Recently, the Board of Directors of Jindal Poly Films Limited their board meeting held on 16th March 2022 approved the internal restructuring of its Packaging Film Business followed by stake sale in the packaging Business to a financial investor.

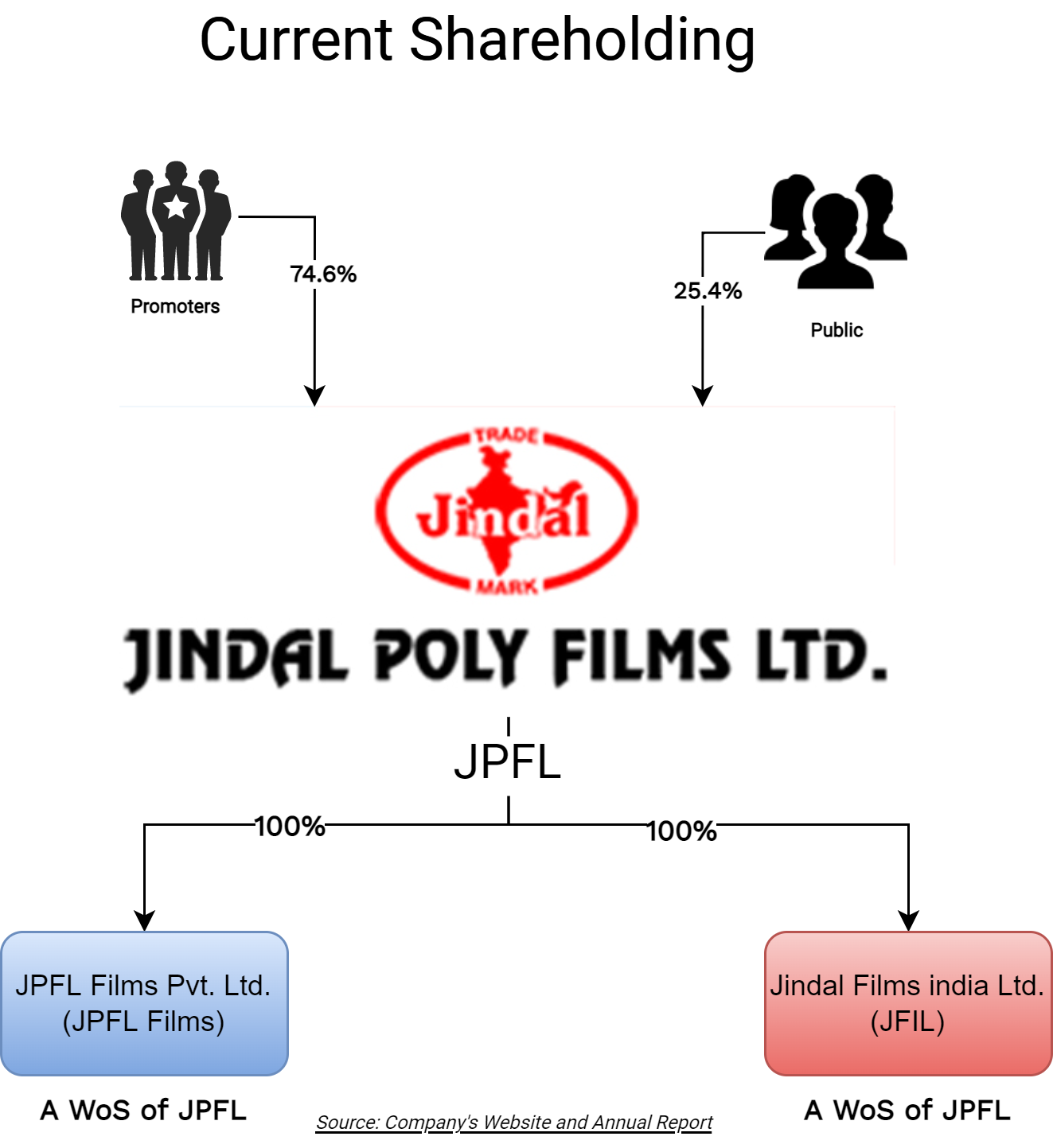

Jindal Poly Films Limited (“JPFL” or “Transferor Company”) is one of the world’s leading companies in manufacturing flexible plastic films and non-woven fabrics products. It provides a full suite of products including BOPP, BOPET, CPP, & other specialized films. Non-woven fabrics find application in hygiene, baby diapers and other medical applications.

The equity shares of JPFL are listed on national bourses.

JPFL Films Private Limited (“JPFL Films” or “Transferee Company”) is incorporated in 2018, does not have any business operations. JPFL Films is a wholly-owned subsidiary of JPFL.

Jindal Films India Limited (“JFIL”) is a wholly-owned subsidiary of JPFL. The company is also engaged into the business of flexible plastic films. JFIL mainly sells the products purchased from its holding company i.e., JPFL.

