Demergers, which are expected to unlock shareholder value, have not worked in favour of shareholders of Omkar Speciality Chemicals and Lasa Supergenerics.

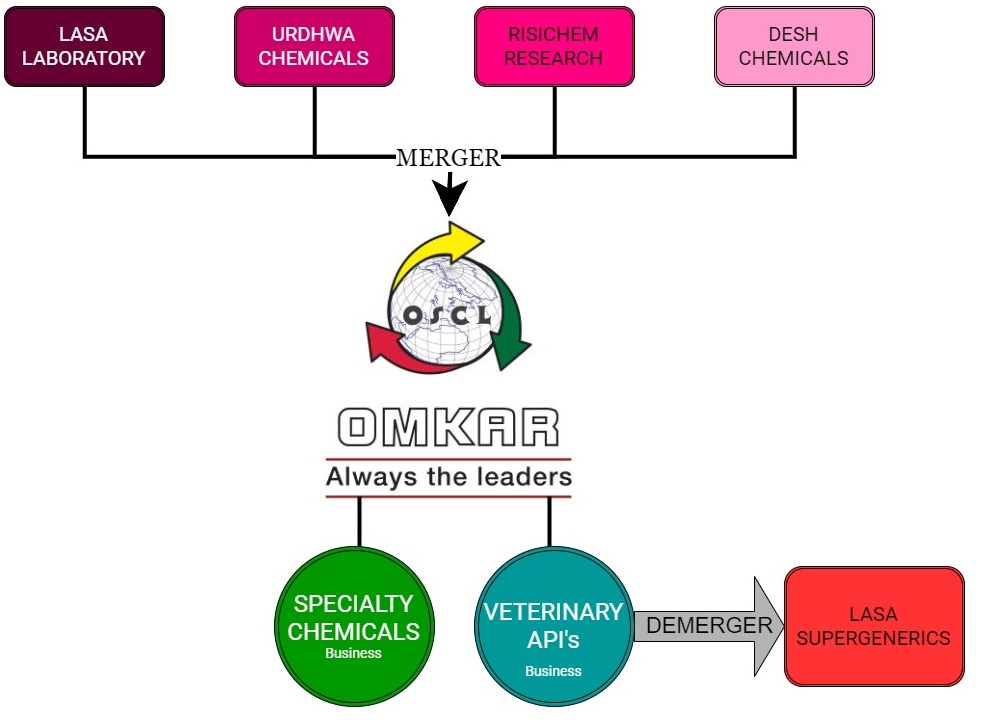

Omkar Speciality Chemicals Limited (Omkar Chemical) incorporated in 2005, is in the business of speciality chemicals & active pharmaceutical ingredient (API). The business was carried out by Omkar Chemical on its own and through its 4 subsidiary companies. API business was carried out in the company’s subsidiary Lasa Laboratory Pvt Ltd (Lasa Lab).

In 2015, director of Omkar Chemical has approved the scheme of arrangement under which all subsidiary companies will be merged into Omkar Chemical and demerger of its API business to “Lasa Super generic Ltd” (a company incorporated by Omkar chemical for the purpose of demerger of API division) with the appointed date being 01/04/2015. The scheme was approved by NCLT in April 2017.

Post demerger, Omkar chemical and Lasa Supergenre business collapsed and both the company facing liquidity challenges as well as potential Insolvency process threat. In this article, we analyzed the company’s financials from Mar-12 onward to understand what went wrong which lead to the current situation.

Transaction in 2015

Financial Analysis: Omkar Chemical

Table 1: Total Borrowings & Interest Cost (All Figs in INR Crores)

| Particular | Mar-12 | Mar-13 | Mar-14 | Mar-15 | Mar-16 | Mar- 17(3) | Mar-18 | Mar-19 |

| Banks | 77.72 | 149.44 | 204.53 | 214.74 | 221.42 | 129.69 | 170.74 | 169.66 |

| FI’s | 21.33 | 0.69 | 1.75 | 9.22 | 6.54 | 28.52 | 2.97 | 2.95 |

| Sub-Total (A) | 99.05 | 150.12 | 206.28 | 223.95 | 227.96 | 158.21 | 173.71 | 172.61 |

| Loan from Related Parties / Directors (B) | 0.20 | 0.71 | 0.19 | 0.00 | 0.09 | 60.14 | 59.00 | 56.89 |

