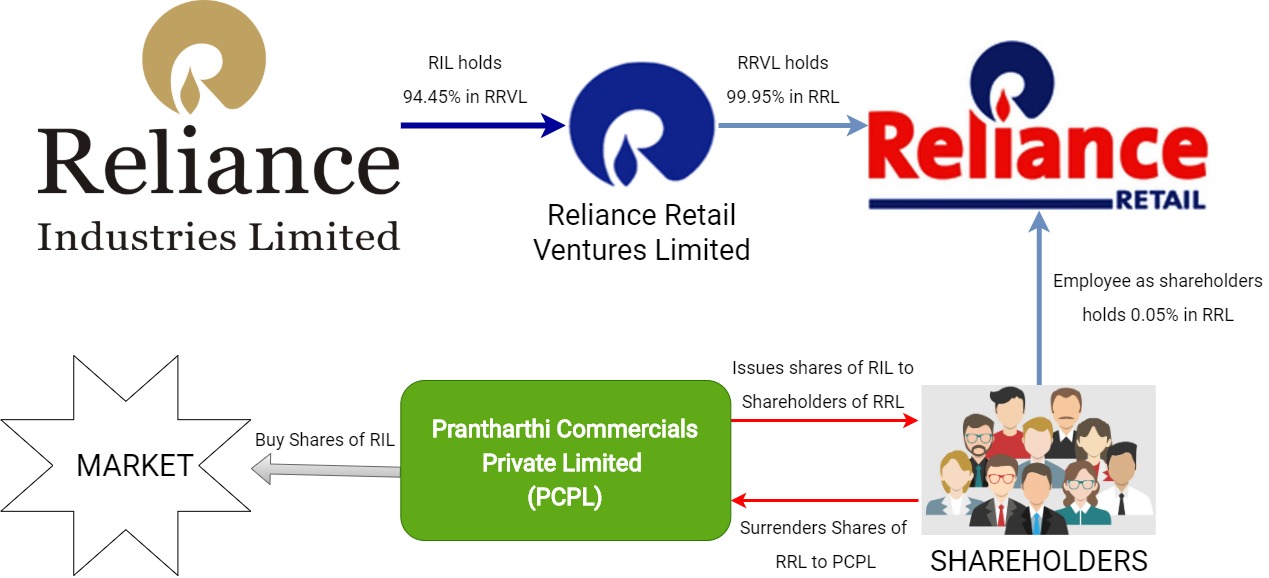

Reliance Industries had received requests from Reliance Retail employees holding equity shares for providing them options to exit and liquidate their holdings, including by way of a listing of the equity shares. It has offered the shareholders of its subsidiary and unlisted unit Reliance Retail to swap their units with RIL shares. Reliance Retail shareholders will get one share of RIL against four Reliance Retail shares. Reliance Retail shares are not listed on any stock exchanges.

Reliance Retail Limited (RRL), is a company mainly engaged in ‘organised retail’ primarily catering to Indian consumers in various consumption baskets. The Company is a subsidiary of Reliance Retail Ventures Limited and an indirect subsidiary of Reliance Industries Limited.

Prantharthi Commercials Private Limited (PCPL), is a private company incorporated under the Companies Act, 2013 on 9th December 2019. The company is incorporated as a Special Purpose Vehicle (SPV) to execute this scheme with main object is to carry on business as merchants, traders, buyers, sellers, importers, exporters, franchisees, sales organizers, distributors, stockists, del-credre agents, C&F agents, wholesalers, retailers, developers, processors, brand and trademark owners and holders, label owners and holders, logo owners and holders, franchise holders, designers, consultants, service providers, dealers and to import, export, buy, sell or otherwise trade and deal in commodities, goods, articles, produce and merchandise of any kind including semi and manufactured products, goods, gadgets, materials of all kinds.

The board of directors and shareholders of the company are one and the same viz. Mr. Raja Ramchandran and Mr. Laxmidas Merchant each having 50% shareholding.

The company’s directors and shareholders seem to be employees of the group and holding directorship in multiple companies of the group since more than 20 years.

The Transaction

RRL had implemented two schemes namely Reliance Retail Employees’ Restricted Stock Unit Plan 2006 and 2007 under which Restricted Stock Units (“RSUs”) have been allotted to eligible employees. On exercise of the RSUs by some of the employees, Equity Shares have been allotted to them. Some RSUs are outstanding against which Equity Shares will be allotted on exercise before effectiveness of the scheme of arrangement (“Scheme”).

