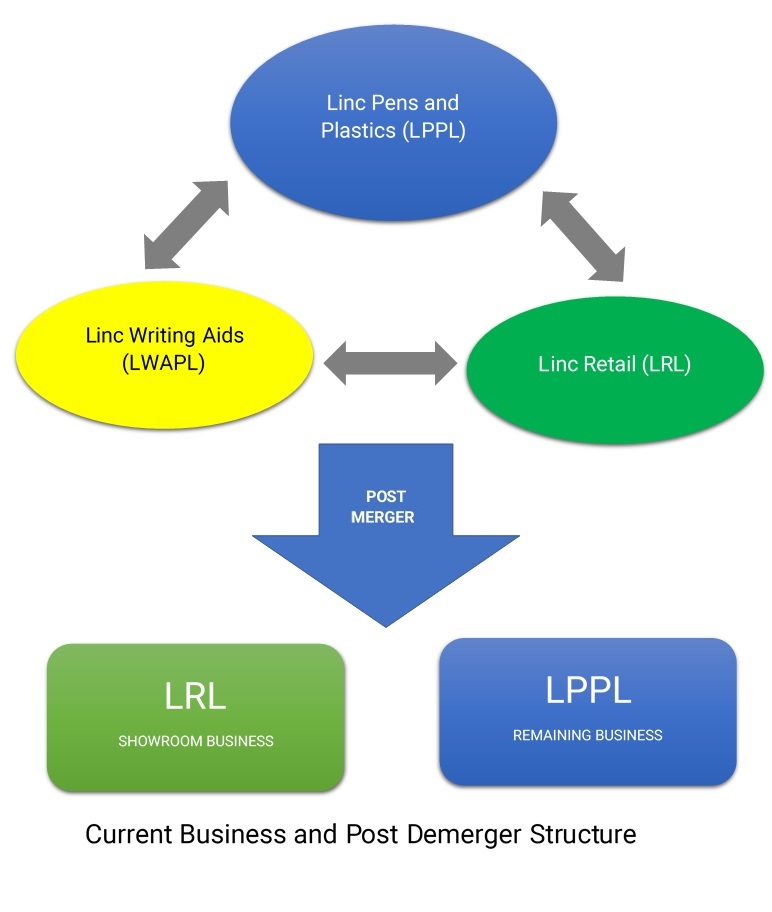

It would be safe to assume, that we have used product from this company listed in 1994 but started almost 40 years ago. Linc Pen and Plastics Ltd. (LPPL) is listed company is engaged in the manufacturing and distribution of Pens and related products for domestic as well across 50 countries. They also have exclusive tie-ups with Mitsubishi Pencil Co., Japan for their Uni-ball brand.

Linc Writing Aids Pvt. Ltd. (LWAPL) is an unlisted company, incorporated in June 1984, engaged in the trading and business of stationary and crockery. LWAPL also holds 10.78% equity stake in LLPL & 19.31% equity stake in LRL.

LWAPL having two Business undertaking

- Showroom Business

- Other Business

The Showroom Business includes stock in trade, stake in LRL and the other business mainly include stake in LLPL and some Land & Buildings.

Linc Retail Limited (LRL) is engaged in retail trading business of stationary.

The Transaction

The board of directors of the company decided to merge “Showroom Business Undertaking” into LRL and to merge the remaining business into LPPL. The appointed date for both the transaction will be 1st April 2018.

Consideration

- LRL will issue 46 equity shares of Rs. 10 each for every 1 equity share of LWPL.

- LPPL will issue its 34 equity shares for every 1 equity share of LWPL.

As it is an internal restructuring, there is no cash consideration involved.

