Company Profile

Incorporated in 1995, Quick Heal Technologies Ltd. is one of the leading IT security solutions company offering a wide range of security software solutions under the brand name “Quick Heal” & “Seqrite”.They are customized to suit consumers, small businesses, Government establishments and corporate houses.

The company has its registered office in Pune with a market share of over 30% in the retail segment in India.

As of 31st December 2015, more than 24.5 million licenses of the products have been installed. The company had over 7.13 million active licenses spread across more than 80 countries.

The company has a network of over 19,000 retail channel partners, 349 enterprise channel partners, 319 government partners and 944 mobile channel partners.

The company has subsidiaries that are present in Japan, Dubai, the United States and Kenya.

Management

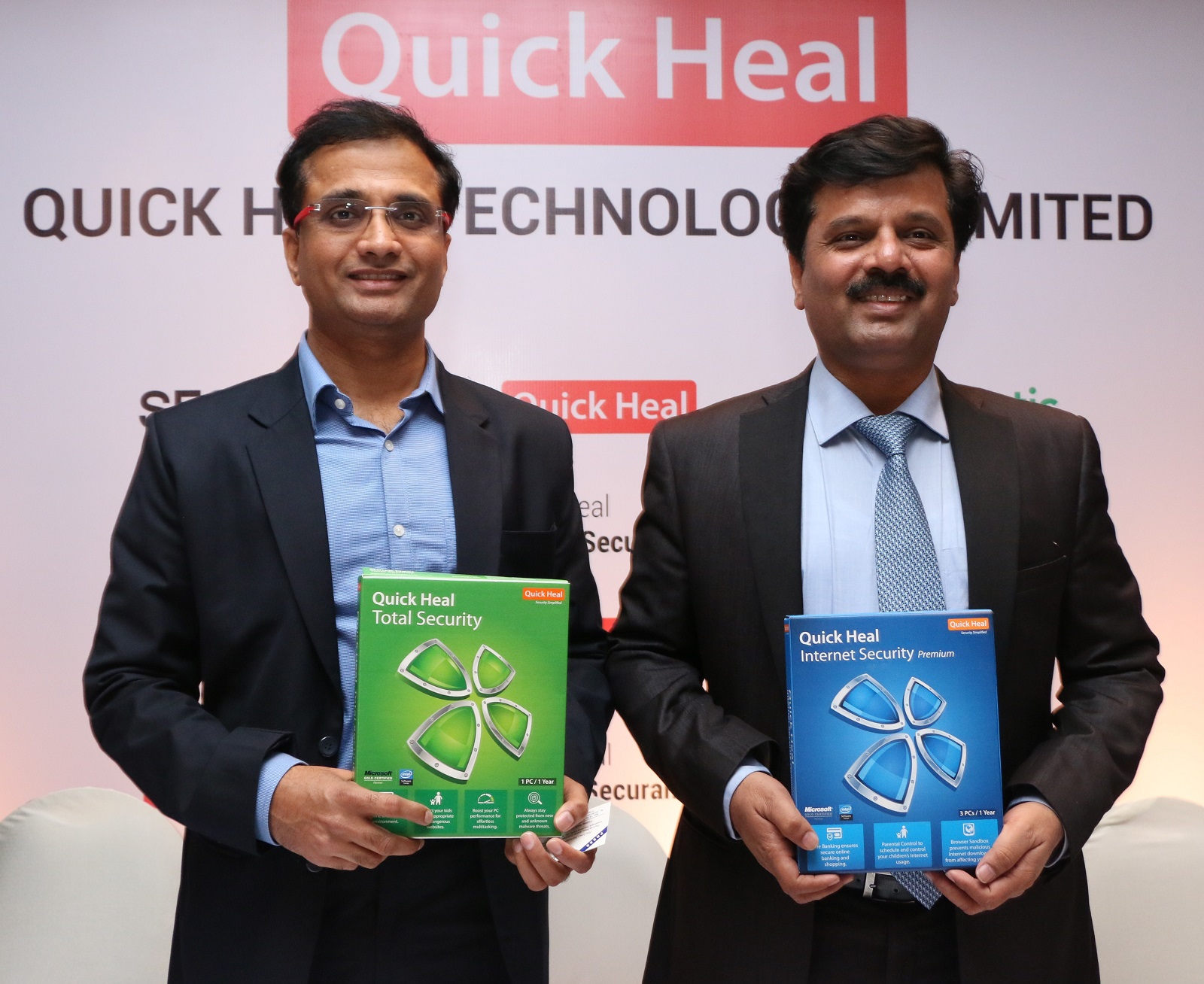

Mr. Kailash Sahebrao Katkar – Managing Director & CEO

Mr. Sanjay Sahebrao Katkar – Joint Managing Director & Chief Technical Officer

Twenty years of simplifying security

From being radio and calculator repairmen to being the titleholders of the most reputed security software brand, the promoters have come a long way with their company.

For the first five years, the company faced a difficult time which brought them on the verge of shutting down their business however their postponing this decision by a few months proved to be a turning point for the company when they decided to test waters by making some crucial decisions.

In 2010, the investment received from Sequoia gave a further boost to expand their business operations globally.

The company has since then diversified its product portfolio. The current revenue mix is retail-centric (87per cent). However, efforts are on to improve its enterprise business, by focusing on the small and medium businesses.

Key decisions taken by the company during this journey was tweaking their distribution strategy; R& D strategy, marketing strategies; reworking on their operational efficiencies and clear distribution of responsibilities between the promoters for the company.

The company has built on the strong platform in the domestic market through organic growth, and will be actively looking at organic and inorganic growth opportunities in the future to expand in the domestic and global network.

Financial Snapshot

|

30th September 2015 |

31st March 2015 |

|

| Revenue (in cm) |

152.27 |

294.33 |

