Sudesh Group is engaged in steel pipes and tubes manufacturer through different group entities including listed entities. In February 2021, the Board of Directors of APL Apollo Tubes Limited, one of the entities belonging to Sudesh Group approved a scheme of amalgamation of its step-down listed subsidiary Apollo TriCoat Tubes Limited and unlisted subsidiary, Shri Lakshmi Metal Udyog Limited with itself. The announcement was made to usher the consolidation of pipe manufacturing business carried through different companies into a holding company.

It is not unfamiliar for many corporates to start similar businesses in different companies/subsidiary companies to achieve different commercial objectives. However, what makes it unique in APL Apollo is the chronology; From the early strategy to start the business under different entities followed by making holding-subsidiary companies and finally consolidation under one roof and intriguingly, all this happened in two three years!

In this article, we have tried to analyze all steps taken by the group in last few years.

Overview of companies involved in the Transaction

APL Apollo Tubes Limited (APL Apollo) is engaged in the business of production of ERW steel tubes. The Company is an umbrella company for Sudesh Group. The equity shares of APL Apollo are listed on BSE & NSE. The Company is promoted and controlled by Mr. Sanjay Gupta & other family members including Rahul Gupta.

Shri Lakshmi Metal Udyog Limited (SLMUL) is engaged in the business of production of ERW steel tubes and GP Coils. It is a Wholly-owned subsidiary of APL Apollo.

Apollo Tricoat Tubes Limited (Apollo TriCoat) is engaged in the business of production of steel designer roofing, fencing, steel door frames, designer hand railings etc. It has two manufacturing units one at Malur Bengaluru, and the second at Ghaziabad Uttar Pradesh. The company is subsidiary of Shri Lakshmi Metal Udyog Limited holding 55.82% in Apollo TriCoat. The shares of Apollo TriCoat are listed on BSE. Apollo TriCoat became a part of AP Apollo in 2018.

