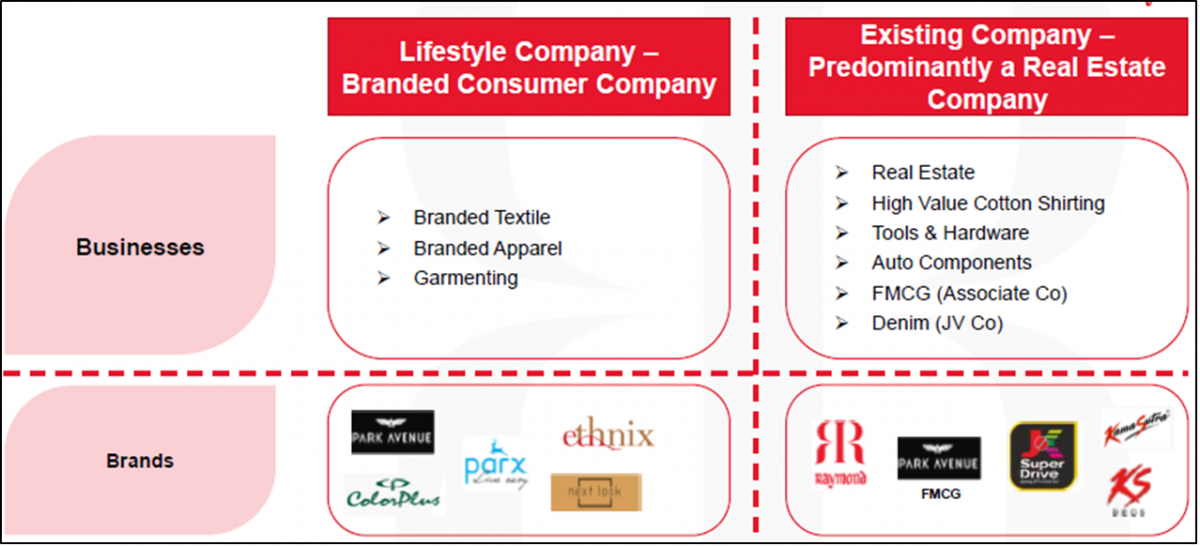

Raymond Group, having an interest in Textile & Apparels, Real Estate, FMCG and Engineering products has decided to streamline its corporate structure. In pursuant to this, the company will separate its lifestyle business division to separate company & later to list it separately.

Raymond Limited (Raymond) is India’s largest integrated worsted suiting manufacturer that offers end-to-end solutions for fabrics and garmenting. Over the years, Raymond has been synonymous with quality, innovation and market leadership. It has some of the leading brands within its portfolio – Raymond Ready to Wear, Park Avenue, ColorPlus, Parx, Raymond Made to Measure amongst others. Raymond has one of the largest exclusive retail networks in the country with over 1500 stores across 601 towns. As a part of the diversified Group, it also has business interests in men’s accessories, personal grooming & toiletries, prophylactics, engineering and auto components across national and international markets.

The Transaction

The company will demerge its core lifestyle business to a new company. The lifestyle business will include the business of branded textile, branded apparel & garments. After the demerger, the lifestyle business company will get listed on bourses with mirror shareholding structure.

The existing company will predominantly become a real estate company having an interest in the business of Real Estate, B2B Shirting Business, Engineering business of Auto components and tools & hardware, Denim and FMCG business.

The appointed date for the transaction is 1st April 2020. Every shareholder of Raymond Limited will be issued the shares of a new company in the ratio of 1:1.

The reason given by the management for keeping High Value Cotton Shirting business in the existing company is its existing litigation with JV partner which is being contested at NCLT and the matter is sub-judice. NCLT has passed an order freezing shareholding of RLCL and sale or transfer fixed assets of RLCL in which JV partner has an interest. Once the matter is solved, the company will come out with some mechanism to transfer this business to lifestyle business.

Earlier it was announced by the company that the existing company will grant perpetual brands usage rights for the “Raymond” brand to the Lifestyle Company at a brand royalty to be charged at a percentage of Turnover with a cap, in line with the best market practices, however, considering the objections from various investors, it is decided to that the brand licensing relating to the “Raymond” name relating to lifestyle business will get demerge with the business.

