In order to make a larger presence in India, Total SA will buy a 37.4% stake in Ahmedabad-based Adani Gas Ltd for Rs 6,200 crore. The French energy giant has made an open offer to public shareholders of Adani Gas to acquire up to 25% stake. It has offered to buy shares at 149.63 apiece, which was 8.7% higher than the previous day of the announcement. The deal is an indication of rising global interest in India’s oil and gas sector.

Total SA will purchase 37.4% shares in Adani Gas Limited through a tender offer to public shareholders to acquire up to 25.2% shares subject to applicable regulations and purchase the residual shares from Adani Family. Adani Family and TOTAL SA shareholders shall ultimately hold 37.4% each and public shareholders shall hold remaining 25.2%. as Securities and Exchange Board of India norms mandate listed companies to maintain minimum public shareholding of 25%.

The partnership will help develop regasification terminals including Dharma Ltd on the east coast of India and Mundra in the west. The partnership comes after a year when the two companies had agreed to set up an equal joint venture to import and retail natural gas. Under the deal, Total will bring its LNG as well as retail expertise and will also supply LNG to Adani Gas.

The partnership will enable Adani Gas to set-up gas distribution network across the country, which is now India’s largest city gas distribution company with presence in 71 districts in 15 states to 8% of the country’s population. Going ahead, Adani Gas will look to augment its gas distribution network over the next decade to industrial, commercial and domestic customers for homes and vehicles. Compressed natural gas (CNG) is distributed for use in motor vehicles and piped natural gas (PNG) is supplied for domestic household, commercial and industrial uses. The two companies will build a fuel retail network of 1,500 stations along highways and intercity connections. Also, the partnership will also establish a joint venture to market LNG in Bangladesh.

The acquisition of stake by Total SA will be the largest foreign direct investment in India’s city gas distribution industry. After the deal takes a final shape, the shareholding of Adani family and Total will 37.4% each and the rest with public.

Why Total wants to partner with Adani

Total, the world’s second largest liquefied natural gas (LNG) player, has been active in India since the 1990s and the company here markets petroleum products and associated services and operates in renewable energies. Adani Gas is attractive to Total as the development of the Mundra and Dharma regasification terminals will provide the French energy giant market access for LNG. Also, as Adani was an aggressive bidder in the recent gas distribution auction, it will provide the French company with a firm demand for gas. In fact, India is at the focal point of Total’s global plan to become a responsible energy major.

As demand for natural gas in the country is projected to rise from 167 mmscmd in FY19 to 252 mmscmd in FY22, Total wants to be a part of the growth story and setting up a standalone gas marketing and distribution business in the country will take a lot of time and investment. India’s natural gas market promises huge potential, which currently accounts for only 7% of the country’s energy consumption. Supported by an active policy of the government which wants to diversify the energy mix of uses, companies will look at newer markets, especially in the hinterlands for cleaner fuel mix. To be sure, the government has chalked out plans to more than double the share of natural gas in India’s overall energy mix from 6.2% to 15% by 2030 driven by large supply, competitive pricing, infrastructure augmentation and easier and business-friendly government regulatory norms. That will also help in reducing global warming and make the environment cleaner.

Adani Gas was a natural choice for Total as it has worked with the company in the past. The partnership will focus on exploring new models of delivering cost-effective natural gas in the country where it is most needed to complement traditional pipelines. Adani will bring its knowledge of the local market and its expertise in the infrastructure sector and club Total’s global expertise to make LNG available across the country. In fact, Adani Gas and its joint venture will distribute gas to six million households in the next 10 years.

To ride the growth curve, Adani Gas will invest Rs 6,000 crore on a standalone basis in the next five to seven years, which will drive strong volume growth. Adani group is constructing a five million tonne capacity LNG import terminal at its Dharma port in Odisha. It is also building a 3.2 million tonne LPG terminal at Mundra port and a 1.2 million tonne LPG terminal at Dharma. As a result of these investments, Adani Gas has the potential to emerge as one of the key players over the long-term in the city gas distribution business in the country.

