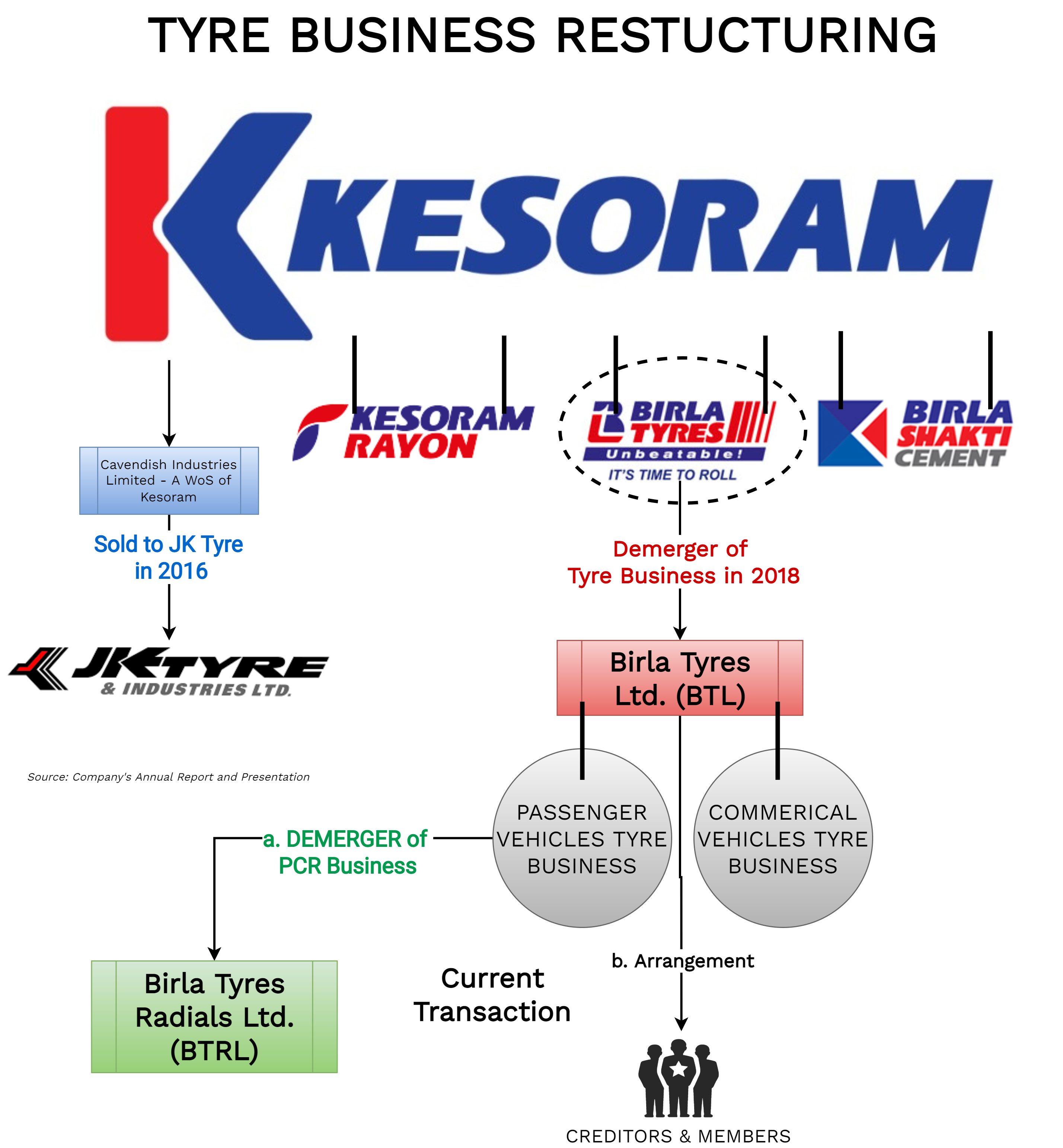

Management of Kesoram Industries have been trying to optimize their Tyre Business Undertaking for quite some time. In 2016, it sold its Haridwar Tyre Manufacturing plant via slump sale of its WoS Cavendish Tyres Ltd to JK Tyre & Industries Ltd. To accelerate growth for its Tyre Business, in 2018, Kesoram Industries Limited demerged and separately listed its “Tyre Business” into Birla Tyrese Limited. To set up its PCR business, during demerger, Kesoram Industries Limited also transferred a significant amount (INR 400 crore+) to Birla Tyres Limited as a loan. However, these steps do not seem to be enough. Recently, Birla Tyres Limited board approved composited scheme of further demerger of Tyres business & arrangement with creditors. Let us analyze whether this step will facilitate the required growth for Birla Tyres?