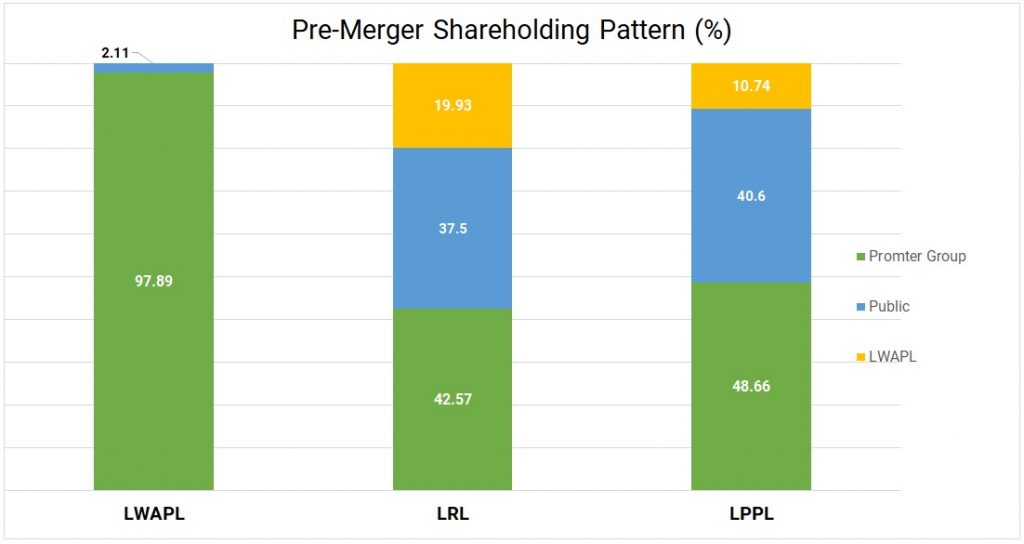

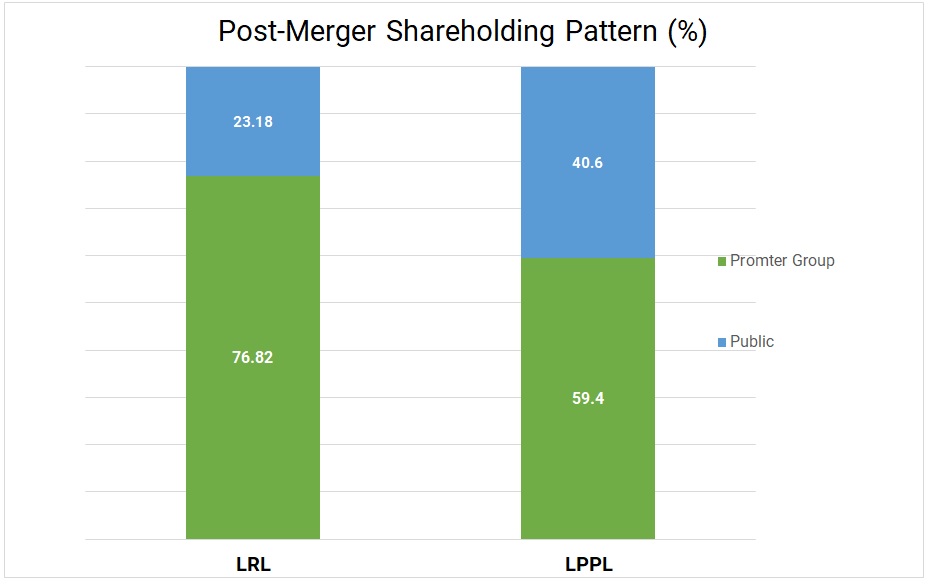

Shareholding Pattern

Currently, Promoters stake in LPPL (including LWAPL) is around 59.43%. Post- Transaction, the promoters stake in LPPL will decrease fractionally. While in LRL the promoter’s stake will increase significantly.

Financial

Table 1: Segment-Wise Financials of LWAPL – FY 17-18 (All figs in INR Lacs)

| Particulars | Remaining | Showroom | Total |

| Equity share capital | 0.00 | 49.26 | 49.26 |

| Reserves and surplus | 480.04 | 229.33 | 709.36 |

| Long term borrowing | 200.74 | 0.00 | 200.74 |

| Long Term Provisions | 5.43 | 0.00 | 5.43 |

| Trade Payables | 117.59 | 181.77 | 299.36 |

| Other current liabilities | 71.77 | 0.67 | 72.43 |

| Short term provisions | 0.32 | 0.00 | 0.32 |

| Total | 875.89 | 461.02 | 1,336.91 |

| Property Plant and Equipment | 24.63 | 7.37 | 32.00 |

| Intangible Assets | 0.67 | 0.00 | 0.67 |

| DTA | 5.64 | 0.00 | 5.64 |

| Non-Current investment | 669.17 | 51.39 | 720.56 |

| Loans and advances | 74.38 | 12.90 | 87.28 |

| Inventories | 59.56 | 185.86 | 245.42 |

| Trade receivable | 22.82 | 198.95 | 221.78 |

| Cash and cash equivalent | 4.14 | 4.29 | 8.43 |

| Short Term loans and advances | 14.87 | 0.25 | 15.12 |

| Total | 875.89 | 461.02 | 1,336.91 |

Valuation

As per the Swap Ratio Report, the valuation of LWAPL comes around ~₹61 crores.

Table 2: All figs in INR Lac

| Particulars | Amount |

| Showroom Business | 227 |

| Remaining Business: | |

| Value of LPPL Stake | 5,369 |

| Other Assets | 515 |

| Total Value | 5,884 |

It looks that the Showroom Business has been valued lessor than its net worth. Other Assets in Remaining Business mainly includes Land & Building as is. As per net worth certificate net worth of LRL increases while the net worth of LPPL decreases post transaction.

Conclusion

Currently, all three entities have

Add comment