The Transaction

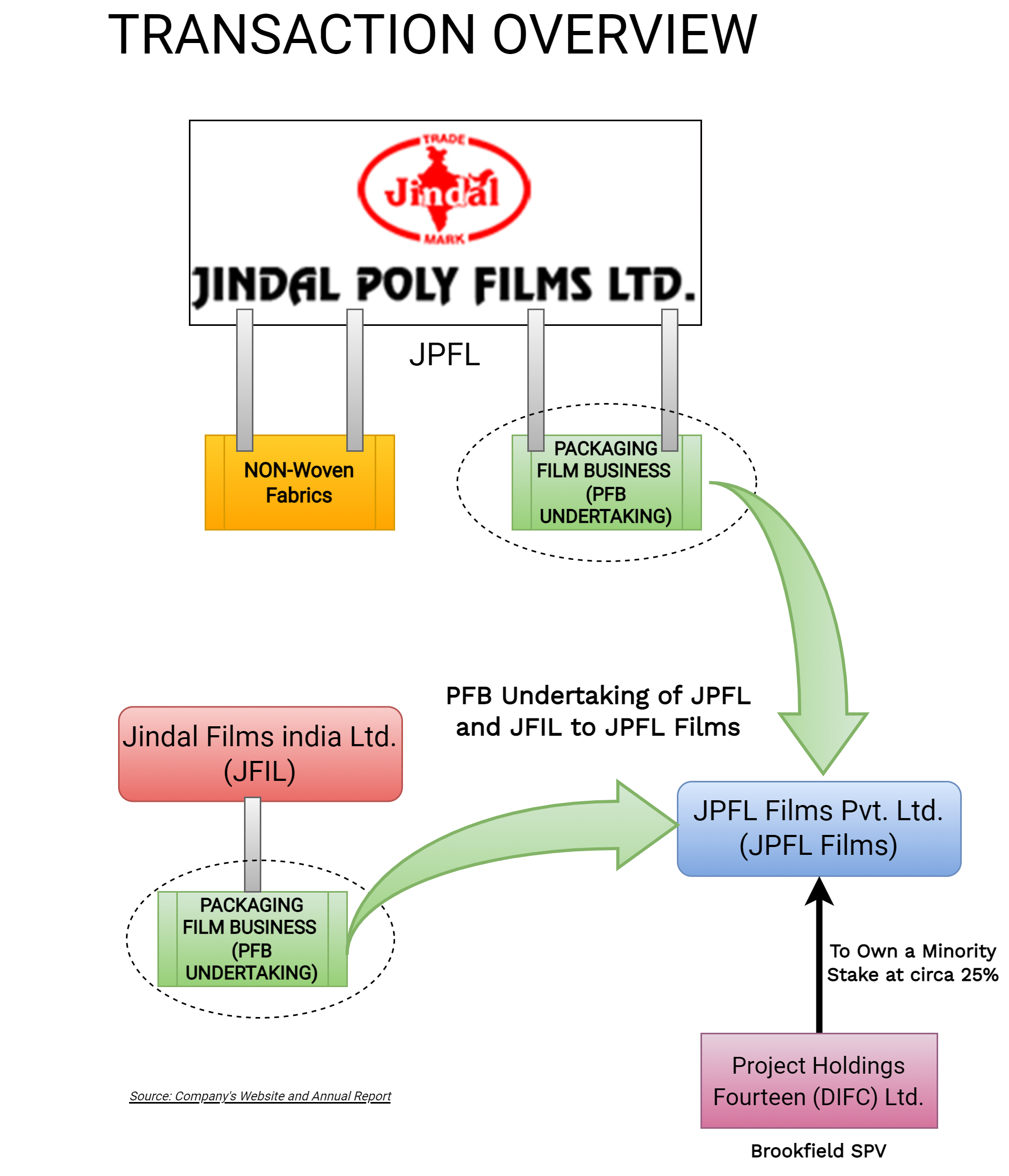

As mentioned above, currently JPFL has two divisions:

- Packaging Films Business Undertaking which includes manufacturing of BOPP, BOPET, CPP & other specialized films

- Non-Woven Fabrics

Subject to approval of the shareholders of the Company by way of a special resolution, the Board of Directors of JPFL approved transfer of the Packaging Films Business Undertaking to JPFL Films, a wholly-owned subsidiary of JPFL by way of a “Slump Sale” on “Going Concern” basis. Along with this, JFIL will also transfer its packaging film business to JPFL Films by way of a “Slump Sale” on “Going Concern” basis.

For this purpose, JPFL and JPFL Films have executed the Business Transfer Agreement on 16th March 2022 (“BTA”).

JPFL will continue its non-woven business and hold other corporate assets. JFIL will be left with investments in other group companies and other assets.

