In a move towards becoming a leading Fast-Moving Consumer Goods Company (FMCG), the Board of Directors of Tata Consumer Products Limited & its subsidiary companies approved the Composite Scheme of Arrangement (“Scheme”) amongst Tata Consumer Products Limited, Tata Coffee Limited and TCPL Beverages & Foods Limited.

Tata Consumer Products Limited (“TCPL” or “Transferee Company”) along with its subsidiaries, associates, joint ventures, is engaged in the business of production, trading, and distribution of consumer products mainly tea, coffee, water, other beverages, salt, pulses, spices, snacks etc. TCPL’s operations are spread across regions like India, Europe, USA, Canada, Australia. The equity shares of TCPL are listed on nationwide bourses. The registered office of the company is in the state of West Bengal.

Tata Coffee Limited (“TCL” or “Demerged Company” or “Transferor Company”) along with its subsidiaries, joint ventures and associates is engaged in the plantation business of cultivation, curing and processing of coffee, tea, pepper, and allied plantation products and in manufacture and sale of instant and soluble coffee powders. TCL is among the world’s largest integrated coffee cultivation and processing companies, the second largest exporter of instant coffee, TCL is a subsidiary of TCPL (holding 57.48% stake) and its equity shares are listed on nationwide bourses. The registered office of the company is in the state of Karnataka.

TCPL Beverages & Foods Limited (“TBFL or Resulting Company) is a wholly-owned subsidiary of TCPL and has been recently incorporated to facilitate the proposed transaction. The registered office of the company is in the state of Karnataka.