Birla Tyres Limited (BTL or the demerged entity), part of India’s BK Birla group, is engaged in manufacturing Tyres for commercial vehicles at its facility located at Balasore, Odisha. BTL is also in process of setting up a new plant for Passenger car Redial Tyres (“PCR Business”) adjacent to its existing plant. The equity shares of BTL are listed on the nationwide exchanges.

Birla Tyres Radials Limited (BTRL or Resulting Company) has been incorporated as a wholly-owned subsidiary of BTL to facilitate the demerger of the PCR business. Post-transaction, PCR business will be demerged to BTRL.

Existing Financial Position of BTL:

The business of BTL has been severely impacted for the last few years which coupled with the ongoing pandemic has almost crippled its tyre business which has run into huge losses. The accumulated losses of BTL as of 30th November 2021 was INR 847 crore and share capital of BTL has stood fully eroded. The Company has defaulted in repayment of term loan, letter of credit, working capital facilities, and related interest payable to lenders aggregating to ₹ 436 Crore (as of 31st December 2021) and has not complied with certain financial debt covenants. Consequent to the non-availability of fund to meet the working capital requirements, the operations of the Company have been currently halted. The previously mentioned conditions indicate stress on liquidity and the existence of material uncertainties which cast significant doubt on the Company’s ability to continue as a going concern.

A substantial part of the debt availed by BTL is invested in the PCR business which is yet to commence operations. The PCR business further requires INR 200-225 crore of investment to commence the business.

Management has announced that the Company had received non-binding proposals from investors which had been discussed in the joint lenders meeting to enable the lenders to evaluate these proposals and facilitate further discussions/negotiations. The Company is also considering options to raise capital by way of equity through strategic and/or financial investors, which will enable the Company to commence its operations and meet the financial obligations.

The Proposed Transaction

The Company announced plans to restructure the business of Birla Tyres Limited by way of a Scheme of Compromise and Arrangement (‘Scheme’) involving –

(a) Demerger of the Passenger Car Radial Tyres (PCR) Business and allied activities of BTL into Birla Tyre Radials Limited (BTRL), on a going concern basis and

(b) compromise and arrangement with Creditors and Members of the Demerged Company

The Appointed Date for both steps will be December 1, 2021. This date will also be a cut-off date for the settlement of the dues of the secured creditors being the Lenders.

Demerger of PCR Business and Reduction in Paid-up share capital

As on the Appointed Date, BTL will transfer its PCR business to BTRL. The transferred undertaking mainly includes Property, plant & equipment – ₹ 52.97 Crores and Capital work-in-progress ₹ 707.09 crore along with the Loan of ₹ 758 Crores of lender will be demerged into BTRL.

Based on the fair valuation of the undertaking, as consideration for demerger, BTRL will issue 20,982 equity shares of INR 10 each at par amounting to ₹ 2,09,820 to BTL. As shares will be issued to BTL only and not to the shareholders of BTL, BTRL will continue to remain as a wholly-owned subsidiary of BTL, and PCR business will not get list separately.

This part of the Scheme also mentions the reduction of the share capital of BTL & BTRL. The existing equity shares of BTRL comprising of 50,000 equity shares of Rs 10 each amounting to Rs 5,00,000 will stand cancelled, extinguished and paid off to the extent of the nominal value in cash.

Further, existing Equity Shares of BTL of Rs 10 each fully paid up shall stand reduced by Rs 5 each and the amount so available shall be used to write off and shall stand adjusted against the carried forward losses of BTL as on 31 March 2021. On the same day after reduction, BTL will issue equity shares to the lender and unsecured creditors as promised for settling their dues.