The partnership deal is part of Total’s plan to invest as much as $18 billion a year globally between 2019 and 2023 to deliver growth, growth mostly through higher LNG sales of 50 million tonnes a year by 2025, according to the company’s outlook presentation in September this year. Total plans to set up 4,000 service stations in new markets by 2025 of which 1,000 are expected to be in India.

Gains for Adani Gas

The largest downstream energy partnership in the country will help Adani Gas to expand across the country and get the best technology from the French giant. The partnership will enable Adani Gas to explore synergies between gas distribution, fuel retail and LNG business. Both the companies will provide unique portfolio of multi-product services and have exclusive marketing rights.

Table 1: Financials of Adani Gas (All Figs in INR Crores)

| Particulars | FY17 | FY18 | FY19 |

| Revenue | 1162 | 1458 | 1824 |

| EBITDA | 277 | 365 | 455 |

| Net Profit | 101 | 165 | 229 |

Source: Company’s Website.

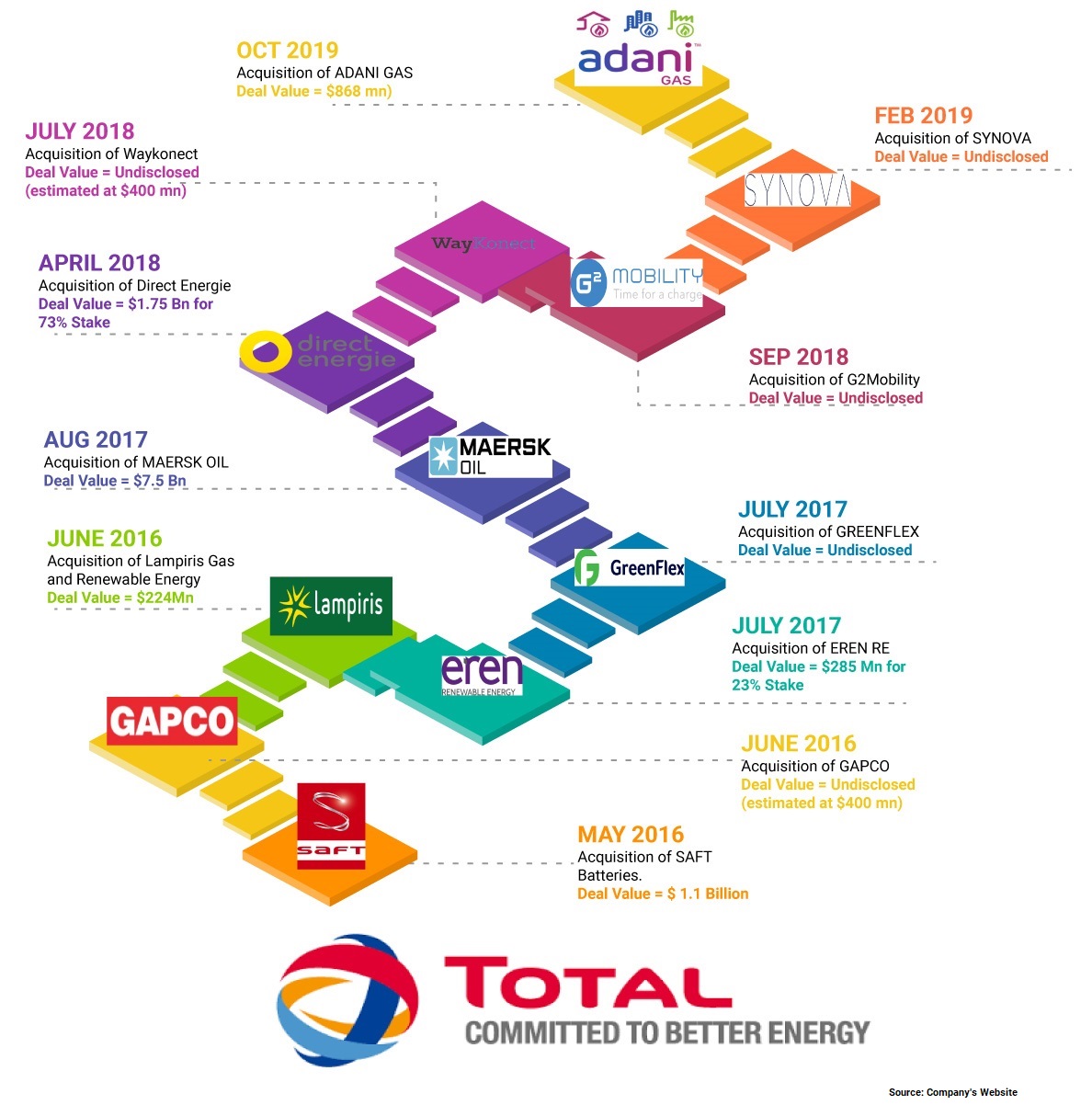

Deals by Total in the past

As a part of its global strategy to expand business through stake purchase, Total purchased a 26.5% stake in a LNG project in Mozambique from Anadarko for $3.9 billion in June this year. Total bought the largest stake in the Mozambique project. In March last year, Total completed the acquisition of Maersk Oil as part of the share and debt transaction announced on August 21, 2017. The operation will enable Total to acquire a company with a growing production, quality assets with a good fit to the company’s portfolio in core regions.

Globally, Total has been signing deals to buy low-cost, long-life assets that are already producing. The company is also expanding its LNG offerings and building out an alternative energy business. The company has a strong balance sheet to make several acquisitions. In August 2017, the Danish container shipping company A.P. Moller-Maersk had agreed to sell its oil and gas business to the French energy giant Total for $4.95 billion. The integration process is underway smoothly. It has also developed Iran’s South Paras natural gas field. In Libya, the company bought 16% stake in the Waha concession for Marathon Oil.

About Adani Gas