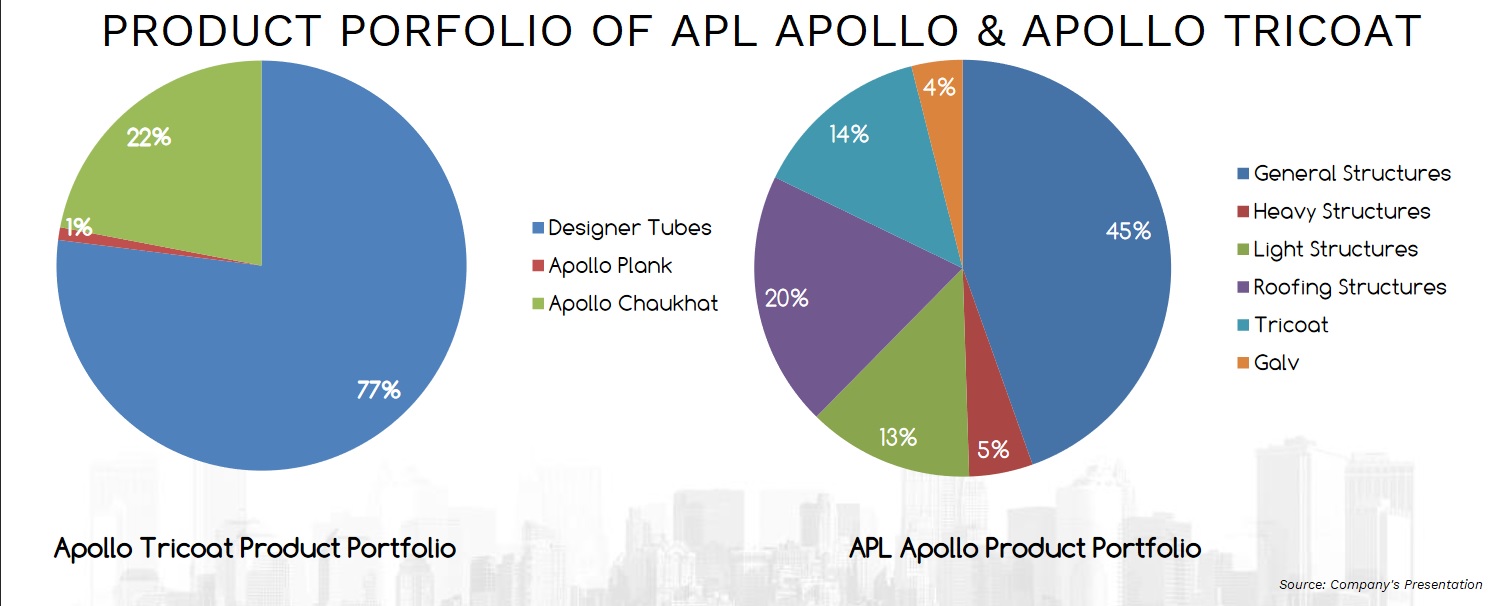

Product Structure among companies

APL Apollo is engaged in the production of ERW & Steel tube pipes while Apollo TriCoat is engaged mainly in value-added products. In the last couple of years, Apollo TriCoat launched several value-added products which are unique and off course, margin accretive to the group.

APL Apollo has 8 manufacturing units with a combined manufacturing capacity of 2.25 mm tons while Apollo TriCoat has 2 manufacturing units with a capacity of 0.35 mm tons. SLMUL is also engaged in the business of ERW steel tubes and GP coils.

The merged entity will have larger portfolio of products, diversified clients and access to each other distribution channels and technology. Apollo TriCoat can effectively use the distribution channel of APL Apollo having total 800 distributors in addition to its own 100 distributors. APL Apollo will have access to high-end galvanizing technology, which will enable to add new products – Inline Galvanizing (ILG) Pipes, Door Frames, Hybrid Pipes and Narrow Section directly under its roof.

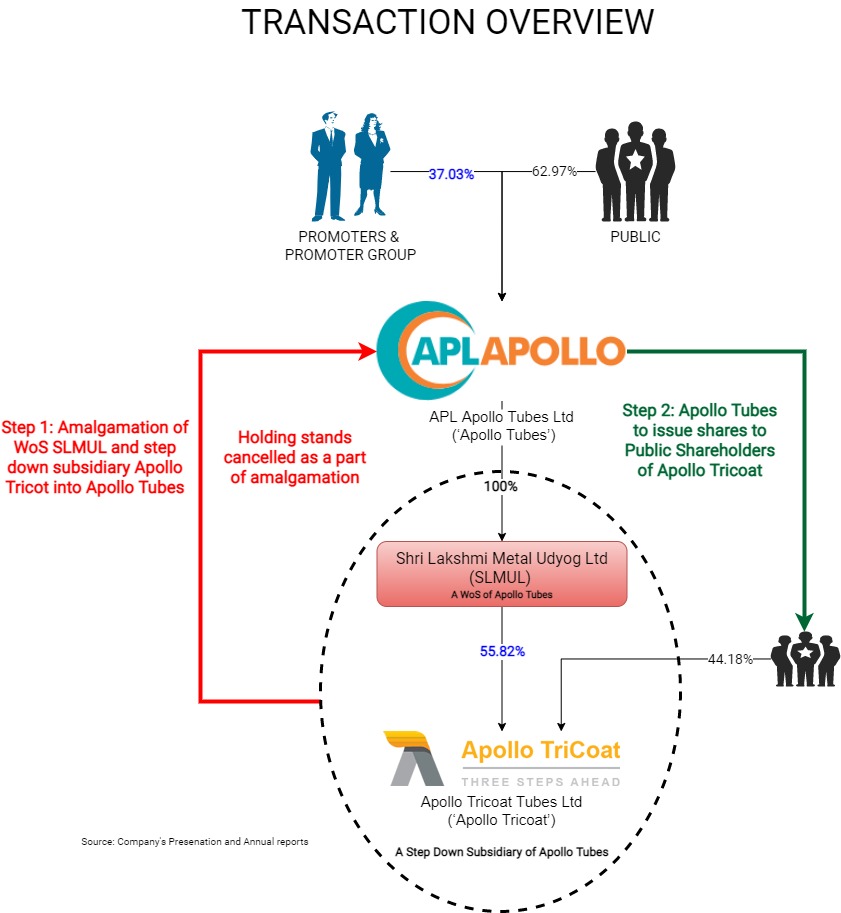

The Proposed Transaction

From Appointed Date 1st April 2021, SLMUL & Apollo TriCoat will merge with its APL Apollo.