The Transaction

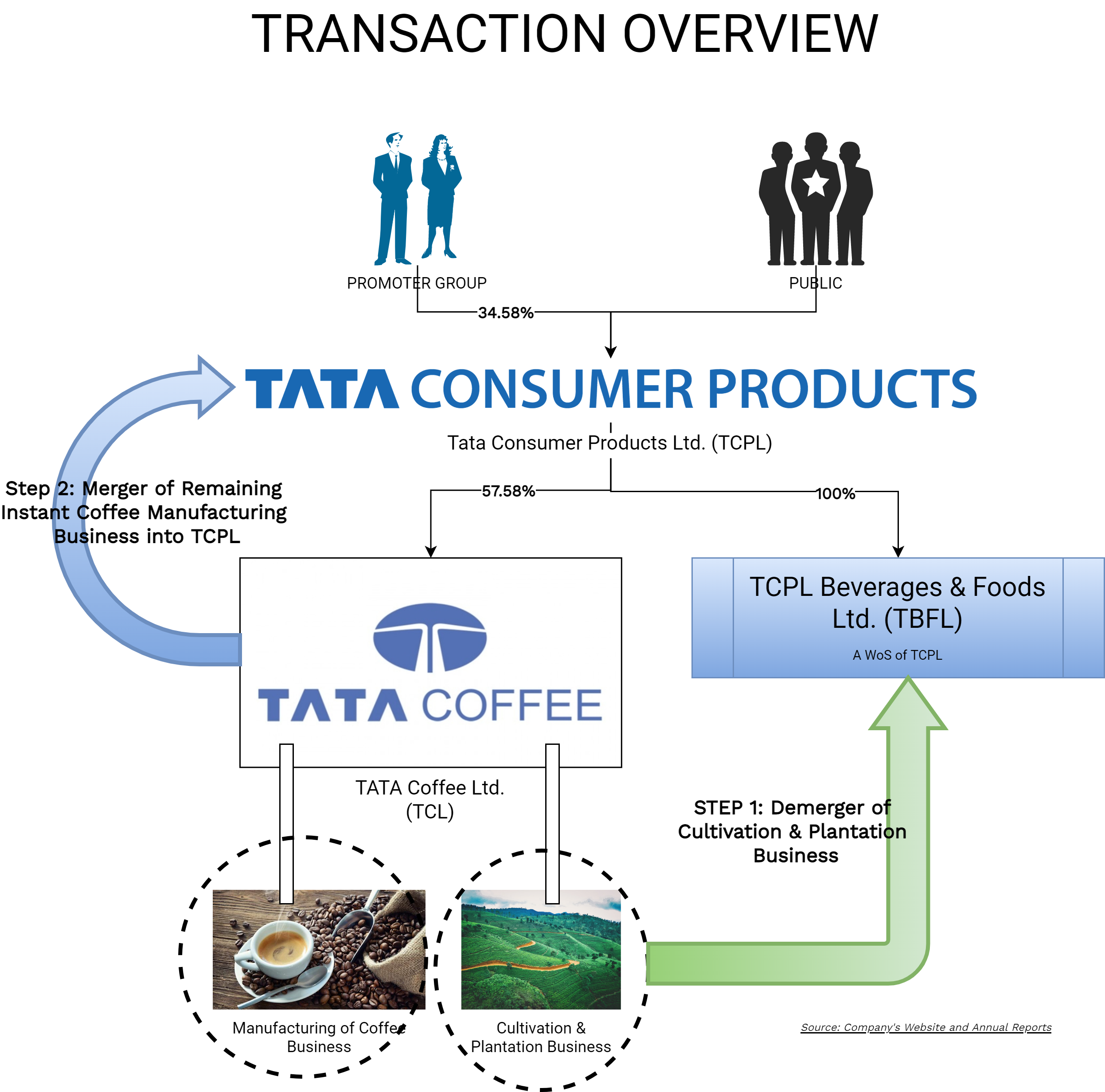

In line with its strategic priority of unlocking synergies and bringing efficiencies, Tata Consumer Products Limited announced a reorganization plan for its domestic & international business. This plan includes the demerger of the Plantation Business of Tata Coffee Limited into TCPL Beverages & Foods Limited and the merger of the remaining TCL, consisting of its extraction and branded coffee business with Tata Consumer Products Limited.

As a first step of the reorganization plan, the demerger of the Plantation Business of TCL into TBFL and as a second step, followed immediately by the amalgamation of the remaining TCL into TCPL.

The “Plantation Business” of TCL has been identified as the business of TCL relating to the cultivation, curing, processing, manufacture and sale of tea, coffee, pepper, and other plantation crops including other plantation allied business and the roast and ground coffee facility in Kushalnagar works.

The Appointed Date for the transaction is Effective Date or such other date as may be mutually agreed by the Companies. The “Effective Date” means the date which will be the first day of the month following the month in which the Companies mutually acknowledge in writing that the last of the conditions and matters referred to in Clause 29.1 of the Scheme have occurred or have been fulfilled, obtained, or waived, as applicable, in accordance with this Scheme. It is further clarified in the scheme that demerger will take the effect and subsequently the merger shall be made effective but the issuance of consideration pursuant to the demerger & merger shall be undertaken simultaneously. Thus, the scheme provides for single “Record Date” for demerger & amalgamation. This is because in both cases shares are issued by TCPL.

Swap Ratio

Despite demerged undertaking will be transferred to the wholly-owned subsidiary of TCPL, the consideration for both demerger & amalgamation will be discharged by the TCPL only.

On effectiveness of the Scheme, the shareholders of TCL (other than TCPL) as on the record date will receive an aggregate of 3 equity shares of TCPL for every 10 equity shares held by them in TCL, through the issuance of:

- 1 equity share of TCPL for every 22 equity shares of TCL, in consideration for the demerger

- 14 equity shares of TCPL for every 55 equity shares of TCL, in consideration for the merger

