JINDAL STAINLESS LIMITED (JSL):

Jindal Stainless Limited (JSL), a part of the OP Jindal group is among the top 10 stainless steel producers in the world and India’s largest and the only fully integrated Stainless Steel manufacturer. Jindal Stainless has grown from an indigenous single-unit Stainless Steel plant in Hisar, Haryana, to the present multi-location and multi-product conglomerate. JSL is a globally recognized producer of Stainless Steel flat products in Austenitic, Ferritic, Martensitic and Duplex grades.

TURNING POINT:

The macro-economic factors viz. cheaper imports, unfavorable duty structure, inputs cost rise and fluctuation of an exchange rate, adversely affected demand, margins and consequently cash accruals for Jindal Stainless. Expansion through capital expenditure for ramping up the Odisha plant and major funding from borrowing and increase in finance cost by two-and-a-half times from 2011 to 2014 led to huge losses in the company.

With this turning point in 2013, promoters infused Rs. 100.27 crore by preferential allotment of 135.5 lakhs equity shares and also in 2014, Rs. 100 crore by preferential allotment of 107.5 lakhs equity shares of Rs. 2/- each and 1.58 lakh Cumulative Compulsory Convertible Preference Shares (CCCPS) of a face value of Rs. 2/- each at a price of Rs.37.65 per equity share/CCCPS to JSL Overseas Limited, a member of promoter group.

But cash flow of the company did not improve, therefore it approached the CDR cell. Earlier, JSL had applied for restructuring Rs 6,500 crore of debt at a lenders’ meet on August 11, 2011. JSL had old loans of around Rs 2,000 crore and additionally taken a debt of Rs 4,500 crore for revamping up its integrated stainless steel project from 2006 to 2010. On August 24, 2012, the CDR Empowered Group approved the reworked package under the CDR mechanism to restructure its debt of over Rs 8500 crore. The debt of the company is largely on account of its two-phase expansion to set up an integrated stainless steel facility in Odisha, which will have a capacity of 8 lakh tonnes per annum and investment of about Rs.9000 crore (Phase I -2500 crore and Phase II -6500 crores).

Jindal’s debt cum business restructuring created four separate entities for efficiency in operations with more management focus, reduction of debt in new projects and raising of finance through debt and equity in the profitable business

TRANSACTION:

After having various rounds of discussion with the Corporate Debt Restructuring (CDR) cell, the company and lenders came up with Asset monetization cum business reorganisation plan (AMP) – to split the company into three units through demerger/slump sale(s) and utilization of the proceeds of the slump sale (s) in deleveraging the company by an amount of approx. 5,500 Crore.

Also, Jindal Stainless Corporate Management Services Private Limited (JSCMPL) has been established to provide consultancy and advisory services inter alia to JSL and JSHL.

With this JSL’s business restructuring plan was approved by its board of directors at the end of December 2014 and the stock exchange in March 2015. The Company filed a Composite Scheme of Arrangement and the same was sanctioned by the Hon’ble High Court of Punjab & Haryana, Chandigarh (High Court) pursuant by its order dated 21st September 2015 (as modified on October 12, 2015). The Certified true copy of the said order was filed with ROC on 1st November 2015.

STRUCTURE: (CDR Scheme)-

- Separation of business into four entities

- Demerger of Ferro Alloys and Mining division into Jindal Stainless (Hisar) Limited (“JSHL”) for one equity of JSHL against one equity of JSL and one Cumulative Compulsory Convertible Preference Shares for one Cumulative Compulsory Convertible Preference Shares.

- Slump Sale of Stainless Steel Plant located at Hisar (Haryana) (including investments in 6 domestic subsidiaries) to JSHL for lump sum consideration of Rs. 2809.8 crore.

- Slump Sale of Hot Strip Plant located at Odisha to Jindal United Steel Limited (JUSL) for lump sum consideration of Rs. 2412.70 crore

- Slump Sale of Coke Oven Plant located at Odisha to Jindal Coke Limited (JCL) for Lump sum consideration of Rs. 492.7 crore