Swap Ratio

Amalgamation of SLMUL with APL Apollo

SLMUL is 100% subsidiary of APL APOLLO, hence there will be no allotment of shares to APL Apollo or its nominees. Share capital of SLMUL will stand cancelled.

Amalgamation of Apollo TriCoat with APL Apollo

Shareholders of Apollo TriCoat, except shares held by SLMUL (1,69,70,000 shares and 55.82%) will receive 1 share of APL Apollo for every 1 share held in Apollo TriCoat. The share exchange ratio stands at 1:1.

Sub-division of face value of equity shares of SLMUL

As an integral part of the Scheme, the face value of one equity share of SLMUL of INR 10 each shall be sub-divided into the face value of INR 2 each.

Rationale for the scheme:

- Simplified structure

- Stronger product portfolio under APL Apollo

- As all the three companies are engaged in the same business, therefore, merger of business of companies gives an additional advantage in terms of savings in working capital i.e. GST on inter-company transaction, transfer pricing, ease to provide financing etc.

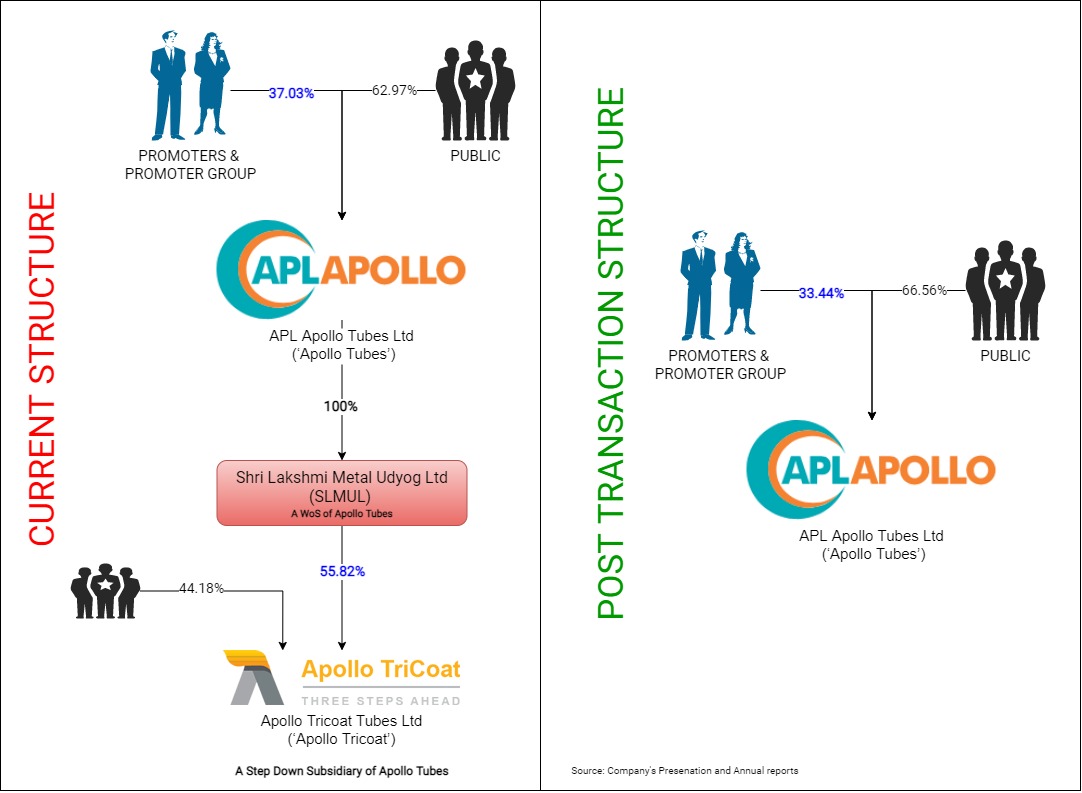

Pre & Post Company Structure & Shareholding Pattern

As the promoters of APL Apollo have sold some ~2.5% shares in the open market after December 2020, so the shareholding post-merger will be 33.44%.