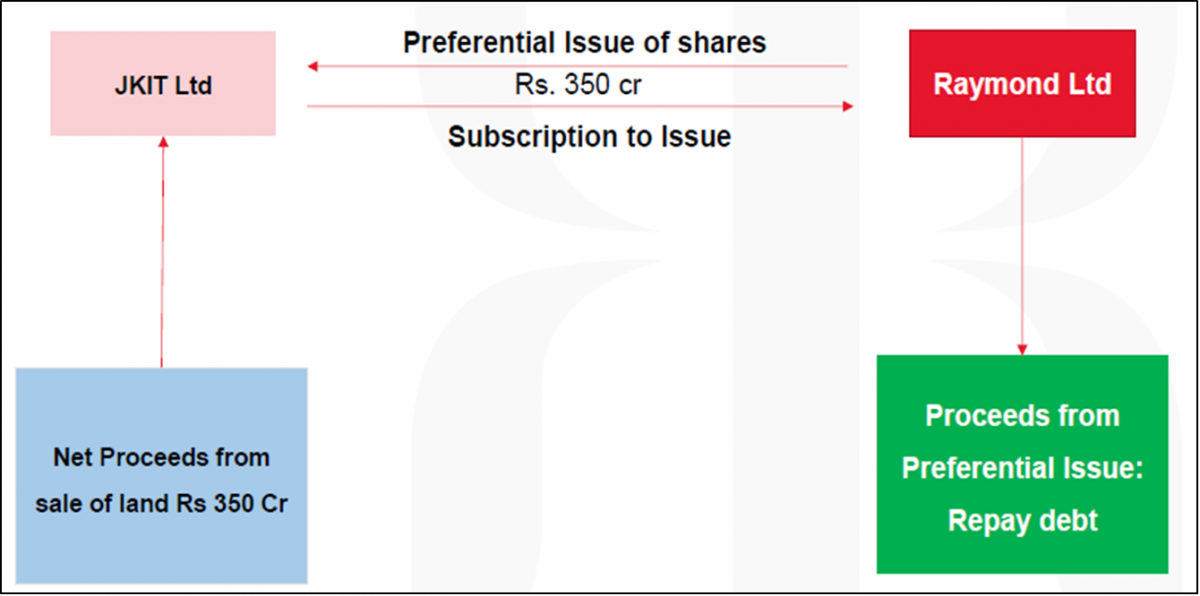

Preferential Allotment

It is also decided that J.K. Investo Trade Limited (JKIT-Associate Company) will infuse the net receipt of INR 350 crores in Raymond Limited in the form of Equity Shares & Compulsorily Convertible Preference Shares through preferential allotment route to pare debt. The equity & Compulsorily Convertible Preference Shares will be issued at INR 674 per share.

JKIT is an associate company in which Raymond Limited holds 47.66% stake. This company recently announced the signing of an agreement of sale of 20 acres of land with Virtuous Retail, which is utilizing the net proceeds of Rs. 350 crores from the land sale to be infused into Raymond Limited. The gross sale value of the land parcel is Rs. 700 crores.

After said allotment, the shareholding pattern of the company will be get changed. The promoter’s holding in the company will increase by ~4.38%.

