Taking ahead the growing trend of consolidation in the financial sector a step further, Chennai-based Lakshmi Vilas Bank (LVB) will merge with Gurugram-based Indiabulls Housing Finance Ltd, one of the fastest growing mortgage lender, in an all share-swap deal. In the proposed deal, the shareholders of LVB will get 14 shares of Indiabulls Housing Finance Ltd (IBHFL) for every 100 equity shares held in the bank.

The deal implies a 36% premium to the closing price of LVB on April 5, 2019 and 63% premium to the bank’s last six months’ average price. The merged entity would have a net worth of Rs 19,472 crore and a loan book of Rs 1.23 lakh crore as of December 2008. Also, the entity’s capital adequacy ratio will be 20.6%. At present, IBHFL’s market capitalisation is 13 times that of LVB. The merger is expected to take 6 to 12 months as it would require regulatory approvals from RBI, National Housing Bank, CCI, SEBI and NCLT. The new entity would likely to be headed by Sameer Gehlaut, the current chairman of IBHFL He would be designated as vice-chairman. Parthasarathi Mukherjee, current MD of the bank will become the joint managing director.

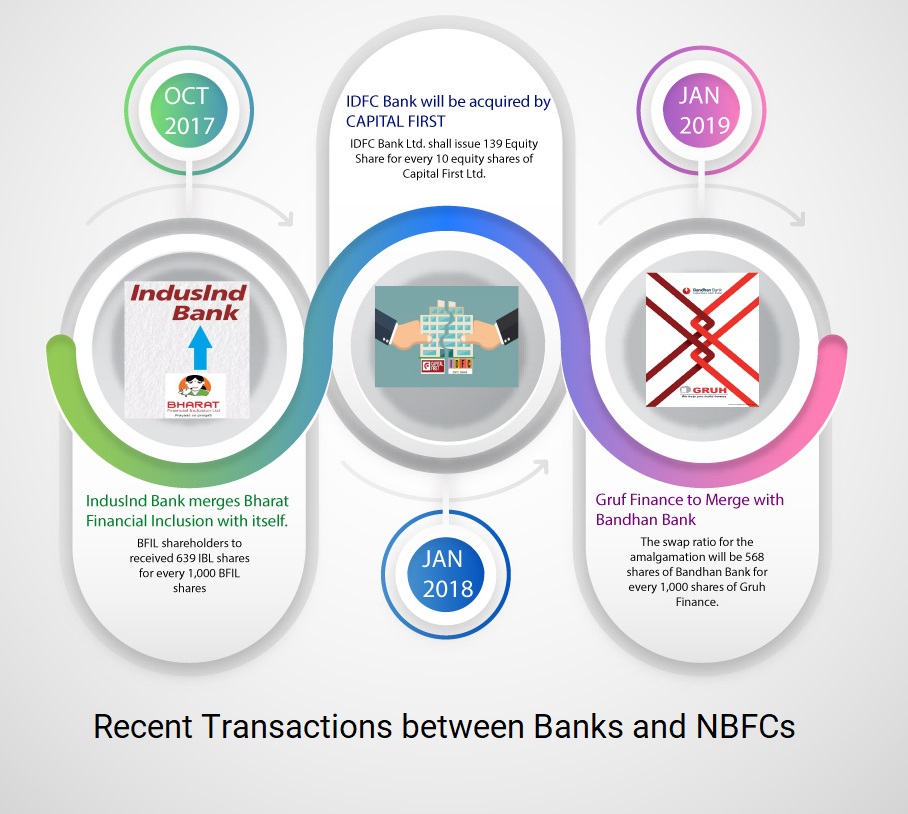

The merger comes at a time when non-banking finance companies (NBFCs), especially housing finance companies, are facing liquidity issues and slowdown in loan disbursement. The proposed deal will be the fourth consolidation between a bank and an NBFC in the last one-and-half year. In October 2017, IndusInd Bank had announced it would merge Bharat Financial Inclusion with itself. The deal is likely to be completed shortly. Also, in January last year, IDFC bank announced that it will acquire non-banking finance company Capital First. The final amalgamation was done in December last year. And three months ago Bandhan Bank announced merger of Gruh Finance (a housing finance company) with itself. The deal has now received regulatory approval from Reserve Bank of India (RBI). Also, on a slightly different note, the three state-owned banks – Bank of Baroda, Vijaya Bank and Dena Bank – completed their merger this month.

