Hon’ble National Company Law Tribunal, Bengaluru Bench (“NCLT”) vide order dated 8th April 2022 admitted the Application under section 7 of Insolvency and Bankruptcy Code, 2016 filed by “Sun Star Hotels and Estate Pvt Ltd”, a financial creditor of the erstwhile Vijay Mallya-promoted company, “McDowell Holdings Limited” (McDowell) claiming default of Rs. 16,80,66,348/- as on 30th November 2021.

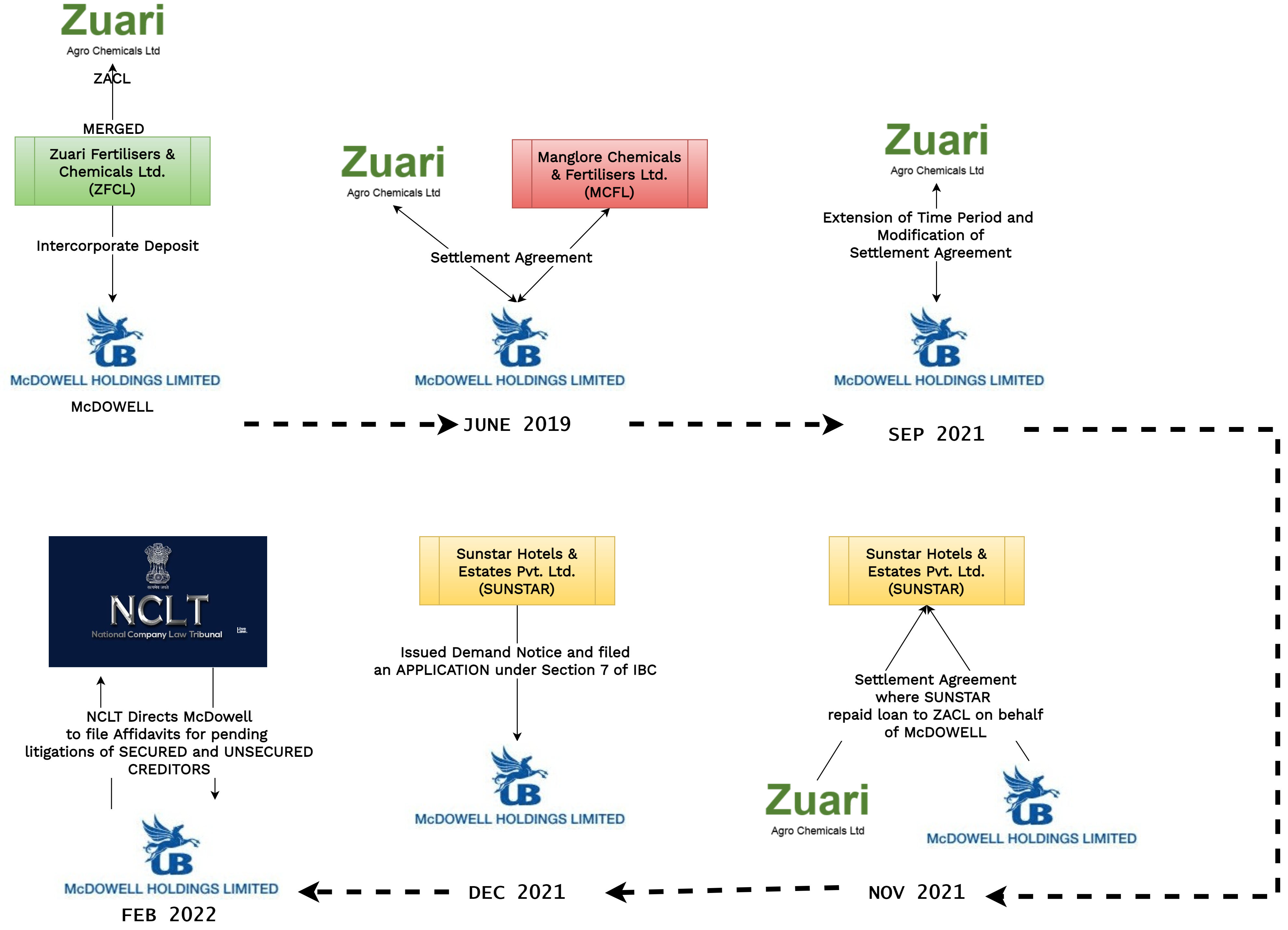

Sequence of Events:–

- McDowell availed Intercorporate Deposit from Zuari Fertilisers and Chemicals Limited (“ZFCL”) which got merged into Zuari Agrochemicals Limited (ZACL).

- On 17th June 2019, McDowell entered into a settlement agreement with ZACL and Managalore Chemicals and Fertilizers Limited (MCFL) to settle the loan of ZACL against shares of McDowell in MCFL and the amount recovered by sale of shares of United Breweries Limited.

