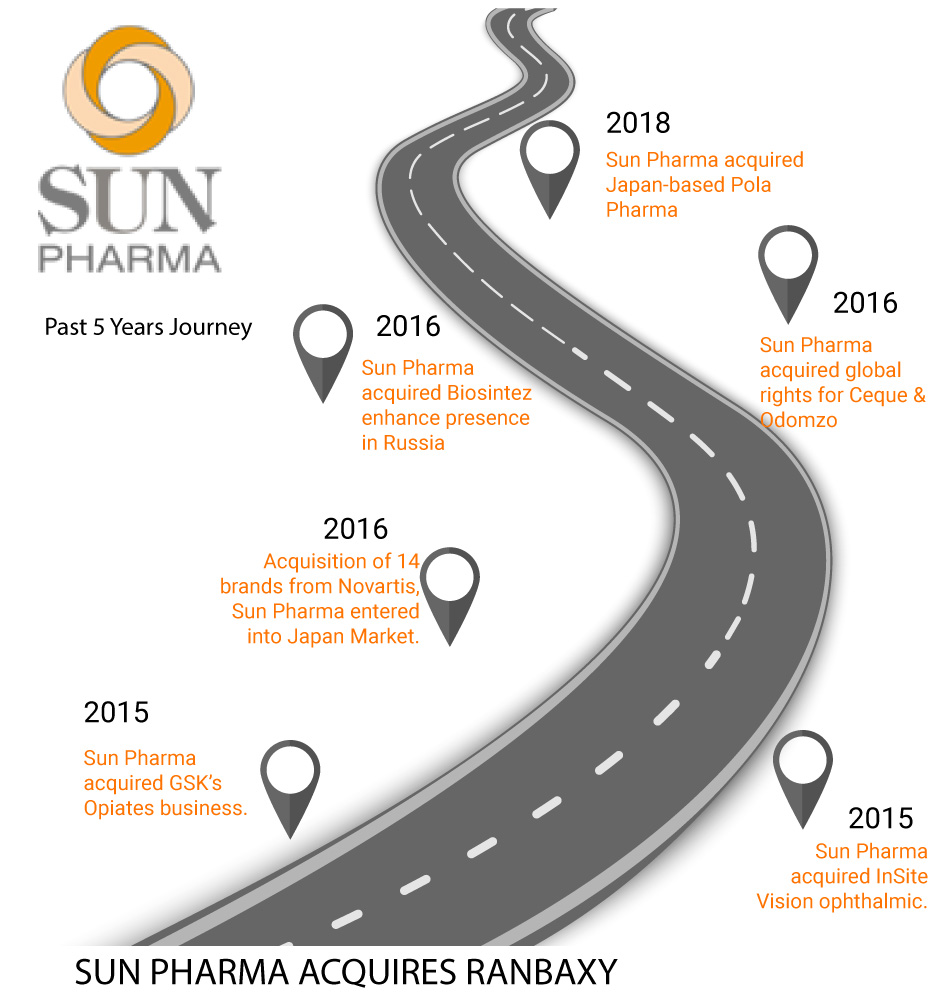

In the 90s, Sun Pharmaceuticals was a rising star. Other pharmaceutical majors Ranbaxy and Dr Reddy‘s looked at its growth with interest. Three decades later Dilip Shanghvi bought over Ranbaxy from Japan’s Daiichi-Sankyo to chart his company’s growth curve. In a move to become world’s fifth largest generics (or off-patent) drugs company by revenue and India’s largest pharma firm by market share, Sun Pharmaceutical Industries Ltd (“Sun Pharma”) announced the acquisition of Ranbaxy Laboratories Ltd (“Ranbaxy”) in April 2014.

However, legacy issues with Ranbaxy and reports of a complaint by a whistleblower to the Securities and Exchange Board of India (SEBI) against Sun Pharma raising issues of corporate governance has put Sanghvi into a tough quagmire. The whistleblower’s complaint, on transactions worth over Rs 5,800 crore between 2014-2017, alleges that Indian drugs manufacturer Aditya Medisales Ltd had transactions with Suraksha Realty, controlled by Sun Pharma’s co-promoter, Sudhir Valia. The whistleblower has alleged numerous irregularities against Sun Pharma promoter Dilip Shanghvi, his brother-in-law Sudhir Valia and Dharmesh Doshi, an associate of the 2001 stock market scam convict Ketan Parekh. All these have put pressure on Sun Pharma and shareholders and the company now needs to look at a quick turnaround.

Ranbaxy Laboratories Limited, established in 1961, was an integrated, research based, an international pharmaceutical company producing a wide range of quality, affordable generic medicines, trusted by healthcare professionals and patients across geographies. It was having operations in 43 countries and 21 manufacturing facilities spread across 8 countries. Ranbaxy was a member of the Daiichi Sankyo Group. Daiichi Sankyo acquired controlling in Ranbaxy in 2008 from its earlier promoters Malvinder Singh and family.