Adani Gas is one of the country’s largest private players in the city gas distribution business and has authorisation to distribute compressed natural gas and piped natural gas. The company had operations in four geographical areas on a standalone basis and in joint venture with IOC prior to the ninth and tenth bidding round of city gas distribution licenses. With the company emerging as one of the most successful bidders, it now has presence in 19 geographical areas on a standalone basis and 19 geographical areas under joint venture.

Adani Gas’s sales volumes were at 1.5 mmscmd in FY19 and have grown at 15% CAGR in the last two years. Increasing geographical areas, favourable regulatory scenario and increasing demand of natural gas are expected to lead to 14.3% CAGR in volumes in FY19-21 to 1.9 mmscmd in FY21. The company used to be a wholly-owned subsidiary of Adani Enterprise, which itself is part of the conglomerate Adani Group that operates in the infrastructure and energy sectors. After the demerger with the parent company, in September 2018, it was listed on the stock exchanges in November last year.

In FY19, Adani Gas had a city gas infrastructure network of 82 CNG filling stations with a compression capacity of 2 million kg/day, providing CNG to over 0.2 million vehicles. The company supplied PNG to 0.38 million domestic customers, 2,550 commercial and 1,300 industrial customers through an integrated pipeline network of over 6,500 kilometer.

About Total

The French multinational integrated oil and gas company was founded in 1924 and one of the seven “Supermajor” oil companies in the world. Its businesses cover the entire oil and gas chain, from crude oil and natural gas exploration and production to power generation, transportation, refining, petroleum product marketing, and international crude oil and product trading. Total is also a large scale chemicals manufacturer. The company comprises five segments: Exploration & Production, Refining & Chemicals, Marketing & Services, Gas, Renewable & Power, and Corporate. The company’s revenue was $209 billion in 2018. The company’s assets have been steadily increasing since 2015. Although Total S.A.’s capital expenditures have been fluctuating since 2010, they recently saw an increase from 2017 to 2018.

Conclusion

Given the fact that gas demand will rise in India, the partnership between Adani Gas and Total will pave a long way for a steady alliance which will be a win-win situation for both the companies because of the synergies and expertise that the two companies can offer.

Add comment