Pandemic coupled with the Steller rise in Over the Top (“OTT”) had questioned survival of multiplexes and movie theatres. Amid of struggle, the two largest multiplex chains in India announced a merger which is likely to usher in having a war chest against OTTs. Will this consolidation see a glimmer of light at the end of the tunnel for the two biggest multiplex companies in India?

INOX Leisure Limited (“INOX” or the “Transferor Company”) the second largest multiplex operator in India operates 160 multiplexes and 675 screens in 72 cities in India. The equity shares of the company are listed on nationwide bourses. The registered office of the company is in Delhi.

PVR Limited (“PVR” or the “Transferee Company”) is the largest multiplex operator in India operates a cinema circuit comprising 871 screens at 180 properties in 73 cities (India and Sri Lanka). The equity shares of the company are listed on nationwide bourses. The registered office of the company is in Delhi.

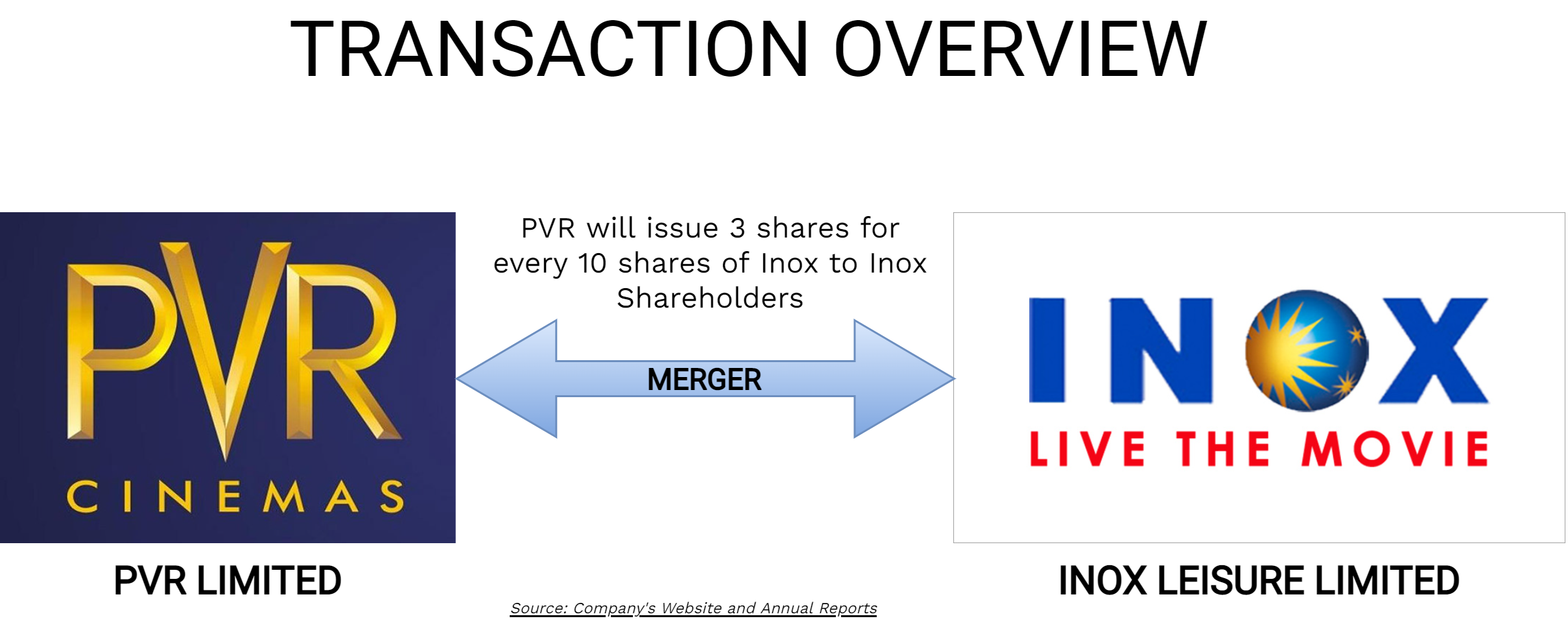

The Transaction

The Board of Directors of PVR Limited & INOX Leisure Limited (INOX) at their respective meetings have approved the merger of INOX with PVR through a Scheme of Amalgamation (“Scheme”). The Appointed Date for the transaction will be Effective Date i.e., the date on which conditions are mentioned in clause 9.1 of Part IV of the Scheme.

