Increasing use of Hydrogen Peroxide in versatile applications like pulp and paper industry, textile, water treatment, and its usage in the food and beverage industry is triggering the product’s overall demand. The growing public awareness has compelled most paper manufacturers to invest heavily in greener technologies which are to be used in the paper manufacturing process where Hydrogen Peroxide finds its use.

Overview of the companies:

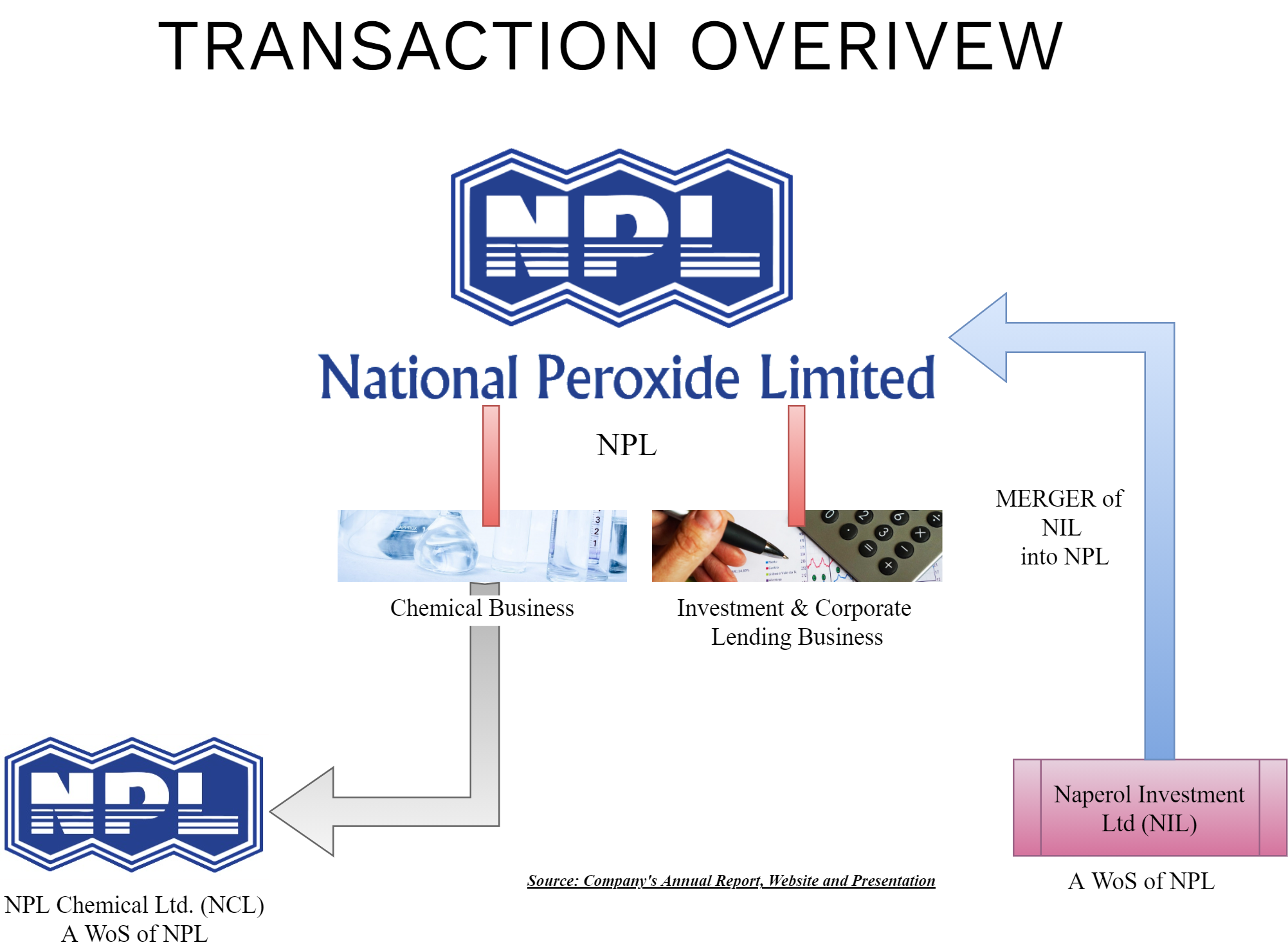

National Peroxide Limited (NPL) is a listed company and engaged in the business of

- Manufacturing of peroxygen chemicals and

- Making long term investments and corporate lending directly and/or through Wholly owned subsidiary Naperol Investment Limited (NIL).