Win-win for both

The merger will be a win-win deal for both IBHFL and LVB. In fact, IBHFL, which is a 20-year old company, will get access to banking platform and provide longevity to its lending business on a consistent basis. The merger will bring access to the bank’s low-cost deposit franchise for IBHFL, which has till now resorted to wholesale finance to fund lending operations. In fact, after the volatility in the bond market after the IL&FS fiasco ensuing liquidity crisis in September has put pressure on wholesale funding from the bond market and NBFCs are finding it tough to raise funds for lending. So, the merger will help IBHFL to raise cheap funds through the banking channel.

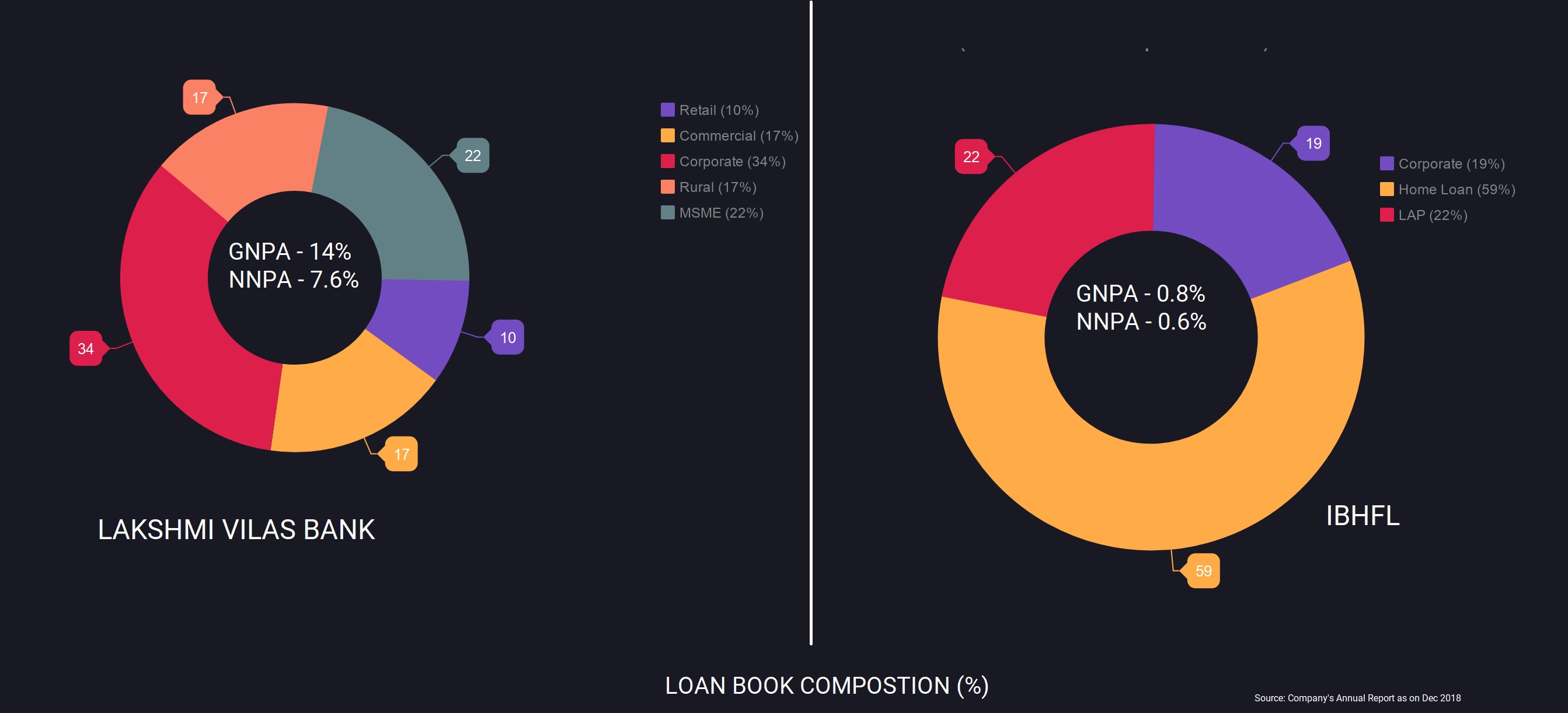

As a bank, IBHFL will have access to cheaper funds through current account-savings account (CASA). Though LVB has been in operations for nine decades, it has struggled to make a mark in the growing banking industry, lost market share and has been constrained for capital. The bank has been in a financial crisis because of mounting non-performing loans and the central bank has put two nominees on its board for close supervision. To be sure, LVB will benefit from the efficiency of IBHFL, which operates on a low cost-to-income ratio of only 12.7% (FY18) backed by strong technology backbone.

