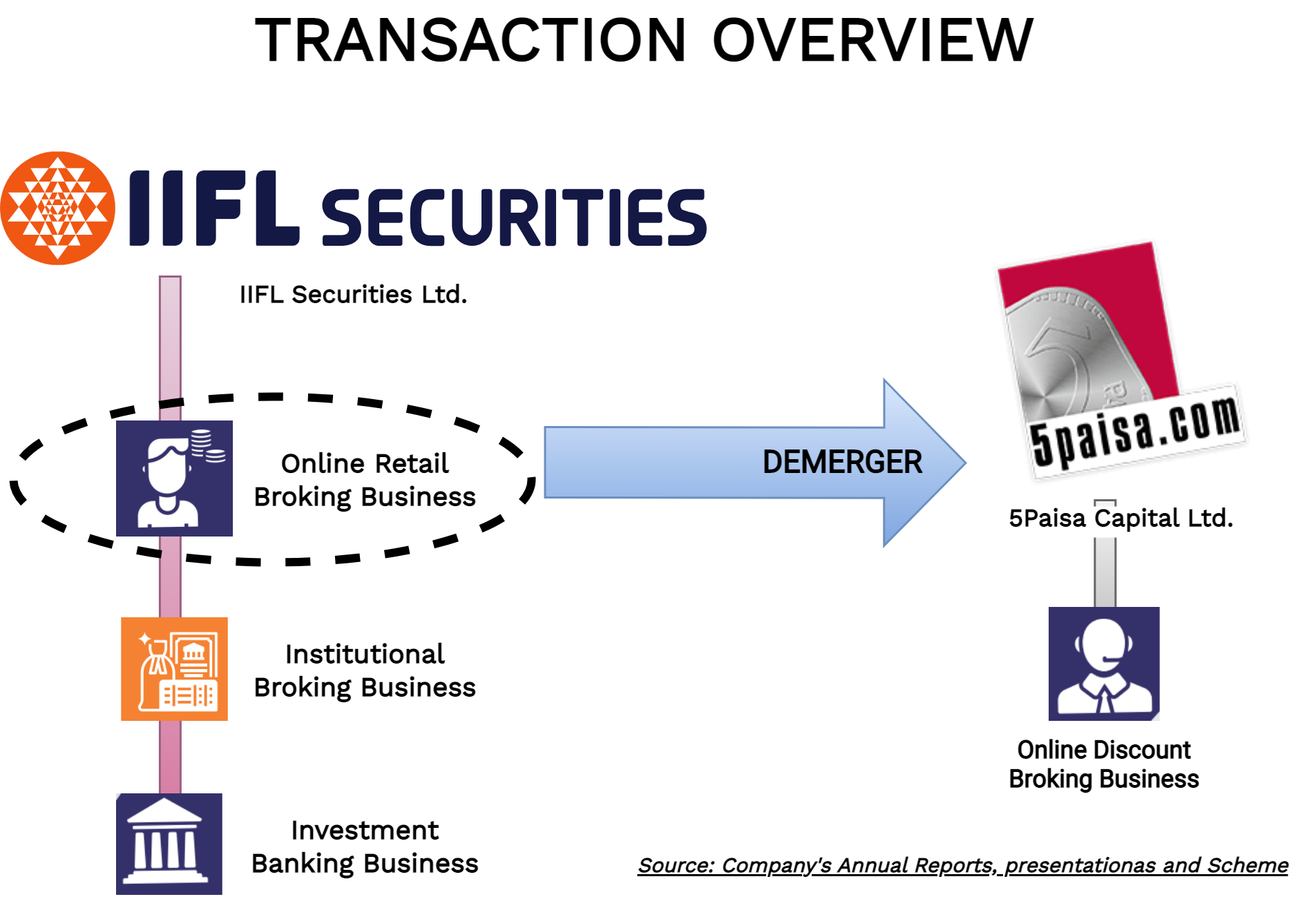

To facilitate growth & rapidly changing dynamics in “Discounted Broking Business,” in 2016, IIFL Group demerged its “Discount Broking” arm from the group’s listed holding company IIFL Holding Limited (Now IIFL Securities Limited) and listed it separately as 5paisa Capital Limited. Broking business catering to relatively higher financial asset customers continued to be with IIFL Holdings Limited. Over a period, the group went under multiple restructuring and change in business dynamics ushered in conflict of interest with its listed discount broking company.