Share Capital

| Particulars | TCPL | TCL | TCPL-Post Restructuring |

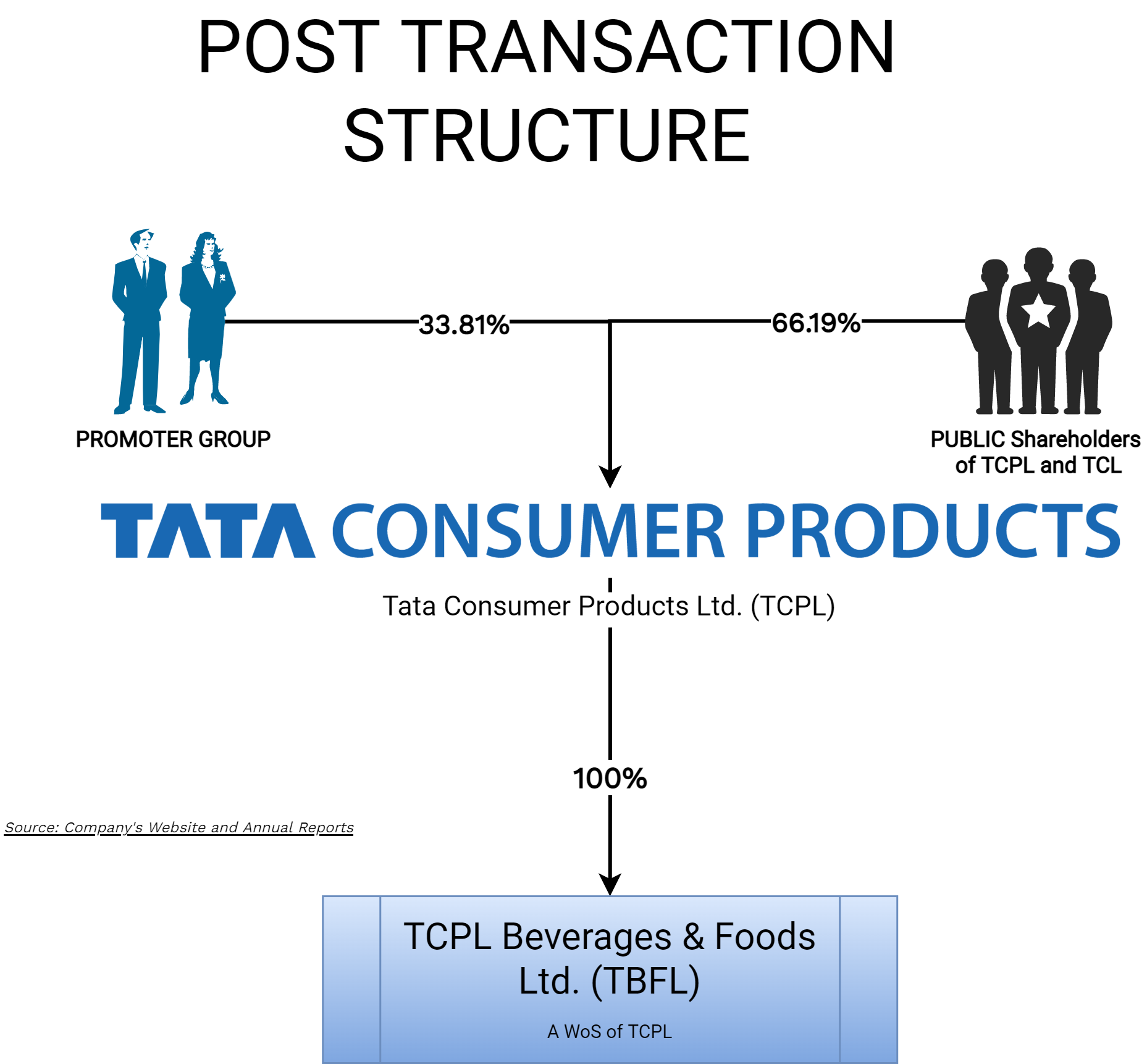

| Promoters | 34.69% | – | 33.84% |

| Promoters: TCPL | – | 57.48% | – |

| Public | 65.31% | 42.52% | 66.16% |

| Paid-Up Capital (No. of Equity Shares of INR 1 each) | 92,15,51,715 | 18,67,70,370 | 94,53,74,881 |

As a result of demerger & amalgamation, no shares will be issued to TCPL being the shareholders of TCL.

Rationale

The proposed scheme is aligned towards vision of TCPL to make itself full-fledged FMCG company. The scheme paws the way for the consolidation of its listed subsidiary TCL with itself which is likely to bring operational efficiencies, revenue and cost synergies including from commonality of customers, sales and supply chain opportunities through enhanced geographical reach with a wider variety of product offerings which will help in gaining market share, optimization of capital, operational (including promotion) expenditure, leveraging sales and distribution network and simplification of overlapping infrastructure.

The transaction structure includes first demerger of the plantation business of TCL to a wholly-owned subsidiary of TCPL which will usher in placing both TCPL’s core branded business & Plantation Business under same umbrella but in a separate company.

TCL shareholders will get access to multiple growth engines and participation in a larger and fast growing FMCG business. TCPL shareholders are expected to benefit from better synergies and business efficiencies going forward and direct cash flow benefits of coffee business.

Direct Taxation

Both amalgamation & demerger will be in compliance with section 2(1B) & 2(19AA) of the Income Tax Act, 1961 (“ITA”), it will not attract any tax liability in the hands of company/ices & its shareholders. Further, it is pertinent to note that the consideration for the demerger will be issued by TCPL and not by TBFL. In a vanilla demerger, the consideration gets issued by the company in which business is getting demerged however, in the present proposed transaction, the consideration will be discharged by 100% holding company. Even though, the transaction will not attract any tax liability as section 2(41A) of the ITA defines a resulting company, inter alia, to include a company and its wholly-owned subsidiaries, to which the undertaking of the demerged company is transferred on demerger. Thus, the resulting company is not only the company to which the undertaking of the demerged company is demerged, but also includes its 100% holding company which may issue shares to the shareholders of the demerged company.