| Total (A -B) | 99.25 | 150.84 | 206.47 | 223.95 | 228.05 | 218.35 | 232.72 | 229.50 |

| Interest Exp(5) (incl. capitalised portion) | 7.56 | 10.78 | 15.86 | 21.15 | 27.38 | 22.73 | 24.07 | 14.53 |

| Other borrowing cost | 0.46 | 0.07 | 0.72 | 1.59 | 1.52 | 0.81 | 2.06 | 0.09 |

| Foreign currency Adj. | 0.42 | 0.00 | 0.53 | -0.08 | 0.00 | 0.00 | ||

| Total Interest cost | 8.45 | 10.85 | 17.11 | 22.66 | 28.90 | 23.54 | 26.13 | 25.71 |

| Average Borrowings* | 99.05 | 124.58 | 178.20 | 215.12 | 225.95 | 193.08 | 165.96 | 173.16 |

| Avg. Int Rate | 8.53% | 8.71% | 9.60% | 10.53% | 12.79% | 12.19% | 15.74% | 14.85% |

*excluding related party loan & closing balance for Mar-12 is considered as average borrowings for Mar-12

- Borrowings and interest rates to services the loan have kept on increasing continuously from Rs. 99 crs (8.53%) in March-2012 to Rs 229.5 crs (14.85%) in March-2019.

- In earlier years company was having ECB’s loan and later switched to domestic borrowing at a higher rate due to increase in foreign exchange.

- There was a merger of subsidiary companies with Omkar and demerger of API division which was approved by the NCLT in April-17 and impact in financial was given in Mar-17, hence bank loan reduced from 221.42 crs to Rs. 129.69 crs in Mar-17, on account of transfer to API division.

- Amount of loan reflecting in the Lasa Supergenres Ltd (API Division) as on Mar-17 is Rs. 119.75 crs

- Loan from directors / related party does not carry any interest (as per Annual Report)

As on Mar-19, Omkar chemical has classified as NPA by all three banks, and total default (principal & interest) is Rs. 199 crs (approx.) as mentioned in the auditor’s report.

Table 2: Assets & WIP Summary (All Figs in INR Crores)

| Particulars | Mar-12 | Mar-13 | Mar-14 | Mar-15 | Mar-16 | Mar-17* | Mar-18** | Mar-19 |

| Tangible Assets | 36.57 | 87.53 | 86.52 | 144.75 | 154.46 | 168.35 | 75.98 | 68.17 |

| Total Intangible Assets | 3.01 | 4.90 | 4.61 | 4.41 | 6.37 | 0.12 | 0.16 | 0.12 |

| Capital Work in Progress | 59.52 | 44.32 | 96.44 | 121.57 | 148.72 | – | – | – |

| Total Assets | 99.09 | 136.76 | 187.57 | 270.72 | 309.55 | 168.47 | 76.14 | 68.29 |

| Operational Revenue | 166.95 | 211.69 | 240.28 | 265.13 | 413.41 | 345.02 | 197.64 | 42.65 |

| Tangible & Intangible Assets (excluding CWIP) | 39.40 | 92.36 | 90.99 | 149.15 | 160.66 | 168.47 | 76.14 | 68.29 |

| Asset Turnover Ratio | 4.24 | 2.29 | 2.64 | 1.78 | 2.57 | 2.05 | 2.60 | 0.62 |

*It is a consolidated figure of omkar chemical excluding API division as per IGAAP

**Omkar chemical figures are considering the impact of Ind-AS

- Ind-AS adjustment effect: In Mar-18, there is an Ind-AS adjustment of Rs. 85 crores.

- Capacity Utilisation: Company keeps on spending for expansion of its fixed assets, whereas its utilised capacity was around 70% -80% (API division was having around 90%), Omkar chemical’s utilised capacity reduced to 60% and then to 21%. in last two years.

- Write off / Impairment Loss: In Mar-17 company has written off capital work in progress (CWIP) to the tune of Rs. 176 crs (though in Mar-17 balance sheet CWIP deletion was Rs. 201 crs which included transfer to API division on demerger) & in Mar-18 there was an addition of Rs. 55 crs in CWIP and subsequently booked as an impairment loss in the same year itself.

- Transfer on account of Demerger: Mar-17 financial include impact of merger/demerger, in fixed assets schedule it was shown that Rs. 29 crs is transferred to Lasa Supergenre Ltd on account of merger/demerger, whereas as per the Lasa Supergenre balance sheet (Mar-17) book value of fixed asset transferred is Rs. 131 crs (including CWIP of Rs. 22.8 crs).