NPL is a leader in the hydrogen peroxide market in India and is one of the pioneers in producing Peroxygen chemicals. The company is promoted by the Wadia group and holds investments in group companies like Bombay Dyeing & Manufacturing Company Limited and Bombay Burmah Trading Corporation Limited.

NPL Chemical Limited (NCL) is a public company and engaged in the business of manufacturing, distributing, and selling peroxygen chemicals. It is a Wholly Owned Subsidiary of NPL and incorporated for the purpose of executing the proposed transaction.

Naperol Investment Limited (NIL) is an RBI registered NBFC and engaged in the business of long-term investment, and corporate lending. It is a wholly-owned subsidiary of NPL. It holds 0.20% shares of Bombay Dyeing & Mfg. Co. Ltd. and 6.13% of Bombay Burmah Trading Corp. Limited.

The Transaction:

The Board of directors in their meeting held in March 2021 approved a composited scheme of Arrangement which will result in:

- Demerger of ‘Chemical Business’ of NPL into NCL and

- Merger of NIL with NPL.

Appointed Date for the transaction is the opening of business hours of 1st October 2020.

Shareholding Pattern:

The shareholding pattern of NCL is a mirror image of NPL. As the consideration for swap ratio for demerger is 1:1. Further, there is no change in the shareholding pattern of NPL pre and post-restructuring.

Rational of the scheme:

As envisaged by the management, some of the rationales for the arrangement are:

- Separation of distinct businesses having different risk & reward

- To invite strategic investor/partner for a particular business.

- Consolidation of investment activities at NPL

Change of Name of companies:

The Scheme also provides for the name of National Peroxide Limited will be changed to Naperol Investment Limited and the name of NPL Chemical Limited will be changed to National Peroxide Limited.

Accounting treatment:

The companies involved in the transaction are account for this transaction as per Ind AS- 103: Business Combination.

Taxation:

The transaction is a tax neutral transaction as per section 2(19AA) and 2(1B) read with Section 47(vib) and 47(vi) of the Income Tax Act 1961.

Why Appointed Date as on 1st October 2020?

If one sees six monthly results for FY 2021(September 2020), the company has PBT of Rs 44 million (excluding other income of circa Rs 60 million) from chemical business. However, in Q4FY21, the company had huge, extraordinary losses of circa Rs 155 million virtually wiping out the whole of the PBT for the second half of FY 21. And if one considers other income of Rs circa 68 million, then the chemical business has loss of equivalent amount. As a result, by selecting 1st October 2020 as the date, more loan gets transferred and write off in the second half will impact the balance sheet of the new company leaving more net funds for remaining investment activities. The company wrote of old assets amounting to 96 million and written off revenue and capital losses arising (including after the balance date) of Rs circa 58 million due to plant shutdown.

Merger of Remaining entity with Bombay Burmah Trading Corporation Limited:

After the proposed restructuring, NPL will remain as a pure holding company having investments in Bombay Burmah Trading Corporation Limited and Bombay Dyeing & Mfg. Co. Ltd which in turns are also holding companies (to an extent). Instead of having multiple holding companies, management may decide to merge the remaining NPL with Bombay Burmah Trading Corporation Limited. The probable reason for keeping separate entities could be a reduction in promoter’s voting rights in group operating companies. (The beneficial ownership will continue to remain the same) as the stake held by NPL & NIL in Bombay Burmah Trading Corporation Limited will get cancelled in the process of merger.

Financial & Valuation:

Though the revenue from chemical business has been volatile, it has enormous potential to grow in the coming future. After the arrangement, as NCL will operate as a pure chemical company & future potential of the business, it may capture valuations attributable to a pure chemical company vis-à-vis NPL will continue to have a holding company discount.

Conclusion:

The decision of separation of core chemical business from investments in group companies may have multiple dimensions. The decision could be a part of succession planning at Wadia group, or the move is aligned towards inviting a partner or complete exit from the chemical business. By selecting 1st October 2020 as the Appointed Date, the management retained more net assets with investment activities as an exceptional write off will impact net worth of the new chemical company to be listed. As the group has multiple holding companies and has cross-holding, it may decide to consolidate all the holding companies at future date.

Does it mean that National Peroxide is getting disconnected with the chemical business, or just disconnecting with the Wadia group. Will it not give a negative impact on the shareholders of NPL.