- Upon the request of McDowell, ZACL extended the time period and modified the terms of a settlement agreement, pursuant to which, debts should have been cleared on or before 16th September 2021.

- On 19th November 2021 Sunstar Hotels and Estates Private Limited (Sunstar) entered into settlement agreement with ZACL and McDowell whereas loan was repaid by Sunstar to ZACL and stepped into the shoes as lender of McDowell. In addition to outstanding ICD, Sunstar advanced a sum of Rs. 1.5 Crores at interest rate of 18% p.a.

- Sunstar issued demand notice against the pending dues to the McDowell on 10.12.2021 and filed an application under section 7 of IBC with NCLT claiming default of Rs. 16,80,66,348.

- On 17th February 2022, NCLT directed McDowell to file an affidavit stating litigations pending and other claims from secured and unsecured creditors.

- On 25th February 2022, McDowell submitted an affidavit stating litigations pending and other claims from secured and unsecured creditors as asked by the NCLT. It is likely to be /must be with the full knowledge of the board.

As per the affidavit submitted by McDowell to the NCLT, McDowell has total liabilities amounting to Rs. 1,684.53 Lakhs against the assets of Rs. 196.81 Lakhs as on 30th September 2021. It seems that the company has ignored the market value of shares of United Breweries Limited which is more than Rs 1000 (One Thousand) crores as detailed below.

McDowell in its Affidavit has further stated is holding 63,45,011 shares of United Breweries Limited (UBL) which have been attached by the ED as follows –

- 45,51,000 shares are pledged with Yes Bank Limited and ECL Finance Limited. Despite of no dues pending towards Yes Bank and ECL, shares have not been released pursuant to direction of ED.

- 1,22,667 shares are in the Demat Account of Yes Bank and ECL which they are not releasing pursuant to order of ED.

- ED unilaterally transferred 16,71,344 shares to its own Demat Account and transferred to the Hon’ble Debt Recovery Tribunal pursuant to the order of the Prevention of Money Laundering Court (PMLA Court)

In the affidavit filed with NCLT stating pending litigations and other claims, McDowell stated that it does not have the required liquidity to meet the dues for the foreseeable future and repay the amount. It has many non-statutory liabilities in existence, which McDowell is not in a position to pay. Due to the absence of the liquid assets, the Respondent will not be able to honour any payments with respect to the existing debts in the near future.

- Simultaneously, two groups of shareholders holding filed an “Interlocutory Application” under the IBC to declare the application filed by Sunstar as Fraudulent and malicious requesting the NCLT not to admit the application filed by Sunstar.

- NCLT dismissed the application filed by shareholders and approved the initiation of the Corporate Insolvency Resolution Process against McDowell on 8th April 2022 and appointed Mr. Konduru Prasanth Raju as Interim Resolution Professional.

Let us consider options available with the shareholders.

Before the Commencement of CIRP (Corporate Insolvency Resolution Process): –

In February 2022, after the strength of the board got reduced to two directors, a group of minority shareholders holding 15.51% shares of McDowell Holdings, requested an Extraordinary General Meeting (EOGM) under section 100(2)(a) of the Companies Act, 2013 to the board. Main agenda of the proposed meeting was the appointment of 4 persons to the board as an “Independent Director” so that SEBI (Securities and Exchange Board of India) LODR /listing guidelines of minimum no. of directors is complied with.

No action was taken by the board Even though shareholders request was in compliance of section 100(2)(a) of the Companies Act, 2013.

Meanwhile, creditor went ahead with the application under section 7 of the Insolvency and Bankruptcy Code, 2016.

Even though the board did not call the meeting, shareholders had the right to call the EOGM under section 100(4) of the Companies Act, 2013 which it seems they have not exercised.

Apart from the calling of EOGM shareholders were having following options which shareholders of McDowell seems to have not exercised –

- Appointment of Small Shareholders Director: –

Pursuant to Rule 7 of Companies (Appointment and Qualification of Directors) Rules, 2014, group of 1000 shareholders or such number constituting 10% of total shareholders, whichever is less, were having the right to appoint “Small Shareholders Director” to represent the interest of small shareholders on the Board.

- Application against Oppression and Mismanagement: –

Member can file an application with NCLT under sections 241(1) and 244 (1) complaining that affairs of the Company are being conducted in a manner “prejudicial to the interest” of the shareholders.

Under section 242(2)(k) of the Companies Act, 2013 NCLT also has the power to appoint the director on the board of the Company and direct him/her to report the NCLT as may be directed.