Table 1: Shareholding Pattern of RRL (As on Dec 2019)

| Particulars | Number of Shares | % |

| RRVL* | 4,98,70,26,060 | 99.95 |

| Specified Shareholders | 25,24,590 | 0.05% |

| Total | 4,98,95,50,650 | 100% |

*RRVL is Reliance Retail Venture Ltd.

Note: The number of RSUs outstanding as on 11 December 2019 is 17,54,894 against which 10,52,937 Equity Shares are proposed to be allotted before the effectiveness of the Scheme.

As the Equity Shares of RRL are not listed on any stock exchanges, RRL has been receiving requests from the employees holding Equity Shares for providing them options for exit and liquidity, including by way of listing of the Equity Shares. However, the Company has no plan to list its equity shares.

To provide liquidity/ exit option, the Company is proposing the Scheme in terms of which, equity shareholders of the Company other than the holding company viz., Reliance Retail Ventures Limited (“Specified Shareholders”), are being given listed equity shares of Reliance Industries Limited (the ultimate holding company of the Company) and the corresponding equity share capital held by them in the Company is being reduced and cancelled.

The “Appointed Date” of the transaction is the Effective Date.

Swap Ratio

Upon the effectiveness of the Scheme and 1 (One) day after the Record Date (as defined in the Scheme), the Specified Shares held by the Specified Shareholders shall be deemed to have been transferred and vested in PCPL, without any act or deed, on part of the Specified Shareholders. In consideration for the said transfer, every Specified Shareholder shall receive 1 (One) Equity Share of Reliance Industries Limited (“RIL”) for every 4 (Four) Equity Shares held by them in RRL as on the Record Date. Upon transfer of the Specified Shares, eligible number of RIL Equity Shares shall be deemed to have been transferred from PCPL and vested in favour of such Specified Shareholders.

Immediately upon implementation of actions contemplated as above, the Specified Shares held by PCPL shall stand cancelled, extinguished and annulled and consequently, the paid-up equity share capital of the Company represented by the Specified Shares shall stand cancelled and reduced, without any consideration.

Upon the implementation of the scheme, Reliance Retail Ventures Limited, the holding company, will hold 100% of the paid-up equity share capital of the RRL.

Changes/Amendment in the Scheme:

In its extraordinary general meeting on January 23, 2020, RRL rolled back the mandatory share swap for shareholders. Instead, the company has made the share swap optional for the shareholders. However, those who participate in the swap will have to surrender the entire holding. This move was a result of many shareholders have claimed that the relative valuation given to RRL was less and they also challenged the share swap ratio at NCLT.

Implications of the Current Scheme under Companies Act, 2013

If one looks at the scheme, it is simple scheme with the minority shareholders of RRL as per the provisions of Section 230(1)(b) for providing them exit. The same could have been achieved by following provisions of buyback of shares and/or selective reduction of shares and challenges for those options as discussed below. However, structure of the scheme is complicated as mentioned above by involving holding company and newly formed SPV, which in normal scheme is not required. The Scheme as originally proposed before NCLT provided for compulsory to exit to Specified shareholder by transferring their shares in RRL to SPV. Because of the concerns raised by minority shareholders particularly relating to structure and valuation, subsequently, the Company has modified the Scheme and given an option to the Specified Shareholders either transfer to SPV or keep their shares.

As per Section 230 of the Companies Act, 2013 there is no restriction to pay in cash or kind, a consideration arising out of Compromises, Arrangements, etc so payment by way of shares of ultimate holding company which is listed in no way violated provisions of the Companies Act, 2013.

Use of a Special Purpose Vehicle

The consideration for the transaction will be given by PCPL, a SPV created for execution of the transaction. Though the directors & shareholder of PCPL belongs to Reliance group, they are not classified as a promoter of RIL. The reason for creating SPV instead of making holding Company (Reliance Retail Ventures Limited) or any other RIL subsidiary part of the scheme could be as purchasing share of ultimate holding Company i.e. RIL would not have allowed under Section 19 of the Companies Act, 2013.

Further, if shares of RIL were issued directly to specified shareholders (which PCPL will purchase), RIL would have become party to the scheme and time & cost for the transaction would have increased significantly. No doubt there will be dilution in holding though insignificant.

Hence, to keep the transaction simple and not to make RIL part of the scheme, a SPV was created. It looks like PCPL will borrow funds of circa INR 140 crore for payments to be made to purchase 8, 94, 382 shares of RIL. Post-Completion of the transaction, PCPL will likely to be merged with another group company or may be with RRL also as its main object is similar to RRL.