Stronger reach

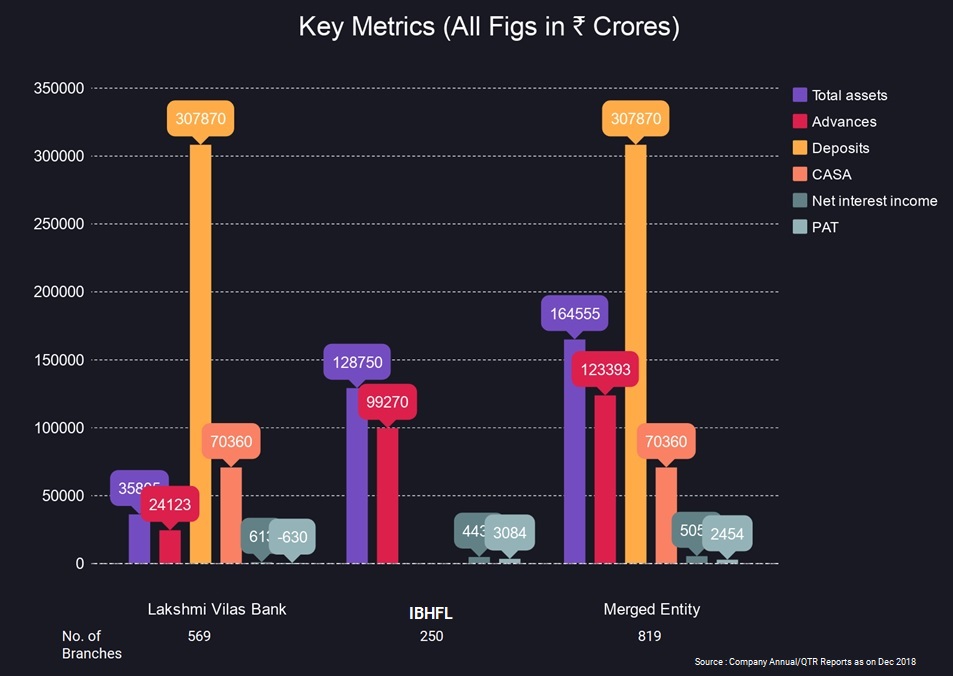

The merged entity will have a stronger reach as IBHFL has a strong presence in the northern and western parts of the country and LVB has a strong presence in south India. As of December 2018, LVB had 569 branches and IBHFL had 250 branches. In fact, IBHFL is getting a banking platform with Rs 30,700 crore of deposits (Rs 7,000 crore of CASA) and 2.2 million depositors. The merged entity can cross-sell products to increase fee income and LVB’s shorter tenor loans coupled with IBHFL’s longer maturity book will ensure optimisation of asset liability management. The diversified loan book will also lead to evenly distributed risk profile. The amalgamated entity will have around 14,000 employees.

The gross non-performing assets (NPA) of LVB is Rs 3,377 crore (as of December 2018) or 14% gross advances. Around 20% of LVB’s NPLs are contributed by five accounts and IBHFL has a great track record of recovering loans. So, one can expect IBHFL to recover some of the bad loans of LMB. Also, IBHFL has the experience of floating a bank in London called OakNorth which has been scaled up well and demonstrated successful execution. It largely does SME lending and Indiabulls has two nominees on the board that advised OakNorth in SME financing.

High liquidity maintained by IBHFL, which was Rs 27,512 crore as on March 31, 2019, will easily meet the Statutory Liquidity Ratio (SLR) and Cash Reserve Ratio (CRR) requirements of the regulator immediately on completion of the merger. However, for IBHFL, the challenge would be to clean the books of LVB, which would mean taking a hit on its profits.

Regulatory issues

The RBI will look at various ‘fit and proper’ criteria of the new management and new shareholders before taking any decision. In fact, the central bank in April 2016 had laid out new guidelines for banking licences which are on tap, implying that applicants are free to approach the regulator at any point of time. In fact, if the central bank approves this merger, then many other NBFCs would take a similar route to acquire weak private sector bank to get a banking licence. This would make old generation private sector banks attractive opportunities.