Table 3: Cash Flows of Omkar Chemical (All Figs in INR Crores)

| Particulars | Mar-12 | Mar-13 | Mar-14 | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

| Operating Activities | 10.25 | -8.72 | 29.13 | 80.84 | 67.26 | 54.80 | 25.96 | 1.38 |

| Investing activities | -62.62 | -42.03 | -60.57 | -93.75 | -46.21 | -62.99 | -64.33 | 10.90 |

| Financing Activities | 43.26 | 42.64 | 26.22 | 10.24 | -26.16 | 13.07 | 35.24 | -13.55 |

| Net Cash flow during the year | -9.10 | -8.11 | -5.23 | -2.67 | -5.12 | 4.89 | -3.13 | -1.28 |

| Closing Cash | 32.58 | 24.04 | 18.44 | 15.54 | 10.29 | 10.58 | 1.35 | 0.07 |

Note: Mar-17 figures are excluding API division business, hence closing balance of Mar-17 not in comparison with Mar-16

- As seen from the above table, Omkar chemical was never able to generate cash flow from the business in last 8 yrs. (except for year ending in Mar-17)

- Company keeps on investing in its fixed assets, but same never able to generate cash flow for the business

- In the Year Mar-17, there was a business reorganisation, subsidiaries companies merged into omkar chemical and API division demerged from the company

- Further company keeps on borrowing year on year, and borrowing (long term & short term) are mainly used for investment in assets

- By the end of the Mar-19, company burned up its entire cash and defaulted in its all bank loans repayment, accounts were classified as NPA by all the banks.

Merger/demerger impact and revaluation of Fixed Assets

A scheme of arrangement for merger of subsidiary companies of Omkar Chemical with Omkar chemical and demerger of API division business to a new company Lasa Super generic Ltd was approved by NCLT in April 2017 with an appointed date of 01/04/2015. The impact of merger/demerger was recorded in the financial statement year ended in Mar-17.

- The difference between the fair value and book value of Assets transferred to resulting company amounting to 63.21 crs (exceptional item loss)

- The difference of 76.11 crs, i.e. the values of liabilities over assets, has been debited to the Share Premium Account.

- API division undertaking was having total assets of Rs. 202.9 crs (includes Fixed Assets -Rs. 128 crs, Inventory -Rs. 34 crs and Receivables Rs. 18 crs), total outside liabilities were Rs. 126 crs (which includes Rs. 91 crs borrowings, trade payable Rs. 31 crs)

- Lasa Super generic Ltd in its book recorded Rs. 26.19 crores exceptional item loss on account of difference between the fair value and book value of Assets.

Receivables/Payables cycle & Inventory

Table 4: Receivables, Payables & Inventory Holding

| Particulars | Mar-12 | Mar-13 | Mar-14 | Mar-15 | Mar-16 | Mar-17 | Mar-18 | Mar-19 |

| Debtors Turnover Ratio | 4.32 | 4.04 | 3.00 | 3.10 | 3.99 | 2.95 | 3.47 | 4.49 |

| Creditors Turnover Ratio | 4.58 | 4.55 | 3.95 | 3.15 | 3.64 | 2.52 | 3.9 | 1.48 |

| Inventory Turnover ratio | 3.17 | 3.38 | 3.06 | 3.06 | 4.38 | 3.99 | 5.1 | 11.81 |

| Receivables (Days) | 84 | 90 | 122 | 118 | 91 | 124 | 105 | 81 |

| Payables (Days) | 77 | 92 | 122 | 140 | 181 | 138 | 200 | 282 |

| Inventory Holding Period | 115 | 108 | 119 | 119 | 83 | 92 | 72 | 31 |

- From the above table it is clear that, the company has a very high debtors collection period, and it took on an average of 80-120 days for realisation.

- The company had on an average 120 days inventory holding period up-to Mar-15 and post that 80-70 days (not considering Mar-19, due to negligible sales and inventory holding)

- The existing software used for inventory records is not satisfactory, auditor’s qualification in Mar-18 Audit report.

- In Mar-18, the Company has recorded inventory obsolescence to the extent of Rs. 40.00 crs due to the inferior quality of the material received from the vendors and non-moving /slow-moving inventory to the extent of Rs. Rs. 4.00 crs due to change in product mix. This was on account of discontinuing of some of our products which were of commodity nature.