Pulling out McDowell of IBC: –

In the case of McDowell, if the group of shareholders is intending to repay the loan of Sunstar, can take the following steps –

- Intimation to Interim Resolution Professional (IRP) and NCLT –

Since the CIRP has been commenced, shareholders of the Company shall intimate their intention to repay the loan to the Interim Resolution Professional and NCLT. If the creditors and shareholders agree, IRP can file an application for withdrawal of CIRP with NCLT.

- Intimation to Resolution Professional (RP)

If the application for withdrawal is not filed IRP or the same is rejected, on completion of the term of IRP, NCLT will appoint RP. Once the RP is appointed, the group of shareholders shall intimate to RP their intention to repay the loan by infusing funds in the company as loan or as equity and consider the same even before formation of CoC and inviting resolution plan.

For whatever reason, the same is not accepted by RP, the group of shareholders can submit resolution plan to settle the debt as may be acceptable to CoC.

Recently, in the case of M/s Ashish Ispat Pvt. Ltd. V/s Primuss Pipes and Tubes Ltd., Hon’ble NCLAT (National Company Law Tribunal) allowed the withdrawal of CIRP before constitution of the Committee of Creditors (CoC) after there is a settlement between the company and operational creditor.

NCLAT referred the Regulation 30A of the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 which allowed the “IRP” to file an application with NCLT for withdrawal of CIRP.

The NCLAT also referred to Swiss Ribbons v Union of India, where the Hon’ble Supreme Court held that before the CoC is constituted, parties can directly approach the NCLT with their withdrawal applications.

- In case of non-payment of loan and not submission of resolution plan by any person, CIRP will get converted into liquidation. If the liquidator is appointed, he will dispose of the assets of the company by auction and will repay the loan from the amount recovered. Except the promoters of the Company, shareholders of the Company can participate in bidding process.

There are multiple options and ways out available to save the company from liquidation and save the valuable assets of the company. However, if none of the options mentioned above is successful, options available post commencement of CIRP are as follows –

Option available to shareholders post commencement of CIRP: –

Two groups of shareholders filed an “Interlocutory Applications” under the provisions of the Insolvency and Bankruptcy Code, 2016 against the initiation of CIRP of McDowell on the ground that McDowell is not an insolvent Company and the application for initiation of CIRP under the IBC has been filed due to fraud and collusion between the Petitioner and the McDowell. The Applications were dismissed by the NCLT.

Provision for shareholders under IBC: –

There is no direct provision under the IBC which entitles the shareholders to raise an objection against the application filed by the financial creditor/operational creditor to initiate a Corporate Insolvency Resolution Process.

- Only CoC is entrusted with task of dealing with and approving resolution plan as per section 30(4)

- Resolution plan approved by CoC is binding on all stakeholders including shareholders as per section 31

- In the event of liquidation, shareholders stand last in order of priority as per section 53.

In the case of McDowell, NCLT rejected the Interlocutory Applications filed by two groups of shareholders by referring the decision passed by Apex Court in M/s Innovative Industries Ltd vs. ICICI Bank & Anr. Wherein Apex Court has held that the moment Adjudicating Authority is satisfied that the default has occurred, the application filed for initiation of CIRP shall be admitted unless the application is incomplete. NCLT further mentioned that it is settled principle of law that, once the debt and default are proved, the solvency of the corporate debtor will not come in the way of admission. Since the McDowell acknowledged the debt and NCLT couldn’t find any incompleteness, application filed by Sunstar was admitted.

Post formation of CoC, shareholders can file Resolution Plan as Resolution Applicant by offering to pay creditors on agreed terms. Even if they are not successful to participate as Resporulation Applicant, they can eventually take part in the auction of assets of the company

Provision for shareholders under Companies Act: –

Though there is no helping provision for the shareholders to protect their interest under the IBC, under the Companies Act, 2013 there is no bar on shareholders to propose a scheme of arrangement under section 230 of the Companies Act, 2013 when CIRP has already started.

Pursuant to section 17(b) of the IBC, post commencement of CIRP, the powers of board of directors stand suspended and the same gets vests into IRP.

Considering the rights of shareholders, we must check the powers available with the shareholders post commencement of CIRP and the power available with the CoC post its formation.

Once the CoC is formed, pursuant to section 28 of IBC, certain rights like change in capital structure by issuance of additional securities, amendment in the constitutional documents, change in the management, change in auditors lies with the CoC.

If shareholders want to act, they should take the necessary steps before the constitution of CoC. Post commencement of CIRP but before the formation of CoC, shareholders may exercise the following powers –

- Calling of EOGM under section 100(2).

- Filing of separate scheme of arrangement under section 230(1) with NCLT.

- Application to the NCLT asking for the relief against oppression and mismanagement on the ground of collusion between the Financial Creditor and Management of the Company, under section 241/244.

Conclusion

Shareholders have multiple options to save the company from going into liquidation both under the Companies Act and Insolvency Act by taking appropriate steps at each stage.

Add comment