The opportunity for mergers and acquisitions in gold mining has already passed as share prices surge, according to the head of the best-performing producer in the past decade.

“It’s hard to see how M&A adds value to anyone,” Randgold Resources Ltd. Chief Executive Officer Mark Bristow told a Bloomberg Intelligence LME Week seminar. “In the gold industry, there’s not a lot of opportunities for mergers.”

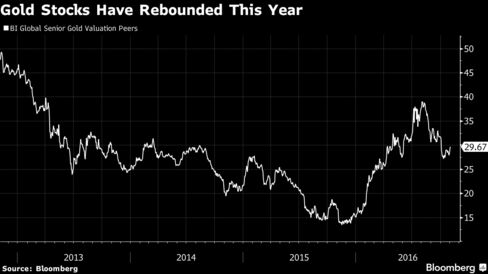

The Bloomberg Intelligence Global Senior Gold index of major miners has almost doubled this year, the best performance in data going back to 2006. Stocks have gained as bullion jumped 22 percent on demand for a haven.

Randgold, which operates mines in the Democratic Republic of Congo, Mali and Ivory Coast, has been seeking projects to add to its flagging pipeline through exploration or acquisitions. The company had been looking at potential deals after a slump in valuations last year, Bristow said in London Wednesday.

Randgold, up more than sixfold in London in the past decade, avoided the worst of that slump, which forced some miners to cut asset values and raise cash. All of the company’s mines make a profit at a price of $1,000 an ounce, it says. Bullion traded at almost $1,300 on Wednesday.