Other options available with the Company

Buyback of Shares

Other options available with the Company was Buyback of the shares. However, it would be imperative to note that the option to offer their shares under buyback would have been at discretion of the Specified Shareholders and there could be a case where few shareholders would have remained continue to be a shareholder of the RRL. Further, it would have resulted in cash-outflow from RRL & there could be immediate income tax implications in the hands of the company and the specified shareholders.

Selective Capital Reduction

The Company could have gone for the selective capital reduction of shares held by the specified shareholders. Lot of Companies like Cadbury India Limited, UTV Software Communications Limited, Syngenta India Limited, Phillips India Limited, etc. have done/doing the same way. however, all of them faced/facing challenges from the minority shareholders.

Further, it would have also resulted in cash-outflow from RRL & there could be immediate income tax implications in the hands of company and the specified shareholders

Implication under Income Tax Act, 1961

In the hands of Shareholders:

Share transfer by specified shareholders of RRL to SPV may deemed to be Extinguishment of Rights as per section 2(47) in the hands of specified shareholders and specified shareholders may face tax implication under the provision of the income tax act. Issue of shares of RIL to specified shareholders of RRl is not in accordance with the amalgamation or demerger as defined under the provisions of Sec 2(1B) and Sec 2(19AA) of the income tax act,1961

In the hands of Holding company:

Due to capital reduction the stake of Holding company (RRVL) getting increases without paying any consideration (Though no. of shares remains the same), Holding company may face tax implication as per section 56(2)(x).

In the hands of PCPL:

RRL reduces its share capital holds by SPV (i.e. the share holds by SPV which is transfer by Specified shareholders) without giving any consideration to SPV. As per section 50CA of Income Tax, 1961 if any shares of unlisted company transfer less than FMV, value determined as per rules is deemed to be full value consideration in the hands of transferor.

Valuation

RRL is India’s largest retail company by turnover, profits and store network. RRL has an overall count of 11,316 stores covering an area of 26.3 million square feet against its competitor Avenue Supermart Limited which Operates 196 stores with total retail business area of 6.97 mn sq. ft.

Table 2: Valuation Particulars

| Particulars | |

| Shares of RIL Diluted (No. in Crores) | 532.06 |

| Swap Ratio | 1:4 |

| Circa RIL per Share Price (₹) | 1560 |

| Value per share of RRL (₹) | 390 |

| Total Valuation of RRL (₹ Crores) | 2,07,504 |

In comparison with its close competitor DMART, RRL has much more revenue and better revenue per sq. Ft matrix. Its product portfolio is also much stronger than DMART. Considering the valuation arrived for RRL, there could be some concerns from the specified shareholders. However, one needs to consider that RRL is an unlisted company & also, it is not debt-free.

Table 3: Financial Comparison of DMART & Reliance Retail (As on March 19)

| Particulars | DMART | RRL |

| Market Valuation (₹ Crores) | 1,20,228 | 2,07,504 |

| Enterprise Valuation (₹ Crores) | 1,20,803 | 2,23,365 |

| Area as on 30.9.2019 (Sq. Ft.) | 69,70,000 | 2,63,00,000 |

| EV per sq. ft. | 1,73,319 | 84,929 |

| Revenue (₹ Crores) | 20,052 | 1,30,566 |

| EBITDA | 1,681 | 6,201 |

Conclusion

As SPV has no business and it will fund RIL shares acquisition through borrowings and post exchange on implantation of the scheme, it will hold shares of Reliance Retail. so, it remains investment company having no income and having loan or paid-up capital of just one lac as on date of the shares of Reliance Retail. Finally, investment company needs to go for restructuring scheme either with the company or firms who financed acquisition or with RRL and cancelling those shares. In any case, it may amount to reduction of capital and/or buyback of shares by paying consideration in kind. It also amounts to reduction or buyback out of borrowed funds if acquisition is financed through debt and not equity. So, to achieve objective of capital reduction out of borrowed funds, the scheme is structured in a complicated manner.

Also, as per notification dated 3rd February 2020 by MCA, Section 230 (11) is notified and effective, which says any compromise or arrangement may include takeover offer made in such manner as may be prescribed. So now an option is also available to the Majority of shareholders holding more than 75% of RRL to make an offer to buy shares of specified shareholders by following the procedure as per notification. In such a case, such a completed structure is not required to achieve the objective.

Add comment