| EBITDA |

48.08 |

81.85 |

| PBT |

36.73 |

79.82 |

| Net Profit |

24.22 |

53.8 |

The company has been growing its top-line by 17 percent annually over the last three years. However, net profit for the company has been falling over the years due to shrinkage in operating margin.

The company has a strong balance sheet with no debt in the company since FY 2013.

As of September 30, 2015, Quick Heal had a debt-free balance sheet with cash balance of Rs 107 crore.

IPO

In February 2016, the company allotted shares at Rs 321 and raised Rs 451.25 crores through the public issue. Quick Heal shares closed at Rs.219, down almost 33%% from the issue price on 23rdFebruary, 2016.

| (A) Fresh Issue | Equity shares up to INR 250 crores |

| (B) Offer for sale | INR 201.25 crores |

| Promoters | INR 118.13 crores |

| Sequoia Capital | INR 83.12 crores |

Objectives of the IPO

The proceeds from the offer of sale would not go to Quick Heal. The company for below purposes would use the proceeds from the fresh issue of equity shares:

| Particulars | Estimated Amount |

| Advertising & Sales Promotion | 111 crores |

| Capital Expenditure on R&D | 41.88 crores |

| Purchase, development & renovation of office premises in Kolkatta, Pune & New Delhi | 27.59 crores |

| General Corporate purposes | Not disclosed |

With the proceeds invested in R&D, the company intends to innovate and develop solutions for existing and upcoming platforms. The company may also pursue acquisitions or investments or license of technologies that would complement its portfolio.

Growth Route for Company or Exit Route for Promoters and Investors?

The proceeds deployed in advertising is for its brand building which would in turn help in expanding its customer base.

Shareholding Pattern

The shareholding pattern of the promoters and investors post issue shall be as below:

| Pre-issue (% holding) | Post issue (% holding) | |

| Promoter & Promoter Group | 87.60% | 72.90% |

| Public (Majority Investment by Sequoia Capital) | 12.40% | 27.10% |

| Total Equity | Rs 62.2 crores | Rs. 70.03 crores |

Quick Heal raised Rs 133.9 crores ahead of the IPO by allotting 41.70 lakh equity shares at Rs 321, the upper end of the price band, to 10 anchor investors.

Offer for sale:

Quick Heal IPO saw the promoters diluting their stake by offering more number of shares on sale than the PE investor and garnering proceeds of around 118 crores. The proceeds received would not be reinvested in the company.