Table 1: Changes in Shareholding post Preferential Allotment

| Particulars | Pre-Preferential Allotment | Post-Preferential Allotment | |||

| Shares (crs) | % | Shares (crs) | % | ||

| Promoter Group | 2.69 | 43.83% | 3.21 | 48.21% | |

| Public | 3.45 | 56.17% | 3.45 | 51.79% | |

| Total | 6.14 | 100% | 6.66 | 100% | |

Financials

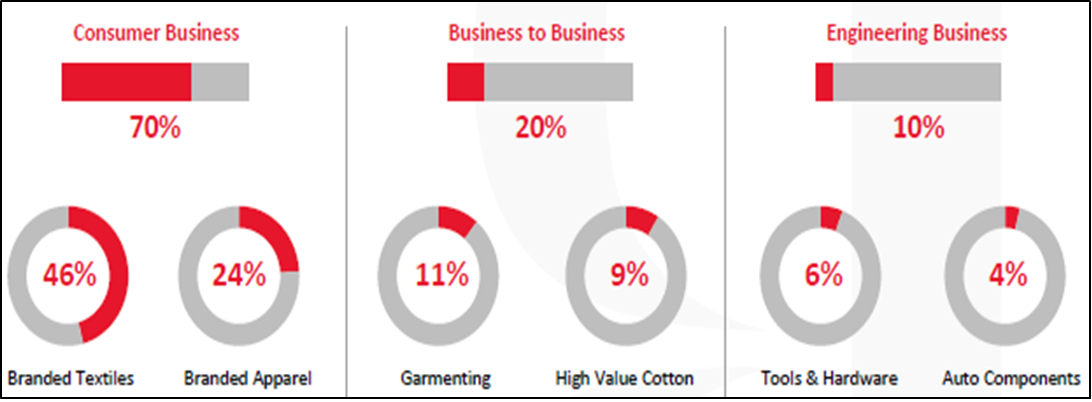

FY 2019 Revenue bifurcation across various segments

Table 2:Financials Division -Wise for FY 18-19 (All Figs in INR Crores)

| Particulars | Lifestyle Business | Existing Company |

| Revenue | 5284 | 1549 |

| EBITDA | 601 | 101 |

| EBITDA % | 11.4% | 6.5% |

In terms of debt, the company after infusion by JTKT will have net-debt of circa INR 2000 crores. About 75% of the net debt will get transferred to the lifestyle business & remaining 25% debt will continue to remain in the existing company. Out of the net debt of Lifestyle business, 30% will belong to the term loan and remaining for the working capital. Most of the remaining net debt (will stay with existing company) will be in the nature of long-term debt.

Comparison with other listed companies

Two years before Arvind Limited announced demerger of its Branded Apparel into a separate company. Few months before, the new company i.e. Arvind Fashion Limited (AFL) got listed on the bourses. In past, Aditya Birla group has also demerged its Branded garment business including retail business into a new company, Aditya Birla Fashion and Retail Limited (ABFRL). The financial of both companies as on 31st March 2019 are as below:

INR in Crores

For Financial year 2019:

Table 3: Financials of ABFRL & AFL for FY19 and H1FY20

| Particulars | ABFRL | AFL | |||

| FY – 19 | H1– FY-20 | FY – 19 | H1–FY-20 | ||

| Revenue | 8,117 | 4362 | 4,644 | 2020 | |

| EBITDA % | 7.6% | 15.9% | 6.3% | 6.4% | |

| Capital Employed | 3,129 | 3750 | 2,052 | 1975 | |

| RoCE | 19.8% | 18.5% | 6.70% | 6.5% | |

Valuation of the companies

Table 4: Valuation of ABFRL and AFL

| Particulars | ABFRL | AFL |

| Current Market Capitalisation | 17,000 | 1850 |

| Enterprise Value | 19,409 | 2982 |

| EV/EBITDA(Assuming 2x of H1FY2020 EBITDA) | 14.00 | 11.56 |

From above, it looks the Lifestyle Business of Raymond may fetch the EV/EBITDA multiple of ~13-15.

Table 5: Possible valuation of the Lifestyle Business

| Particulars | Amount |

| Likely EV/EBITDA Multiple | 13 |

| EBITDA FY 2019 | 601 |

| Enterprise Value | 7800 |

| Net Debt | 1500 |

| Market Cap-Lifestyle Business | 6300 |

Conclusion

In past, Aditya Birla Group & Arvind group hived-off their branded apparel business into a separate company. Considering the continuously changing dynamics of retail branded business, unravelling branded apparel business from other businesses can be the only right way to survive, nurture and grow it.

In future, Lifestyle Business company may have to take onboard some strategic investors to support and optimise its marketing and advertisement costs and create a distribution network both online and offline at a fraction of the cost.

Post implementation of RERA, the real estate business has become money-spinning for big players. Most of the companies having a history of more than 50 years are shifting their factories from the heart of the city because of environmental issues. Instead of keeping the city land idle, they prefer to monetise it. The same strategy worked extremely well for Godrej, Glaxo, etc. Players like Bombay Dyeing, Aditya Birla group are also announced similar plans. In the coming period, Raymond may sell its Engineering business and become a pure-play Real Estate Company.

Overall, the proposed demerger is a welcome step from the Raymond group which will create value for all the stakeholders.

Add comment