The Transaction

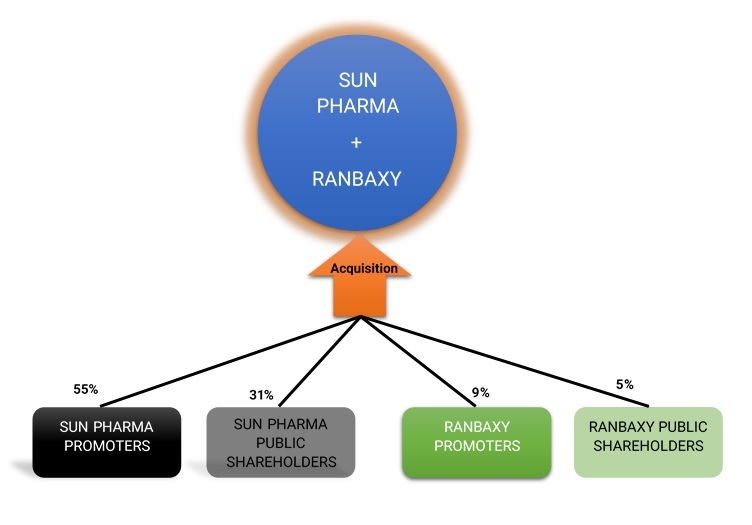

In 100% stock-deal, Sun Pharma announced the acquisition of Ranbaxy in 2014. In 2015, Sun Pharma completed the acquisition. This was a landmark transaction in the Indian pharmaceutical industry. This merger was planned to strengthened Sun Pharma’s positioning as the world’s 5th largest speciality generic Company. It has made Sun Pharma the leader in the Indian pharmaceutical market with almost 9% market share. The merger opened different geographies for Sun Pharma including the US, emerging markets and Europe. It also gave Sun Pharma an entry point in the Over-the-Counter (OTC) business segment.

As a result of the merger, Daiichi became a shareholder in Sun Pharma with ~9% stake. Public shareholders of Ranbaxy got 4.95% stake in Sun Pharma. Existing Public shareholders holding in Sun Pharma got reduced to 31.2% from 36.44%.

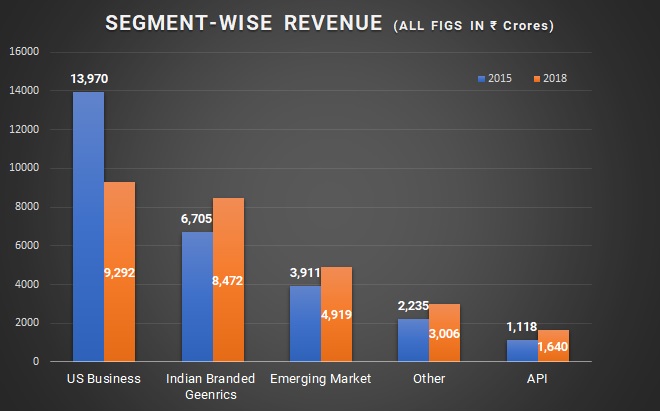

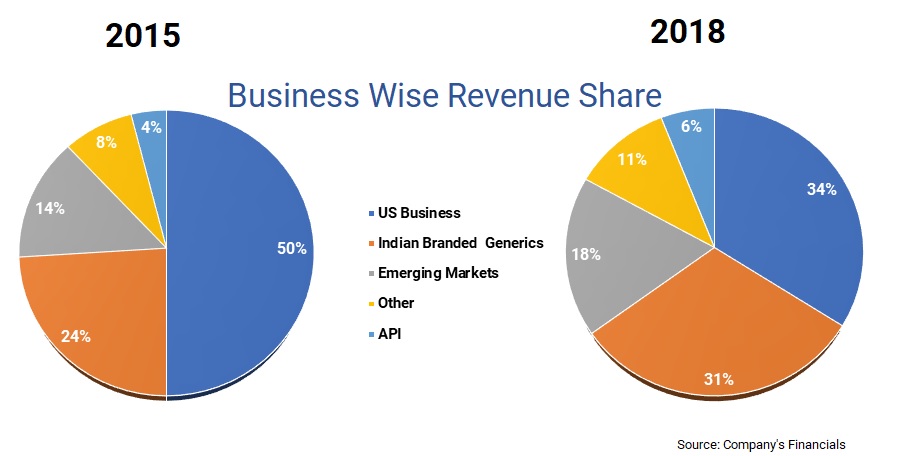

Revenue bifurcation across various segments

One of the key objectives behind the merger was to expand Sun Pharma’s presence in the US market through leveraging Ranbaxy’s network. However, During the period its contribution from the US market has come down by 33%.

The US-FDA, on January 23, 2014, had prohibited using API manufactured at Toansa facility (of erstwhile Ranbaxy Laboratories Ltd) for the manufacture of finished drug products intended for distribution in the U.S. market. In December 2015, the USFDA issued a warning letter to the manufacturing facility at Halol.

During the same period, its revenue share of International markets has also come down from 75% to 68%.