IIFL Securities Limited (“Demerged Company” or “IIFL”) is one of the leading players in the financial services sector offering equity, currency and commodity broking, depository participant services, merchant banking and distribution of financial products. The Demerged Company is a member of BSE Limited, the National Stock Exchange of India Limited, Multi Commodity Exchange of India Limited, National Commodity & Derivatives Exchange Limited and registered with National Securities Depository Limited and Central Depository Services Limited as depository participants. The equity shares of the Demerged Company are listed on BSE and NSE.

5paisa Capital Limited (“Resulting Company” or “5paisa”) is engaged in providing an online technology platform for trading in NSE, BSE and MCX through web-based trading terminal, mobile application and a state-of-the-art call and trade unit. The equity shares of the Resulting Company are listed on BSE and NSE.

Both companies are controlled by the same group. In 2016, 5paisa was separately listed on bourses pursuant to the demerger of 5paisa digital undertaking from IIFL Securities Limited (erstwhile IIFL Holdings Limited) into 5paisa.

In 2019, IIFL group collapsed its holding-subsidiary structure through mega restructuring which pawed the way for separate listing of its wealth, securities business.

The proposed transaction

The Board of Directors of both Companies (“the Board”) at its meeting held on December 6, 2022 has considered and approved the Scheme of Arrangement (“Scheme”) between IIFL and 5paisa which inter alia provides for the demerger, transfer and vesting of the Online Retail Trading Business of IIFL into 5paisa.

“Online Retail Trading Business” as defined under the Scheme means the Broking business predominantly involving retail individual investors undertaking trading and investment activities through online Broking platform including Do-It-Yourself (DIY) customers.

[rml_read_more]

The Appointed Date for the transaction is 1st April 2023.

As envisaged in the scheme, the proposed restructuring is expected, inter alia, to result in the following benefits:

(a) Mitigate the overlap, improve efficiencies, and sharpen focus;

(b) Facilitate focused management teams with conducive culture for respective businesses;

(c) Help the Companies achieve scale and strive for leadership in their focus growth areas;

(d) More efficient utilisation of capital for growth of the consolidated business in separate entities; and

(e) Investor can have superior visibility on performance prospects and strategy for their investment.