Sequoia Capital has put less than half of its combined equity shares on offer for sale. The average cost of acquisition for Sequoia Capital for its five-year-old investment works out to INR96 per share. By participating in the IPO, Sequoia Capital freed up its original investment. The PE investor has reduced its stake from around 10.5% to 4.1% through this route.

The total issue was overall oversubscribed by 7.98 times.

PRE-IPO: Capital Restructuring

1996

The company started with a share capital of Rs 2000 of 200 equity shares of Rs 10 each.

2010

The company’s share capital in 2010 was Rs 7.14 crores of 71.4 lakh equity shares of Rs 10each that was done through the additional infusion of capital by the promoters and bonus issues.

In 2010, Sequoia Capital partnered with Quick Heal in their quest to become a market leader in computer security.

Over the period of time, Sequoia Capital invested Rs 36 crore in Quick Heal and separately also bought shares worth Rs 24 crore from the promoters; thus having total equity shares of 62.5 lakhs

| Date | No. of shares | Issue Price | Total amount | Cumulative no. of shares |

| Sequoia Capital Investments Holdings III | ||||

| 11th August,2010 | 4,36,394 | 768.67 | 33,54,42,976 | 4,36,394 |

| 17th January,2011 | 32,729 | 768.67 | 2,51,57,800 | 4,69,123 |

| 26th February,2014 | 32,83,621 | — | — | 37,52,744 |

| Sequoia Capital India Investments III | ||||

| 8th September,2010 | 2,90,928 | 768.67 | 22,36,27,626 | 2,90,928 |

| 17th January,2011 | 21,820 | 768.67 | 1,67,72,379 | 3,12,748 |

| 26th February,2014 | 21,89,236 | — | — | 25,01,984 |

2014

In February 2014, there was a bonus issue of 5.34 crores of shares to the promoters and the existing shareholders of the face value of Rs 10.

2015

During the year; Quick heal allotted 11.72 lakhs equity shares on account of the exercise of ESOP at an average issue price of Rs 88.44 with a face value at Rs 10 each.

The company’s total share capital as on 31stDecember 2015 was 62.2 crores with 6.22 crore equity shares of face value at Rs 10 each.

The total infusion of capital done by the promoters in this journey was around Rs 23 lakhs.

Is taking the IPO route for its future plans justified?

In 2010, when Sequoia capital invested in the company Quick Heal was valued at 600 crores.

They had started preparing for the IPO since 2012 however they were not receiving the valuations expected which was pegged at 1200 crores by the market at that time and hence delayed until their valuations would reach between 2500 crores to 3000 crores.

This IPO can only be seen as an exit strategy for a beneficial gain of the promoters and partly for the PE investor by diluting its equity for a hefty premium. The promoters in the past have also transferred their own shares worth 24 crores to Sequoia capital.

The total amount received by the promoters was around 140 crores through dilution of their equity and there is no mention about where the proceeds have been utilized against the total capital infused by them in the company.

This makes us question the promoters’ faith in their company and its future growth prospects or whether the promoters are exploring other business opportunities other than Quick Heal.

The partial exit for Sequoia Capital in this IPO is an opportunity to secure its capital and ensure that it continues with the company’s growth journey.

The company could have easily raised debt through external sources taking into account its strong balance sheet rather than entering the capital market. The stock since the time it has debuted on the stock exchanges has been falling down considerably from its issue price which may seem that the stock had been expensively priced.

Post-IPO Performance Expectations

Quick Heal’s future will depend on how innovative they are; considering the company does not have any moat or competitive advantage.

The company has allocated around 45% of the funds received from the IPO for advertising/promotion activity and around 20% for R&D.

The company has a concentrated product portfolio and operates in a business having low entry barriers. Whether the higher allocation of funds in advertising would be a wise decision in achieving a higher market share and help the company to continue to grow as fast as they did in the past will be seen in the coming time.

Taking into account that the company in the past had deployed a capital of around 300 crores; the company’s top line has been increasing y-o-y however its margins are continually shrinking which has been a cause of worry.

Will the infusion of additional 250 crores in the business generate more revenues y-o-y, increased profit margin; increase its return on capital employed that only time will tell.