As a matter of fact, there could be one regulatory hurdle in the IBHFL-LVB merger. The central bank’s regulations require that a group to be a promoter of a bank must not have more than 40% of its income from non-financial businesses. The regulator’s worry is that promoter entity should not use depositors’ money to give cheap loans to clients of other business. Though Indiabulls’ real estate business does not account for more than 20% of the group’s total revenue, the group’s chairman, Sameer Gehlaut has indicated that he is willing to give up real estate business for financial services.

Table 1: Capital Adequacy Ratio (%)

| IBHFL | LVB | Merged entity | Regulatory requirement | |

| Capital Adequacy Ratio | 23.1 | 7.7 | 20.6 | 10.88 |

| Tier 1 | 16.1 | 5.6 | 14.4 | 8.88 |

Indiabulls may exit real estate business

Currently, the promoters’ stake in Indiabulls Real Estate is around 37% (in FY18) and real estate business accounts for about 10% of the group’s total profit. In fact, according to an investor’s presentation, around 88.5% of the total assets and 81.2% of gross income are from financial services business. Though that is well within the regulatory limit, the group’s chairman, Sameer Gehlaut has indicated after the merger announcement that he is willing to give up real estate business for financial services in case the central bank is not comfortable with a bank owner having realty business under its wings.

As the promoters of Indiabulls are very keen on a banking license and pursue financial services, they may exit the real estate business to avoid any regulatory hurdle in getting the banking license. Also, in the last few years, Indiabulls’ real estate business is shrinking and promoters’ heart and passion now lies only in financial services. So, in a nutshell, distancing the group from real estate business is expected to improve the chances of obtaining regulatory approval for the proposed merger with LVB.

About Indiabulls Group

Indiabulls Group is one of the country’s leading business houses with interests in housing finance, real estate, securities, construction equipment leasing and facilities sector. The group had combined revenues of over Rs 22,115 crore and profit (PAT) of over Rs 6,072 crore as on March 31, 2018. All the group companies are listed on the Bombay Stock Exchange, and the National Stock Exchange. The combined market capitalization of these companies for FY18 was Rs 75,838 crore.

IBHFL is the fourth largest housing finance company in the country with assets under management of Rs 1.24 billion. The company was established as a wholly-owned subsidiary of Indiabulls Financial Services, a leading non-banking financial company providing home loans, commercial vehicle loans and business loans that was established in 2000. The company offers a broad suite of lending and other financial products to target client base of middle and upper-middle class individuals and small and medium sized enterprises.

About LVB

The bank was set up in 1926 by a group of seven businessmen of Karur (in Tamil Nadu) under the leadership of V.S.N. Ramalinga Chettiar. The objective was to cater to the needs of people in Karur who were occupied in trading businesses, industry and agriculture. The bank was incorporated on November 3, 1926 under the Indian Companies Act, 1913, and obtained the certificate to commence business on November 10, 1926. Subsequent to introduction of the Banking Regulations Act, 1949 and Reserve Bank of India as the regulator for the banking sector, the bank obtained its banking license from RBI on June 19, 1958, and on August 11, 1958 became a scheduled commercial bank. In 2014, the corporate office was shifted to Chennai.

The bank expanded branch network beyond Tamil Nadu to neighboring states such as Andhra Pradesh, Karnataka and Kerala and gradually to more important financial centres such as Mumbai, New Delhi and Kolkata as well as in other significant business centres in Maharashtra, Gujarat and Madhya Pradesh. Implementation of Core Banking Solution (CBS) was started in October 2006, and all of the bank’s branches were migrated to CBS by March 2008. The bank’s gross advances as on December 31, 2018 was Rs 24,123 crore and total deposits Rs 30,787 crore.

Conclusion

Questions have been raised as to how a company with high exposure to a speculative sector like real estate can own a bank. The central bank will now have to be prepared to deal with questions this particular deal will throw up and likely interest from other corporate groups which always had intentions of owning a bank. The merger of Bank into NBFC has its own compliance challenges

The proposed merger is likely to face some challenges like handling technology synchronisation and employee management. Also, any slowdown in the real estate sector will adversely hit growth and earnings and push up default rates. Any adverse regulatory changes like increase in risk weights, cap on the interest spread under refinance schemes can impact IBHFL’s growth and profitability.

Given all the risks associated with the deal, if the synergies work out well, it may improve visibility of IBHFL’s long-term growth trajectory. Given the company’s good track record of managing loans and good recovery, the banking platform can bring synergies in the medium to long-term.

Add comment