The Packaging Films Business Undertaking of JPFL is proposed to be transferred for a lumpsum consideration which is equal to or above as calculated in accordance with Section 50B of the Income-tax Act, 1961 read with Rule 11 UAE of the Income-tax Rules, 1962 and in such manner and on such terms and conditions as may be decided by the Board, in its sole and absolute discretion. Thus, the consideration can be cash, loan or issue of any financial instruments such as equity shares, Convertible or Non-Convertible Preference Shares, Debentures etc or a combination thereof.

Investment by Brookfield Asset Management Inc

Project Holdings Fourteen (DIFC) Limited (“Brookfield SPV”), a special purpose vehicle of Brookfield will invest INR 2000 crore mainly through primary infusion of Rs 1999 crores in JPFL Films (Packaging Film Business of JPFL) i.e. subscribe to 19,990 Compulsorily Convertible Preference Shares (CCPS) having a face value of 10,00,000 each of JPFL Films (on preferential basis) amounting to INR 1999 crore. It will acquire 20 equity shares of JPFL Films for an aggregate consideration of INR 1 crore and as a result of both, it will have circa 25% stake in JPFL Films.

Further, 25% shareholding of Brookfield SPV in JPFL Films (on a fully diluted basis) is subject to downside protection in the form of a ratcheted equity structure, tied to the financial performance of JPFL Films and even after any adjustment, Brookfield SPV shall continue to be a minority investor.

Other Terms

JPFL and Brookfield SPV have the right to nominate up to 4 directors and up to 2 directors respectively, on the board of directors of JPFL Films.

The Shareholder’s agreement provides for various exit options for Brookfield, including a listing of equity shares of JPFL Films. Brookfield has also entered into an investor rights agreement.

JPFL and Brookfield SPV have agreed for put option to be exercised by Brookfield SPV only in a circumstance where the shareholders of JPFL do not approve steps required for providing an exit to Brookfield SPV at a period & price determined as per the terms of the shareholders agreement between JPFL & Brookfield SPV.

To maintain corporate governance, the shareholder agreement contains a list of reserved matters in relation to which decisions cannot be taken by a single party. It provides for enhanced governance rights in relation to operations of JFPL Films where JFPL Films will be required to seek the prior consent of Brookfield and JPFL in relation to all matters referred/ required to be referred to the board of directors and/or shareholders of JFPL Films for their approval.

Rationale

The investment by Brookfield in the Packaging Films Business will be primarily used for future growth and expansion of the business. The amount will not only deleverage balance sheet but also JPFL Films will evaluate diversifying into adjacent high-growth packaging segments and potentially enter value-added forward integration opportunities either organically or inorganically. It will also look at investing majority or minority stakes in innovative and high-growth companies in the areas of JPFL’s focus segments. Further, the division make get an opportunity to capitalise on the global network of Brookfield to expand its export business.

Tax Implications

JPFL will transfer its Packaging Film Business to JPFL Films by way of a “Slump Sale” on “Going Concern” basis for lumpsum consideration which is equal to or above as calculated in accordance with Section 50B of the Income-tax Act, 1961 read with Rule 11 UAE of the Income-tax Rules, 1962. Excess of consideration above net-worth of the packaging film business undertaking will be liable to tax as capital gains in the hands of JPFL.

Earlier Re-Structuring

In 2018, the Board of Directors of JPFL approved a Scheme of arrangement between JPFL and its wholly-owned subsidiary company, Jindal Photo Imaging Limited (now known as Universus Photo Imagings Limited) for the demerger of the Photo business division of JPFL with the appointed date i.e. April 01, 2019. Post demerger, the equity shares of Jindal Photo Imaging Limited got listed on nationwide bourses. Recently, promoters came up with a voluntary delisting offer of Equity Shares of Universus Photo Imagings Limited. However, later the delisting offer failed as the price discovered through the reverse book building process has been rejected by the promoters.

Financials & Valuation

Segment financials of JPFL for Financial year 2021

INR in crore

The current market capitalisation of JPFL is circa INR 5000 crore. Brookfield has assigned a pre-money equity valuation of INR 6000 crore to the Packaging Film business. Debt pertaining to the Packaging Film business division will also get transferred to JPFL Films. As on 31st March 2021, JPFL has a total borrowing of circa INR 900 crore & cash & cash equivalent (including investment & loan to group companies) of circa INR 650 crore.

Conclusion

Brookfield’s investment in JPFL Films marks this deal among the largest private equity deals in the Indian Packaging sector. Considering the increased scope & newer opportunities around the sector, a lot of international financial investors are showing an interest in this sector. The amount realised from stake sale will be used for the above-stated rationale and partially may also be used to pay consideration for the Slump Sale. The deal will facilitate future expansion with strong financial partner on board. However, any value creation for public shareholders after considering holding company discount in the short term is ruled out.

Add comment