To avoid any confusion/litigation relating to direct taxes, in several clauses, it is explicitly mentioned that both demerger & merger are in compliance with the section 2(1B) & 2(19AA) of the Income Tax Act, 1961.

Accounting Treatment

As TCL & TBFL are subsidiaries of TCL, all the entities involved under the transaction are commonly controlled and thus both merger & demerger will be recorded in the books of the respective companies in accordance with the Appendix C of Indian Accounting Standard – 103 on Business Combinations and other Indian Accounting Standards as applicable.

Other Aspects

Upon implementation of the Scheme, the name of TBFL will be changed to Tata Coffee Limited. All the costs relating to the demerger shall be borne by TBFL while for the amalgamation will be borne by the TCPL. To save time & confusion regarding the stamp duty in the state of Tamil Nadu, the scheme also provides for the market value of various properties pertaining to TCL located in the state of Tamil Nadu.

Further, immediately after announcement of the scheme, TBFL has approved the allotment of 75,00,000 Optionally Convertible Redeemable Preference Shares of INR 10 each to TCPL, though a result of demerger shares were issued to shareholders of TCPL and in effect, it looks like demerger was without receiving any consideration directly by TCPL.

Pursuant to the wrong pocket clause mentioned in the scheme, if any part of demerged undertaking is not transferred to TBFL on the effective date pursuant to demerger, then TCL or its successor shall take necessary actions to ensure that such part of demerged undertaking be transferred to TBFL for no further consideration. Similarly, if any part of the remaining business is inadvertently held by TBFL after the effective date then TBFL shall ensure to transfer such part to TCL or its successor for no consideration.

Schedule I & II of the Scheme provide details of the immovable properties getting transferred through demerger and amalgamation, respectively.