Swap Ratio:

Upon the merger being effective, 3 (Three) equity shares of INR 10 (Indian Rupees Ten) each fully paid up of PVR will be issued for every 10 (Ten) equity share of INR 10 (Indian Rupees Ten) each of Inox.

Capital Size of the Companies:

| Particulars | PVR | Inox | PVR-Inox (Merged Entity) |

| Paid-Up Capital | 60,99,65,870 | 122,33,90,940 | 97,65,63,150 |

| Face Value | 10 | 10 | 10 |

| No. of Shares | 6,09,96,587 | 12,23,39,094 | 9,76,56,315 |

Despite being half the size of PVR, Inox is having double the capital size that of PVR.

Post-merger, as per clause 9 of the Scheme, the promoters of INOX will be classified as promoters in the merged entity along with the existing promoters of PVR.

Further Clause 10 has been added to deal with the composition of the Board of Directors of the merged entity. Ajay Bijli would be appointed as the Managing Director and Sanjeev Kumar would be appointed as the Executive Director. Pavan Kumar Jain would be appointed as the Non- Executive Chairman of the Board. Siddharth Jain would be appointed as Non-Executive Non-Independent Director in the combined entity. Even though Inox promoters will be appointed as directors on the board of the Merged Entity, they will not get involved in any day-to-day transactions of the Company since their appointment will be as “Non-Executive Director,” whereas PVR Promoter Group vide Mr. Ajay Bijli – Executive MD and Mr. Sanjeev Kumar – Executive Director will engage in day-to-day activities of the Company.

For the smooth operations of the merged entity & to avoid any conflicts between Inox & PVR promoter groups, there will be amendments in the chartered documents of the merged entity through the scheme. Upon effectiveness of the scheme, the Board of Directors of the merged company would be re-constituted with total board strength of 10 members and both the promoter group (Inox & PVR promoters) having equal representation on the Board with 2 board seats each. Further, in case of dilution of their stake, fall-away board rights available with each group. If the respective promoter group fall below 7.5% but above 5%, each promoter group will nominate 1 director and, in the event, it falls below 5%, the promoter group will lose their right to appoint director on the boards.

So long as Inox promoter’s equity holding is above 7.5% in the merged entity, they will have the right to appoint Chairperson on the Boards and PVR promoters having equity holding above 5%, Ajay Bijli shall be appointed as Managing Directors. Further, there will be right available with each promoter group to appoint non-executive non-independent directors till their equity holding remains above the prescribed limit mentioned in the chartered document. On certain key decisions like material change in business, annual business plan, disposal/acquisition of business, borrowing more than prescribed limit, shares issue, amendment to chartered documents, distribution, winding-up etc. shall require an affirmative vote from both promoter groups (till respective group’s equity holding is above 7.5%).

Brand Strategy:

The combined entity will be named PVR INOX Limited with the branding of existing screens to continue as PVR and INOX respectively. New cinemas opened post-merger will be branded as PVR INOX. Thus, the identity of the existing brands will be maintained & going forward the new name will be a combination of both brands.

Rationale for the Merger

With INOX operating 675 screens across 160 properties in 72 cities and PVR currently operating 871 screens across 181 properties in 73 cities, the combined entity will become the largest film exhibition company in India operating 1546 screens across 341 properties across 109 cities.

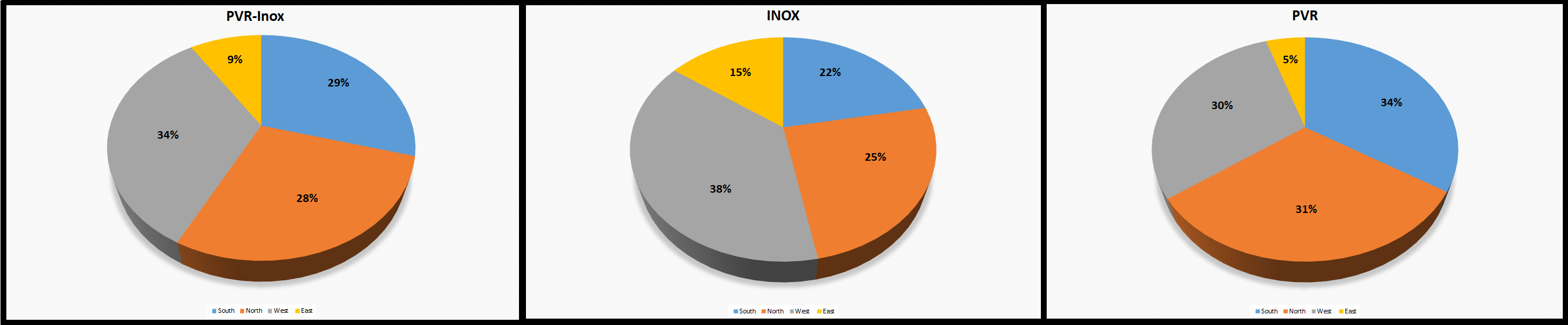

PVR is having strong expansion across the South & North region while Inox has strong expansion in West. The merger will usher in consolidating positions across various regions. Further, management has told that there are limited overlaps of location.