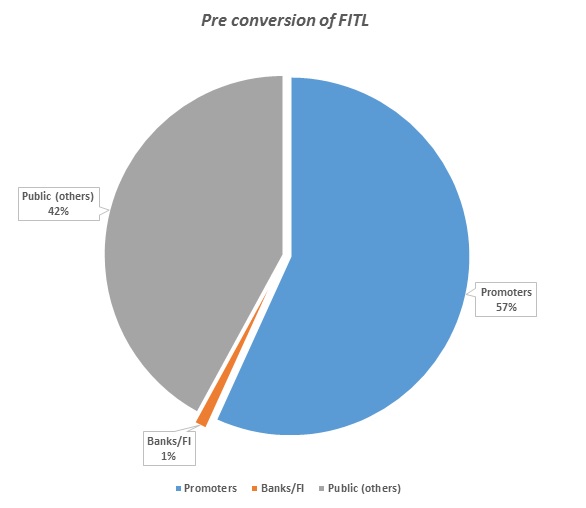

Shareholding Pattern – PRE – FITL

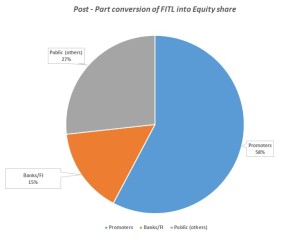

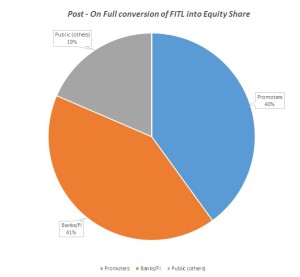

- Conversion of Funded Interest Term Loan (FITL) into Equity and convertible preference shares Each CDR lender participating in the funded interest term loan has an option to convert into equity shares up to an amount equivalent to 30% based on certain terms and conditions. Consequently the CDR lenders exercised their right to convert the outstanding Funded Interest Term Loan I and II in the following manner:FITL amounting to Rs.250 Crore to be converted into5,36,48,068 fully paid up Equity Shares of Rs.2 each, at a price of Rs.46.60 per Equity Share of by way of preferential allotment on private placement basis; and either 6,13,21,888 Cumulative Redeemable Preference Shares (“CRPS”) or 6,13,21,888 Optionally Convertible Redeemable Preference Shares (“OCRPS”), of the Company, having face value of Rs. 2/- each, to be issued at a price of Rs. 46.60/- per share of about Rs.751.76 Crore both being entitled to a fixed cumulative dividend at a rate of up to 0.25% p.a. Consent via special resolution at the general meeting on 21st December 2015 was accorded to the board for issue of shares The expected shareholding of the promoter group would be as follows–

- The Loans would be secured by personal guarantee of Mr. Ratan Jindal and promoter group companies.

The details of Demerger and Slump Sale are as follows:

DEMERGER – JINDAL STAINLESS HISAR LTD

The business comprising of Ferro Alloy and Mining is transferred through the demerger process. The net asset value as on 31.03.2014 of both the demerged undertaking (i.e. Ferro Alloy and mining) is Rs. 585.13 crore. The Consideration is discharged to the shareholders of JSL in a form of one Equity Share and one Cumulative Compulsorily Convertible Preference shares in JSHL for every one equity share and one cumulative compulsorily convertible preference shares in JSL respectively. The record date for allotment is 21stNovember 2015 whereas the bankers were not part of equity or preference share capital. So the bankers will have rights of equity and preference share in the JSL only and not the JSHL.

JSHL was formed as a WoS of JSL but once the consideration is discharged by JSHL and there on cancellation of holding of JSL in JSHL it will cease to exist as WoS.

Whether the Remaining JSL will be investment Co and any business left the company?

The remaining undertaking will compromise of manufacturing facility located at Jajpur Odisha and 11 direct and step down Subsidiaries including investment in JUSL and JCL

With the Sanction of the Scheme JSHL has already ceased to be a subsidiary of the company. The other two subsidiaries will also cease to be subsidiary companies post receipt of approval from OIIDCO induction of new investors in the said companies. However, these will continue to remain associated companies of the Company.

So the major loan which was used for expansion of Jajpur Odisha plant will remain with the company and will be payable from the slump sale consideration received from the JSHL and JCL and JUSL.

Whether ownership of properties and leasehold rights transferred with respective undertaking?

The ownership or leasehold rights are not transferred as part of demerged or slump sale undertaking, it remains in the remaining business of the company. One reason might be bankers might have asked the company to keep the same in the company for security purposes and it also created investment division in the company where the company might have entered in leasing agreement for the same, but it has to be considered that new investors who are investing the business where the land facilities are not of the company.

SLUMP SALE – JINDAL STAINLESS HISAR LTD

The business of Hisar unit with Net Asset Value as on 31.03.2014 of Rs. 1649.58 core is transferred to the JSHL as slump-sale for a consideration of Rs. 2809.80 crore and will be discharged as follows:

| Particulars | Crores |

| Paid by JSHL in cash | 2600 |

| Intercompany due (transfer of business to JSHL through demerger) | (575.98) |

| Issue of 7.86 crore equity shares to JSHL at a price of Rs.46.6 per share | 366.18 |

Please note that net consideration paid is higher due to inter-company balances as shown above. JSL issued equity shares to JSHL due to liquidity constraint.