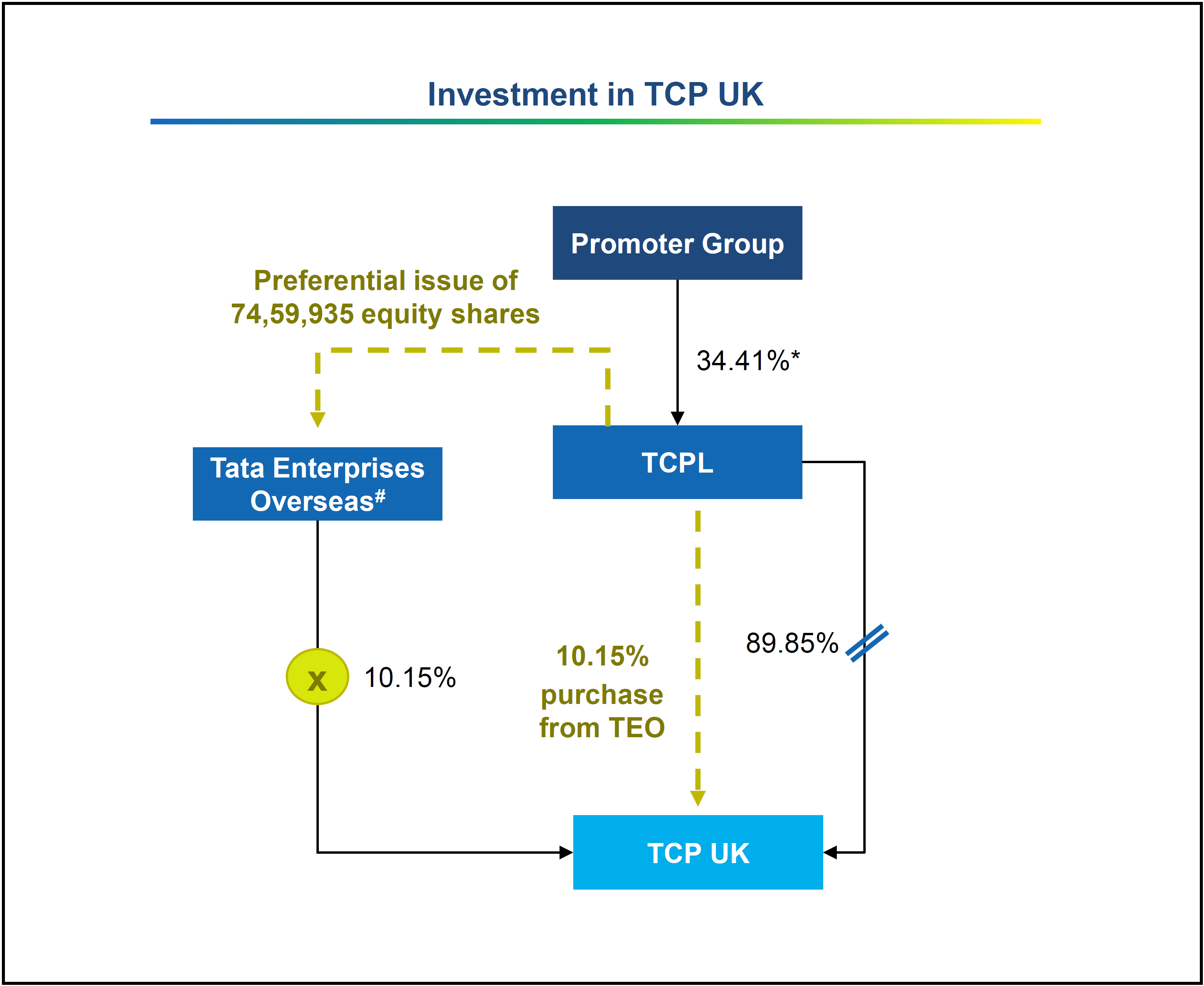

Consolidation of Interest in TCP UK

The Board of Directors of TCPL also approved the purchase of 10.15% minority interest in its UK subsidiary, TCP UK, from the promoter group entity, Tata Enterprise (Overseas) AG, Switzerland (TEO). As consideration, TCPL will issue 74,59,935 equity shares i.e. 0.80% stake to TEO, by way of preferential issue in accordance with the applicable regulations. The above transactions will result in TCPL having 100% ownership of the business of TCL and of TCP UK, which will be an enabler for efficient reorganization initiatives of its international business.

TCP UK is engaged in processing, marketing and distribution of tea, coffee and related products in the UK and has subsidiaries in the USA, Canada, Australia, Poland etc.

Financials

Consolidated financials of TCPL & TCL for FY 2021-22

INR in crore

*: Excluding the current portion of long-term borrowing.

Bifurcation of TCL’s revenue between branded (value-added products) & plantation business for FY 2021-22

Valuation

As per the joint valuation report issued by the valuers, the valuation of the plantation business of the TCL has been valued at circa INR 34.72 per equity share which translates to circa INR 650 crore. While the remaining business of TCL has been valued at circa INR 3650 crore. TCPL has been valued at circa INR 70,500 crore.

The valuers have arrived at above values using weighted average of various internationally accepted methods like Discounted Cash Flow Method, Market price Approach (only for TCPL) and Comparable Company Multiple Method.

While for share swap for acquiring the remaining stake in TCP UK, TCP UK has been valued at circa INR 5658 crore using equal weights to Discounted Cash Flow method & Comparable Companies Multiple Method & TCPL is valued the same at circa INR 70,500 crore.

Other few re-structuring by TCPL in recent past

With the aim to bring two complementary businesses of the group, in 2020, TCPL acquired through demerger “consumer product Business” consisting of marketing of Tata Salt of Tata Chemical Limited to TCPL. TCPL also acquired the branded business of Dhunseri Tea and Industries Limited which includes the leading local brands in Rajasthan, India – ‘Lal Ghora’ and ‘Kala Ghora’

To give a new avatar to the company, the name of changed to Tata Consumer products Limited from Tata Global Beverages Limited.

Later, Tata Consumer Products Limited acquired 100% shares of Tata SmartFoodz Limited (TSFL) from Tata Industries Limited for a cash consideration of ₹395 crore. TSFL, under the brand name Tata Q, offers a range of food products. TCPL also acquire a 100% stake in Kottaram Agro Foods—the maker of Soulfull brand of breakfast cereals and millet-based snacks for a consideration of INR 155.8 crore. Further, it has also acquired PepsiCo’s stake in NourishCo Beverages Limited—a 50:50 joint venture between PepsiCo & TCPL.

Conclusion

In an extremely focused manner, TCPL is aggressively aiming to become large FMCG company by acquiring small brands and at same time consolidating various food business held by the tata group and acquiring businesses to fill the gap in products. Recent move to consolidate TCL operations with TCPL is step towards it.

The transaction has been structured with due care. Plantation business will be placed in an unlisted wholly-owned subsidiary (TBFL) of TCPL while the branded/value added business will get consolidated with TCPL’s core business. It is interesting to note that TCPL has also subscribed to the optionally convertible preference shares of TBFL and not as part of the scheme. The natural next step is likely to be invite joint venture partner in the subsidiary or sell the subsidiary company. The whole consolidation is being done in the most efficient manner.

Add comment