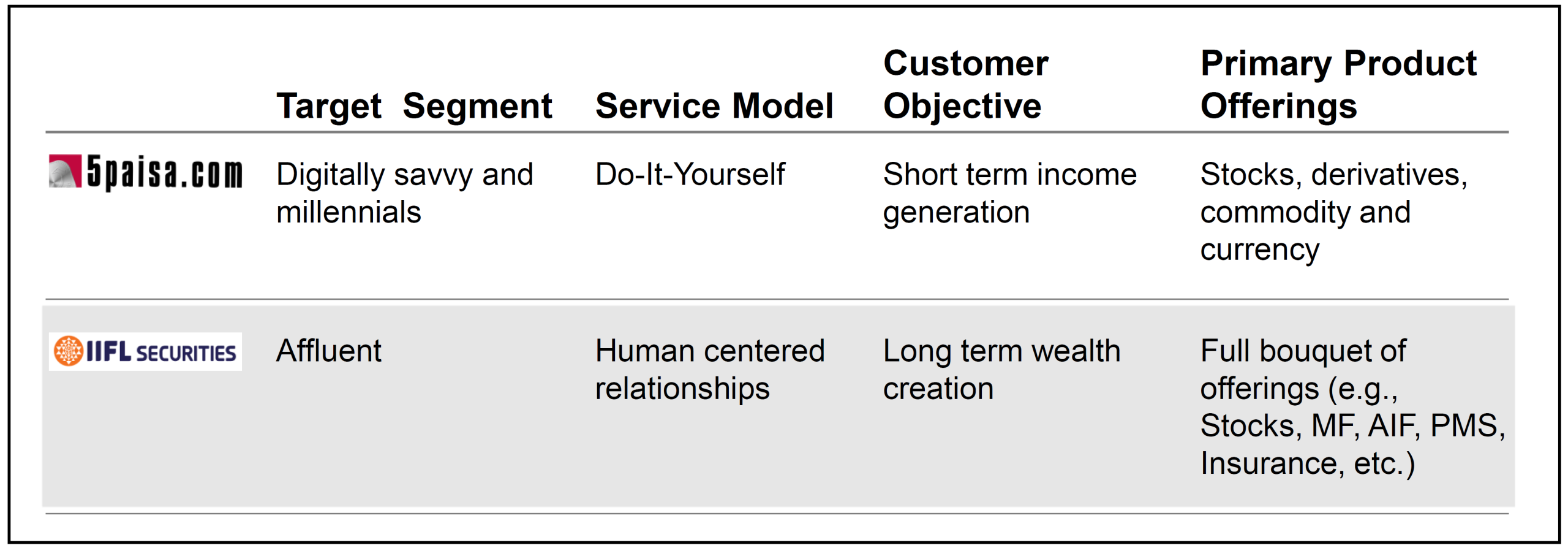

5paisa is servicing the early-stage customers whose assets size is typically lessor than 10 lakhs while IIFL securities is focused towards affluent category whose assets are above 10 lakhs requiring personalised services. With drastic changes happening in broking business, people irrespective of asset size preferring to digital services which is creating conflict of interest between broking services of 5paisa & IIFL.

Further, the acquisition will pave the way for increase of its existing customer base from existing 3.2 million to 4.7 million, an increase of circa 47%. Pursuant to this, the market share of 5paisa (based on number of customers) will increase to 4.5% from 3.2%.

Swap Ratio

The consideration for the demerger will be 1 (one) fully paid-up equity share of INR 10 (Indian Rupees Ten only) each of the Resulting Company, credited as fully paid up, for every 50 (fifty) equity shares of INR 2 (Indian Rupees Two only) each of the Demerged Company.

Capital Structure

| Particulars | IIFL | 5paisa (pre) | 5paisa (post demerger) |

| Paid-up number of shares | 30,43,53,007 | 3,06,25,568 | 3,67,12,629 |

| Face value | 2 | 10 | 10 |

| Promoters Stake | 31.26% | 32.69% | 32.45% |

There will be no change in the shareholding pattern of the IIFL. As promoters hold almost same % holding in both IIFL & 5paisa, post transaction, promoter holding will have nominal dilution. The paid-up capital of 5 paisa will be increased by circa 20%.

Financials

Financials of 5paisa

INR in Crore unless otherwise stated

| Particulars | 2019 | 2022 | H1-2023 |

| Revenue | 63 | 297 | 164 |

| Pat | -17 (Loss) | 14 | 18 |

| No. of Customers (in lakhs) | 1.9 | 27 | 32 |

| Revenue Per Customer | 3315 | 1100 | – |

The turnover of the demerged division i.e. Online Retail Trading Business of the Company as on March 31, 2022 was Rs. 5,175 Lacs. The turnover of Online Retail Trading Business was 4.50 % to the total turnover of the Company as on March 31, 2022. Revenue per Customer translates to circa INR 345.

Clearly, revenue per client is decreasing for broking arm and there is need to offer different value-added services to customers.

Tentative Valuation

As envisaged under the joint valuation report, the valuation of demerged undertaking has been carried out using Discounted Cash Flow method & Comparable Companies Multiple method. Based on 50% weightage to each method, the valuation of demerged undertaking has been ascertained as circa INR 283 crore.

Assigned Valuation

INR in Crore

| Particulars | IIFL-Demerged Undertaking | 5paisa |

| Assigned Valuation | 283 | 1421 |

| FY 2022 Revenue | 51.75 | 297 |

| No. of Customers (crores) | 0.15 | 0.32 |

| Revenue Multiple | 5.46 | 4.78 |

| Value assigned per Customer (₹) | 1887 | 4444 |

As revenue per customer is drastically lower for IIFL than 5paisa, value assigned per customer is lower. Further, the merged entity though will add customer base, the revenue per customer will come down. One may also need to consider the active client among total clients.

Conclusion

The proposed demerger is to avoid any potential conflict of interest between group’s two listed entities. No doubt, this will provide 5 paisa an opportunity to increase its overall client base however, one need to consider the active client addition & revenue per client of IIFL’s online trading business vs 5paisa.

With arrival of Zerodha & Upstox’s of the world, broking business has totally changed the way it used to operate. In the era of “Zero” brokerage charges; it becomes essential for broking companies to introduce value added services for survival. This move seems to be aligned with creation of value-added services in broking business. However, one may need to consider why the same was not demerged at time of 5piasa demerger in 2016.