Arrangement with Creditors

1. Resolution of the Debt of Secured Creditors

| Particulars | Amount | Comment |

| Total Fund Based Debt | INR 1057.87 crore | INR 758 Crores will be transferred to the PCR division which will get demerged, and the remaining will be re-structured |

| Re-Structuring of Remaining Debt | INR 299.87 crore | Upfront Payment: INR 75 crore conversion to equity: INR 83.18 crore conversion to redeemable preference shares: INR 141.69 crore |

| Non-Fund based debt | INR 10.25 crore | will be continued with charging only the commission @ 0.75% of the facility along with nil margin |

It is also mentioned that BTL shall source additional funds of about Rs 300 crores or more from new lenders in BTL to meet working capital requirements, towards partial payment of the debt to lenders and towards partial payment of overdue comprising statutory liabilities and unpaid salary & wages.

2. Resolution of Debt of Unsecured Creditors of BTL –

- BTL has overdue liabilities of ₹249.30 Crores as on 30th November 2021 comprised of unsecured operational creditors which also includes workers and employees’ dues.

- Arrangement with the above-mentioned overdue liabilities will be as follows –

- ₹ 49.91 Crores of the previously mentioned debt will be converted into equity shares of ₹ 5 each up to a maximum of 15% of the total paid-up share capital of BTL issued at the fair value of ₹ 14 each

- ₹ 100 crores of the aforesaid debt will be converted to Redeemable preference shares (Zero Coupon) which will be redeemed over a period of eight years starting from FY 2028

- Remaining dues of ₹ 99.39 crores shall be paid off by BTL over a period of the next 4 years starting from FY 2022.

- BTL has unsecured financial creditors of Rs 546.45 crore mainly consisting of loan given by Kesoram Industries Limited while demerger of Tyre division as on 30 November 2021:

- Arrangement with the above-mentioned unsecured financial creditors will be as follows –

- ₹ 81.97 Crores will be converted into new Equity Shares of Rs 5 each in BTL up to maximum of 25 % of the total paid-up share capital of BTL issued at the fair value of ₹ 14 each

- The remaining dues of Rs 464.49 Crs shall be converted to Redeemable Preference Shares (Zero Coupon) to be redeemed over a period of five years. This redemption shall be affected after payment of dues of the Lenders, the unsecured creditors including worker and employee dues (after FY 2036).

Summary of settlement with creditors

| Particulars | Amount(INR in crore) | Converted to | |||||

| Upfront | Equity Shares | Preference Shares | Deferred Payment | ||||

| Secured Creditor | 299.87* | 25% | 47% | 28% | – | ||

| Overdue Liabilities | 249.30 | 10% | 20% | 40% | 30% | ||

| Unsecured Creditors | 546.45 | – | 15% | 85% | – | ||

*: Excluding debt to be transferred to PCR Division.

Rationale of the Scheme of Arrangement

BTL’s commercial business has been halted due to insufficient funds. It has taken a heavy loan to start the PCR business which has yet to be commercialized. It further required ₹ 200 crore additional funds for commencement. BTL is continuously receiving recall letter from lenders. This has become a nightmare for the company. On one hand, it requires more funds to commercialise its already significantly funded expansion project while its revenue-generating business was not able to operationalize due to lack of funds. The only solution was to do settlement with lender & unsecured creditors and at the same time find an investor for its PCR business. Through the proposed scheme, BTL is facilitating the entry of an investor in PCR business and re-operationalize its core business.

The scheme will also streamline the operations of BTL (mainly borrowing) as a substantial part of the debt availed by the BTL is invested in the PCR Business which will get transferred to BTRL.

Shareholding Pattern

Pursuant to the arrangement with creditors, BTL will issue equity shares to the creditors. Its paid-up equity shares will stand to increase from 14,25,90,079 equity shares of INR 10 each to 29,61,69,670 shares of INR 5 each.