SLUMP SALE TO JINDAL UNITED STEEL LTD:

After the acquisition of the business through Slump Sale for a consideration of Rs. 2412.67 crore from JSL, it will engage in the business of hot strip mill, plate finishing facility, bell annealing facility located at Kalinga Nagar Industrial Complex, Duburi 755 026, District Jajpur, Odisha, India. The Net Asset Value of the acquired business undertaking as on 31.03.2014 is Rs. 2262.43 core. The consideration is discharged by JUSL is as follows:

| Particulars | Crores |

| Paid by JUSL in cash | 2150 |

| 17.5 crore 0.01% Non-cumulative compulsorily convertible preference shares at Rs. 10 each (10 years) | 175 |

| 8.77 crore 0.01% Non-cumulative non-convertible redeemable preference shares at Rs. 10 each (20 years) | 87.7 |

Currently, it is a WoS of JSL and the consideration will be discharged by JCL in cash through debt raised from the bankers and later on funding from the investors to deleverage the company and keep the debt equity ratio under control

SLUMP SALE of JINDAL COKE LTD :

After the acquisition of the business through Slump Sale for a consideration of Rs. 492.70 crore from JSL, it will engage in the business of manufacturing, processing, finishing and dealing in all kinds and forms of coke and coke products located at Kalinga Nagar Industrial Complex, Duburi 755 026, District Jajpur, Odisha, India. The Net Asset Value of the acquired business undertaking as on 31.03.2014 is Rs. 373.69 core. The consideration is discharged by JCL is as follows:

| Particulars | Crore |

| Paid by JCL in cash | 375 |

| 2.6 crore, 0.01% Non-cumulative compulsorily convertible preference shares at Rs. 10 each | 26 |

| 9.16 crore 0.01% Non-cumulative non-convertible redeemable preference shares at Rs. 10 each | 91.6 |

Currently, it is a WoS of JSL and the consideration will be discharged by the JCL in cash through debt raised from the bankers and later on funding from the investors to deleverage the company rationale the debt equity ratio.

BENEFITS TO BANKER:

- Immediate debt repayment of about Rs. 5,500 crore from the project which was in gestation period and shifting the term loan to the entities which are more profitable. The specific repayment to each lenders is not available with us but might be a proportion of loan.

- Banker’s will have an equity stake in JSL increasing from a negligible stake to 15.40% and thereafter right to increase to 40% stake with a conversion of convertible preference shares.

- Segregation of term loan to every business undertaking and particularly to a profitable business entity.

- The interest rates have been shifted from fixed to float rate of interest.

- Account not getting converted to Non-Performing Assets

BENEFITS TO JINDAL GROUP:

- It will ensure long-term stability and attract investors in the profitable business

- Improve competitiveness and Focused management (focus on core competencies) for each of the business verticals

- Deleverage JSL and improve debt servicing

- Re-distribution of Debt:

Debt-laden Jindal Stainless (JSL) aims to cut its debt, through operational and financial restructuring by distributing the total debt among the four firms. Of this, Rs 2,600 crore debt has been transferred to JSHL, Rs 2,400 crore to JUSL and Rs 500 crore in JCL. - Reduction in interest:

The consolidated financial was not able to raise the finance at a cheaper rate as it was overleveraged and not generating funds for repayment whereas with the restructuring JSHL and JCL is able to raise fresh funds at 10.95% as compared to JSL’s interest rate of 14.3%. So there is a 3.35 percent reduction in interest payment. But there will be higher interest payment in the future in profitable business. - RBI’s new 5/25 Scheme:

The current repayment of debt period for JSL was maximum 8 years. But with the JUSL opted for the Reserve Bank’s (RBI) new 5/25 scheme for a debt of Rs 2,400 crore, the lenders are allowed to fix longer amortization period for loans to projects in the infrastructure and core industries sector. So by virtue of this new guideline, JUSL will raise Rs 2,400 crore of debt for 25 years.

- Re-distribution of Debt:

- Increased profitability, capacity utilisation, and reduced costs

- With the separation, the existing unused facilities of hot strip mill, of 1.6 MTPA capacity, will now be utilised for 0.8 MT stainless steel and 0.8 MT carbon steel so idle capacities in the plant are fully utilised.

- The existing coke oven of 0.43 MTPA will run at double capacity at JCL once the by-products are recycled with investment Rs.200 crore to the existing Rs.500 crore.

Please note that above restructuring will have minimum transaction cost implication:

- Income Tax implication: There will be income tax liability on slump sales transaction under section 50B of Income Tax Act 1956, So in the FY 2014-15 there is an exceptional gain from slump sale to JSHL of Rs. 1160 crore. Whereas in F.Y. 2015-16 there will be approx. Rs. 270 crore exceptional gains from the slump sale to JUSL and JCL.

- Stamp Duty implication: No stamp duty is payable in respect of the order of the Court sanctioning this Scheme as the Haryana Stamp Act does not include any specific entry for stamp duty payable in respect of a court’s order sanctioning a composite scheme of arrangement. And the Indian Stamp Act, 1899 issued by the Government of Odisha, provides a specific exemption from payment of stamp duty in case of deeds executed for reconstruction and amalgamation of companies when sanctioned by the High Court subject to certain conditions.

CONCLUSION:

The debt cum business restructuring has led to the repayment of banker’s debt of Rs. 5,500 crore and FTIL to be converted into equity shares which will increase banker’s stake to 40%. However, management control will remain in the hands of the promoters.

It will also help the company to improve efficiency in operations with more management focus, reduction of debt and raising of finance through debt and equity in the profitable business against the combined business. The market has discounted JSL’s price from the Total Market capitalisation of Rs. 1,400 crore to total market capitalisation of both companies of Rs. 1,100 crore.It will ensure long-term stability and also help to unlock value for the shareholders.