Table 1: Pre & Post Shareholding Pattern

| APL Apollo Pre-Shareholding | Issue due Merger | APL Apollo Post Shareholding | |||

| Particulars | Nos. | % | Nos. | Nos. | % |

| Promoters | |||||

| Sanjay Gupta | 1,75,000 | 0.14% | – | 1,75,000 | 0.13% |

| Veera Gupta | 29,50,000 | 2.36% | – | 29,50,000 | 2.13% |

| Ashok Kumar Gupta | – | 0.00% | – | – | 0.00% |

| Rahul Gupta | 15,01,000 | 1.20% | – | 15,01,000 | 1.09% |

| Rohan Gupta | 11,25,000 | 0.90% | – | 11,25,000 | 0.81% |

| APL Infrastructure Private Limited | 4,35,00,935 | 34.86% | – | 4,35,00,935 | 31.47% |

| Sub Total | 4,92,51,935 | 39.4% | – | 4,92,51,935 | 35.63% |

| Public | 7,55,32,190 | 60.53% | 1,13,87,304 | 8,69,19,494 | 62.89% |

| Saket Agarwal (Classified as public as on 4th December 2020) | – | 0.00% | 20,42,696 | 20,42,696 | 1.48% |

| Total | 12,47,84,125 | 100% | 1,34,30,000 | 13,82,14,125 | 100% |

Acquisition of Apollo TriCoat Ltd

In 2016, Mr. Saket Agarwal entered into a Share Purchase Agreement with the promoters of Potential Investments and Finance Limited (now known as Apollo TriCoat) to acquire 16.75% stake in the company. It triggered an open offer requirement. After acquisition by Mr. Saket Agarwal, the name of the company got changed to Best Steel Logistics Limited. Best steel was offering comprehensive and tailor-made Warehouse Management, Distribution and inventory management services of steel and steel products. The Company owned/leased 4 (four) strategically located warehouses spread across a total of 373,000 square feet of area across Pan-India.

Table 2: Financials of Apollo Tricoat (All Figs in ₹ Crores)

| Particulars | Amount |

| Revenue (FY 2017) | 61 |

| PAT | 1.41 |

In the Annual Report of the company for the year 2017, it is mentioned that Rahul Gupta was holding ~5.41% stake in the company. Mr. Rahul Gupta did execute a couple of buy/sell of shares of the company through open market.

In January 2018, Best Steel announced the preferential allotment of equity shares and convertible warrants to Mr. Rahul Gupta & Others.

Table 3: Preferential Allotment

| Particulars | No. of Shares | Price Per Share (₹) | Total (₹ Crores) |

| Equity Shares | 72,00,000 | 120 | 86.4 |

| Convertible Warrants | 49,00,000 | 120 | 58.8 |

Further, it was also clarified that Mr. Rahul Gupta intends to become promoter of the Company and Mr. Saket Agarwal, the existing promoter of the company will re-classify himself as a “Public.” This has triggered for the requirement of SEBI (Securities and Exchange Board of India) Open Offer by Mr. Rahul Gupta. Thus, the open offer has been made in accordance with the regulation by him for equity shares representing 26% stake in the company at INR 120 per share, though he could not get enough shares in open offer.

Immediately, after acquisition by Mr. Rahul Gupta, he started the turnaround process. He introduced a new business of manufacturing of TriCoat Tubes in three variants – SureCoat, DuraCoat and SuperCoat, with the advanced Galvant technology. This technology and the products have been introduced for the first time in India. The Company decided to change the nature of business to manufacturing and so changed the name of the company to ‘Apollo TriCoat Tubes Limited.’ The company also invested ` 100 Crores in setting up a plant in Malur, Bengaluru with an initial capacity of 50000 MT per annum. In last two years, the company launched several unique first in India products and ramped up capacity.