Financial Progress

Table 1: Financials over the years (All fig in INR Crores)

| Particulars | 2012 | 2014 | 2015 | 2016 | 2018 |

| Revenue | 8,491 | 16,632 | 27,939 | 28,517 | 27,328 |

| EBIT % | 43.3% | 45.4% | 30.1% | 31.4% | 23.6% |

| PAT% | 31.3% | 18.9% | 16.2% | 16.5% | 7.9% |

| Employee Benefits Cost as % of Revenue | 14.0% | 12.5% | 15.9% | 16.8% | 19.6% |

| Networth | 12,235 | 18,525 | 28,008 | 31,404 | 38,100 |

| Borrowings | 265 | 2,489 | 7,596 | 8,338 | 9,752 |

| Cash & Cash Eq | 3,367 | 7,590 | 10,998 | 13,989 | 9,929 |

| Capital Employed | 12,500 | 21,014 | 35,604 | 39,742 | 47,852 |

| RoCE | 29.4% | 35.9% | 23.6% | 22.5% | 13.5% |

| RoE | 21.7% | 17.0% | 16.2% | 15.0% | 5.7% |

| EPS | 11 | 13 | 19 | 20 | 9 |

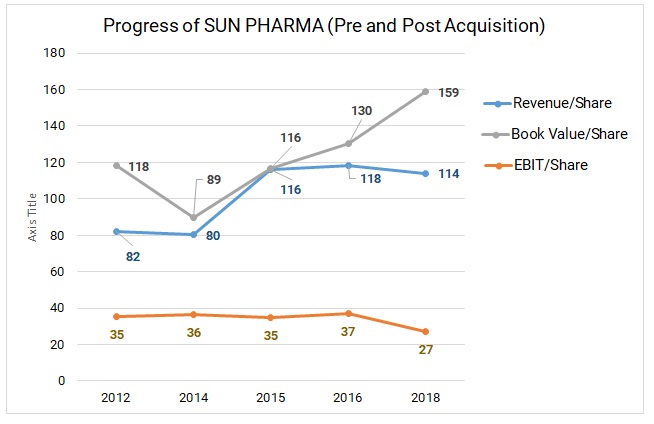

In 2018, the consolidated revenues of Sun Pharma degrow by around 4%. Its EBIT margins have also decreased significantly. The growth rate in terms of revenue & profitability has significantly changed after the merger.

Sun Pharma’s Compounded growth rate before the merger & after the merger:

Ranbaxy performance before the merger

| Particulars | 2009 | 2014 |

| Revenue | 8,083 | 13,451 |

| EBIT % | 18.1% | 5.0% |

| PAT % | 3.7% | -8.0% |

| Employee Benefit Cost | 1,417 | 2,577 |

| Employee Benefit Cost as % of Revenue | 17.5% | 19.2% |

| Networth | 4,343 | 3,305 |

| Debt | 3,629 | 6,394 |

| Capital Employed | 7,972 | 9,699 |

| RoCE | 18.4% | 7.0% |

| RoE | 6.8% | -32.5% |

Ranbaxy’s Revenue grew about 13% but EBIT and PAT declined by 16% and 26% respectively during FY 09 to FY 14.

Allegations

The transaction of the merger of Ranbaxy has been stuck in a legal roadblock after some retail investors had filed writ petition in Andhra Pradesh High Court for insider trading. In August 2017, Sun Pharma, its managing director Dilip Shanghvi and nine other entities settled an insider trading probe on payment of Rs 18 lakh towards settlement charges.

In November 2018, a note by an institutional investor alleging Sun Pharma over corporate governance practices went viral. Just after the note, another set of allegations against sun Pharma came to light. A Senior Company Executive had submitted a 150-page document to the Securities and Exchange Board of India in September alleging insider trading by the company through several foreign entities.

Minority Gain

*As Ranbaxy got merged with Sun Pharma, we have considered MCAP of Sun pharma for calculating minority shareholders value for Ranbaxy.

Conclusion

Sun Pharma’s aim behind Ranbaxy merger was to become an undisputed leader in the Indian pharmaceutical market, However, post-merger, Sun Pharma was stuck due to various reasons. In 2015, it has experienced challenges in CGMP compliances at its biggest plant at Halol. For the last couple of years, due to intense competition in the US pharma market, the crown jewel for Indian Pharma Companies is witnessing price war which has resulted in significant reduction in revenues for Indian Pharma players and even substantial reduction in margins. The company expanded in every possible region but till there are no returns on those investments, as a result, operational profit margins came down. Sun Pharma’s strategy of growth by becoming a global leader is hindered with many macro factors affecting the pharma sector with legal hurdles faced by the company leading to lacklustre performance. ROCE became abnormally low which did not allow the company to repay debt.

One of the key objectives behind this merger was to accelerate growth & create value for the stakeholders. However, somewhere Sun Pharma couldn’t able to integrate Ranbaxy as it was busy in solving macro factors. Though management claims, it has achieved the targeted synergy benefits amounting to $ 300 million in FY 18, a huge cultural difference has resulted in an increase in the cost of operations mainly employee cost for Sun Pharma. In addition to this, corporate governance issues have resulted in Sun Pharma out of the frying pan into the fire situation. Sun Pharma needs a bit of luck to take care of Macro issues so that it can go on the path of growth at the earliest.

Add comment