Part of the loan given by the promoters will get converted to equity shares and thus equity shares will get issued to promoters as well. Further, during an earlier demerger (Tyre Business) Kesoram Industries Limited has given a loan of more than INR 400 crore (classified under unsecured financial creditor) part of which will also get converted to equity shares. Due to this, Kesoram Industries Limited will hold circa 18.37% equity stake in BTL. Further, shares held by Kesoram will be classified as public shareholding.

In terms of preference shares, Kesoram Industries Limited will hold circa 61.13% of preference capital.

Accounting Treatment

The value of all assets and liabilities pertaining to the PCR Business in the books of BTL shall cease to be assets and liabilities of BTL and hall be derecognized by BTL at their carrying values while BTRL shall record the transferred assets and liabilities pertaining to the PCR Business at fair values as per Valuation Certificate as BTL will cease control over BTRL in near future.

Taxes

Any demerger is direct tax-neutral provided it satisfies the conditions mentioned under section 2(19AA) of the Income Tax Act, 1961. One of the conditions is, as a part of consideration, the resulting company shall issue its shares to the shareholders of the demerged entity. Under the existing scenario, the entire consideration will be discharged by BTRL to BTL and not the shareholders BTL. Thus, the demerger may not be tax compliant and direct tax may get triggered. Further, the scheme also does not provide any reference to the demerger as per the provisions of section 2(19AA) of the Income Tax Act, 1961. However, considering the value of undertaking is only ₹ 2,09,820 which is also mentioned in the scheme, the duty, if comes will be minimal.

As far as Goods & Service Tax (GST) is concerned, the demerger will be tax neutral provided it is a transfer of an undertaking on a “Going Concern” basis. The assessment of Going concern needs to do as on the Effective Date which is the date of which the certified copy of the order of NCLT sanctioning the Scheme is filed with the Registrar of Companies, Kolkata. Till the time BTL may re-start its halted construction of PCR division.

Cost

The entire cost for the arrangement will be borne by BTL.

Financials of BTL

INR in crore

*: Excluding amount payable to demerged company.

Provision under the Law

BTL has proposed “Arrangement” with the creditors under section 230(1)(b) of the Companies Act, 2013. Since the word Arrangement has wide meaning accepted by the courts, there are various ways under which arrangement can be done with the creditors against the outstanding loan. There can be arrangements under the Insolvency and Bankruptcy Code, 2016 also in the form of “Resolution Plan” after the insolvency proceedings initiated against the company on the application filed by the creditor.

Loan can be converted into shares pursuant to section 62(3) of the Companies Act, 2013 provided terms of the loan provide for such conversion and the same has been approved by the shareholders before accepting such loans. Considering the wide meaning of term arrangement, BTL has converted the loan into shares under section 230 only and not under section 62(3) of the Companies Act, 2013.

Under the Insolvency and Bankruptcy Code, 2016 employees are considered under the category of the operational creditors. Though section 230 of the Companies Act, 2013 does not mention anything about the compromise or arrangement with the employees since the pending compensation of the employees is liability of the Company BTL has also proposed the arrangement with its employees.

SEBI ICDR does not contain any provision about valuation of shares for the conversion of loan into shares. BTL has taken the report from the registered valuer for the purpose of deciding value of shares proposed to be issued.

At the NCLT level, BTL may not face many difficulties in getting the approval of the scheme since the secured creditors will have to provide their consent to the scheme as required under the provisions of SEBI Master Circular while getting an observation letter from the stock exchange.

Conclusion

BTL is trying to settle its borrowings outside the Insolvency and Bankruptcy Code with a defined timeline which may usher in averting further value erosion for stakeholders, especially minority shareholders. Through the scheme, it will also demerge its yet to start PCR business which, in our view is likely to followed by change of control in near future I.e., Acquisition by strategic or financial buyer. This transaction is in a way a variation of debt structuring of CG power Ltd where first strategic buyer was identified, and borrowers were settled as part of the same scheme. This will not only deleverage BTL but also lead to focus on its core commercial vehicle segment. In the process, BTL was part of Kesoram Industries Limited until 2018, will again hold an 18.37% equity stake in BTL. Only time will tell whether this restructuring can finally facilitate the required growth or prove to be a temporary breather.

Add comment