In one of the con-calls held by APL Apollo in 2018, they clarified that the reason for starting Apollo TriCoat was unique products. These products were new to India and technology is different than that used by APL Apollo. Thus, they took decision to keep APL Apollo separate from these products. Within months of launching products, the company witnessed good demand for these new technology products. In October 2018, SLMUL, a WoS (Wholly Owned Subsidiary) of APL Apollo, entered into a Share Purchase Agreement with Mr. Rahul Gupta for acquisition of 80,30,030 Equity shares of Rupees 120/- each and Options attached to 43,00,000 warrants at a price of Rupees 120/- per option of Apollo TriCoat Tubes Limited. This has again triggered open offer requirement in the very same year. The open offer has been made at ₹ 135 per share.

The key reason for acquiring Apollo TriCoat through SLMUL can be twofold:

- SLMUL already engaged in coated products

- Lack of availability of land with SLMUL for expansion vis-à-vis enough land available with Apollo TriCoat

Table 4: Timeline of Acquisition of Apollo TriCoat

| Particulars | Time | Per Share Value |

| Earlier purchase from market by Rahul Gupta | Circa 2016, 2017 | Various prices (some being at ~14 per share) |

| Preferential Allotment to Rahul Gupta | January 2018 | INR 120 |

| Open Offer by Rahul Gupta | January 2018 | INR 120 |

| Transfer by Rahul Gupta to SLMUL | October 2018 | INR 120 |

| Open offer by SLMUL | October 2018 | INR 135 |

To fund the acquisition, immediately in November 2018, the Board of Directors of APL Apollo approved equity infusion on a preferential basis into the Company through (a) Equity infusion of INR 72.00 crore through the Preferential Issue of 400,000 Equity Shares at `1,800 per equity share. (b) Equity infusion of INR100.00 crore through issue of 500,000 Options attached to Warrants of the Company at `2,000 per equity share

In addition, SLMUL acquired 1,325,000 Equity Shares being 5.16% of the paid-up share capital of Target Entity from open market and 1,536,209 Equity Shares representing 5.98% of the paid-up share capital of Target Entity as tendered under open offer, both aggregating to 2,861,209 Equity Shares being 11.14% of the paid-up share capital of Apollo TriCoat Tubes Limited.

Related Party Transactions:

Some of the related party transactions by Apollo Tricot with APL Apollo for the last 2 years.

Table 5: Related Party Transactions (All Figs in ₹ Lacs)

| Particulars | 2019 | 2020 |

| Revenue | 325 | 11,025 |

| Sale of Raw Material | 2,494 | |

| Purchase of Goods | 711 | 1,408 |

| Advances received | 2,958 | – |

| Loan Taken | – | 2,000 |

Financials

The financials of both companies for the year FY 2020

Table 6: Financials of Apollo TriCoat & APL Apollo (All Figs in ₹ Crores)

| Particulars | APL TriCoat | APL Apollo-Consolidated |

| Revenue | 663 | 7723 |

| EBITDA | 75 | 499 |

| PAT | 42 | 256 |

| Networth | 200 | 1356 |

| Borrowing | 112 | 832 |

| Capital Employed | 312 | 2188 |

| Plant, Property and Equipment | 288 | 1471 |

| Net Current Assets | 69 | 224 |

Table 7: Turnover of the companies for 9 months ended on 31st December 2020

| Particulars | Amount |

| APL Apollo | 4167 |

| SLMUL | 482 |

| Apollo TriCoat | 1005 |

Conclusion

In last two years, Apollo TriCoat has really ramped all the products very well. Using the existing network of APL Apollo, in no time, Apollo TriCoat marketed its value-added products to the mass segment. Within two-three years of manufacturing, it achieved revenue of INR 1000 crore plus for nine months ended in December 2020. Being value-added, margins and returns on capital employed from Apollo Tricoat is significantly better than its holding company which is engaged in conventional products. The merger will likely to pawed the way for the consolidation of value-added products into mainstream companies. The consolidation will reduce the regulatory challenges like transfer pricing while doing the inter-company transactions at the same allowing certain synergies to kick in.

Overall strategy since inceptions seems to carve out with proper planning. Promoters started Apollo TriCoat in a different company so as to separate the modern technology from existing. However, sooner they announced taking Apollo TriCoat under APL Apollo. Later, they wait to get the new business matured and once it crossed INR 1000 crore revenue mark, they announced the merger. It will be interesting to see what added benefit group can reap from the merger.

Add comment