The combination would augur well for the growth of the Indian cinema exhibition industry, besides ensuring tremendous value creation for all stakeholders, including customers, real estate developers, content producers, technology service providers, the state exchequer, and the employees.

OTT platforms due to higher mobile internet penetration, low cost of internet data, ease of access, multi-homing, free content, and low subscription charges has already begun to have an impact and will continue to impose significant pressures on the theatrical business. The film business is going through a rapid transformational change due to advent of technology and hence, to compete effectively, it has become imperative to consolidate for the long-term sustainability of the business.

Accounting Treatment:

As currently, the control of Inox & PVR lies with different promoter groups, the merger will be accounted in the books of PVR as per the “Acquisition Method” provided in the Indian Accounting Standard 103 “Business Combination”., though in the true sense, it is business combination hence ‘Pooling of Interest Method” should have been followed. The assets & liabilities pertaining to the transferor company i.e., Inox will be recorded at fair value as on the acquisition date (Appointed Date) and the difference between fair value of assets & liabilities after reducing the amount of consideration paid (shares issued) will be adjusted as “Goodwill.”

Competition Commission of India Approval:

The merger between the first & second largest multiplex player will usher in having a market share of around 40-50% of the merged entity. Any re-structuring transaction exceeding the prescribed limit as mentioned in The Competition Act, 2002 needs prior approval from CCI. Though the proposed merger will usher in significant consolidation of market share, the management of Inox & PVR said that CCI approval will not be necessary as the transaction is not exceeding the prescribed limit mentioned in the act.

Acquisition in recent past

In 2015, Inox acquired Satyam Cineplexes for consideration of INR 182 crore with 38 screens, a prominent player in the multiplex space with a strong presence in North India.

In 2015, PVR acquired the cinema exhibition business of DLF Utilities Limited with brand name “DT Cinemas”, on a slump sale basis for an aggregate consideration of approximately Rs. 500 (Five hundred) Crores. DT Cinemas (DT) was having operations in National Capital Region and Chandigarh. In 2019, PVR acquired SPI Cinemas for consideration of circa INR 900 crore mix of cash & equity, south India’s largest cinema chain with a presence in key markets of Tamil Nadu, Telangana, Andhra Pradesh, Karnataka, Kerala, and Mumbai.

Recent Fund Raise

As a result of the pandemic, the operations of multiplex were shut or operating with limited capacity. This has dented the financials of all the multiplexes across globe and for survival, most of the multiplexes did negotiate rent with landlords & fundraised through debt & equity.

PVR did two fundraise of INR 1100 crore through issuance of equity consisting of Rights Issue (INR 300 crore) and Qualified Institutional Placement (INR 800 crore). Similarly, Inox also raised INR 265 crore through Qualified Institutional Placement.

Financial & Valuation

Financials of Inox & PVR for 9M ended on 31st December 2021

INR in Crore

*: After adjusting other income

Valuation:

INR in Crore

PVR has better ticketing prices while premium food & beverages spread. Further, PVR focuses more on a prime locations in tier I cities while Inox is having more focus on tier II & III cities.

Conclusion

In a way, it is a case of a real merger as promotors of the transferor company will continue to be classified as promotors and will also have board seats, though not be part of operations and day-to-day management The proposed merger is likely to be a compulsion move for survival than achieving the synergies. The merger will place the merged entity in dominating position which will entail not only better negotiations with producers/distributors but will allow to accelerate the pace of growth in new cities across India. No doubt, simultaneously it will usher in cost savings in future.

The existing promoters of Inox will become co-promoters in PVR and the operations of the merged entity will be managed jointly. To have smooth operations & no dispute among promoters, the Scheme envisages designation & composition of board of the merged entity. The merged entity may again look to raise funds and built a war chest to fight against the global & regional OTT players. Further, the scheme has a provision to re-align the rights of each of the promoter group upon equity dilution in future. Going ahead the merged entity will focus on having premiumisation of PVR and margins of Inox. Only time will tell how this merger will re-shape the industry as a whole and value-accretive for the stakeholders of both companies.

Add comment