Impairment/Write-off of assets due to demerge

Table 5: Write-off of Assets & Booking of Exceptional Losses (All Figs in INR Crores)

| Year | Omkar Chemical | Lasa Super Generics | Total | ||

| Fixed Assets | Inventory | Exceptional loss* | Exceptional loss* / ** | ||

| Mar-17 | 176.32 | – | 63.21 | 30.61 | 270.15 |

| Mar-18 | 52.59 | 44 | – | – | 96.59 |

| Total | 228.91 | 44.00 | 63.21 | 30.61 | 366.73 |

*Exception loss consist of difference b/w fair value & book value

**Lasa Super generic exceptional loss consists Rs. 4.4 crs loss on account of impact of profit and loss account after reinstatement of financial in terms of the scheme of arrangement

- Impact of demerger is recorded in the books for Mar-17 financials. Omkar chemical has written off CWIP to the tune of Rs. 228 crs in Mar-17 & in Mar-18.

- Overall in just two years, it shows that Omkar chemical and Lasa Super Generic has written off / booked exceptional losses to the tune of 366 crs, which is a major dent in the financial.

- Since money has already been invested in the CWIP and writing of CWIP in totality raising a question about the company intentions regarding capitalisation and mis-utilisation of funds.

How promoters raised the funds:

From time to time company has raised the funds from various banks for both long term and working capital purpose, but from Mar-18 & Mar-19 company has defaulted in re-payment of bank loans and Omkar chemical accounts had been declared as NPA by the banks.

- Borrowed funds from the bank in form of term loans & demand loans (working capital loan)

- Loans from bankers are secured by way of charges on fixed asset & stock and debts.

- Further company has raised money from the related party to the tune of Rs. 113 crs (60 crs in Omkar Chemical and Rs. 53 crs in Lasa Super generics), as reflecting in Mar-17 financials.

- Promoters have also pledged their shareholding to a great extent to raise the personal loans.

Table 6: %Shares Pledged by Promoters

| Particulars | Mar-16 | Mar-17* | Mar-18 | Mar-19 | Sep-19 |

| % Pledged to total share held | 36.37% | 24.89% | 58.40% | 59.00% | 76.94% |

*decrease on account of sale of shares by the promoters

Note: Above shares are just promoter group holding and not the entire share capital of the company

DEAL IMPACT

- As can be seen from the cash flow statement, Company keeps on investing in its fixed assets year on year, but was unable to generate free cash flow in any year (Except in Mar-17)

- It continued to raise funds by way of loan and as QIP

- Most of the investment in the fixed assets were lying in the Capital work in progress (almost 50% of the total fixed assets). Such CWIP was not able to generate any revenue for the company and Asset Turnover ratio of the company was hovering around 2 to 2.5.

- By Mar-17, the company had around 203 crs in the CWIP, out of which Rs. 176 crs were written off during the year, remaining was transferred to API division through demerger. Further company has also written off Rs. 44 crs inventory on account of obsolescence in Mar-18. Total write off and exceptional losses booked by the company in two years i.e. Mar-17 & Mar-18 is around Rs. 366 crs.

- The company borrowed funds from bankers & financial Institutions and from the related party (interest-free) to finance its capitalisation and working capital. Picked borrowing of the company reached at Rs. 346 crs (Omkar Chemical – Rs. 218 crs & Lasa Super generics -Rs. 129 crs) out of which loan from the related party is around Rs. 113 crs.

- As on Mar-19, the company has defaulted in repayment of loan of bankers in both the companies and accounts have been classified as NPA in Omkar chemical.

- Further Omkar chemical sales have doomed and as on Mar-19 was merely Rs. 45 crs, it will be quite difficult at this stage to repay its borrowings and fund working capital unless a restructuring of debt and increase in order book, else insolvency process will be the last option which bank will not hesitate to put company into for recovery of their dues.

It is clear, that there was a systemic failure in capital allocations, write off and adjustments not supported by logical and commercial reasons. Not only that but accounting policies and provisions of various laws somehow camouflage such losses without recording through profit and loss account. It is not clear whether this was a commercial failure, family settlement or just use of restructuring exercise and approvals of those restructuring under various provisions to hide negligence and /or diversion on part of the management.

As it stands the merger-demerger transaction hasn’t been able to unlock any value to any of the stakeholders of Omkar Chemicals or Lasa Supergenerics.

Add comment