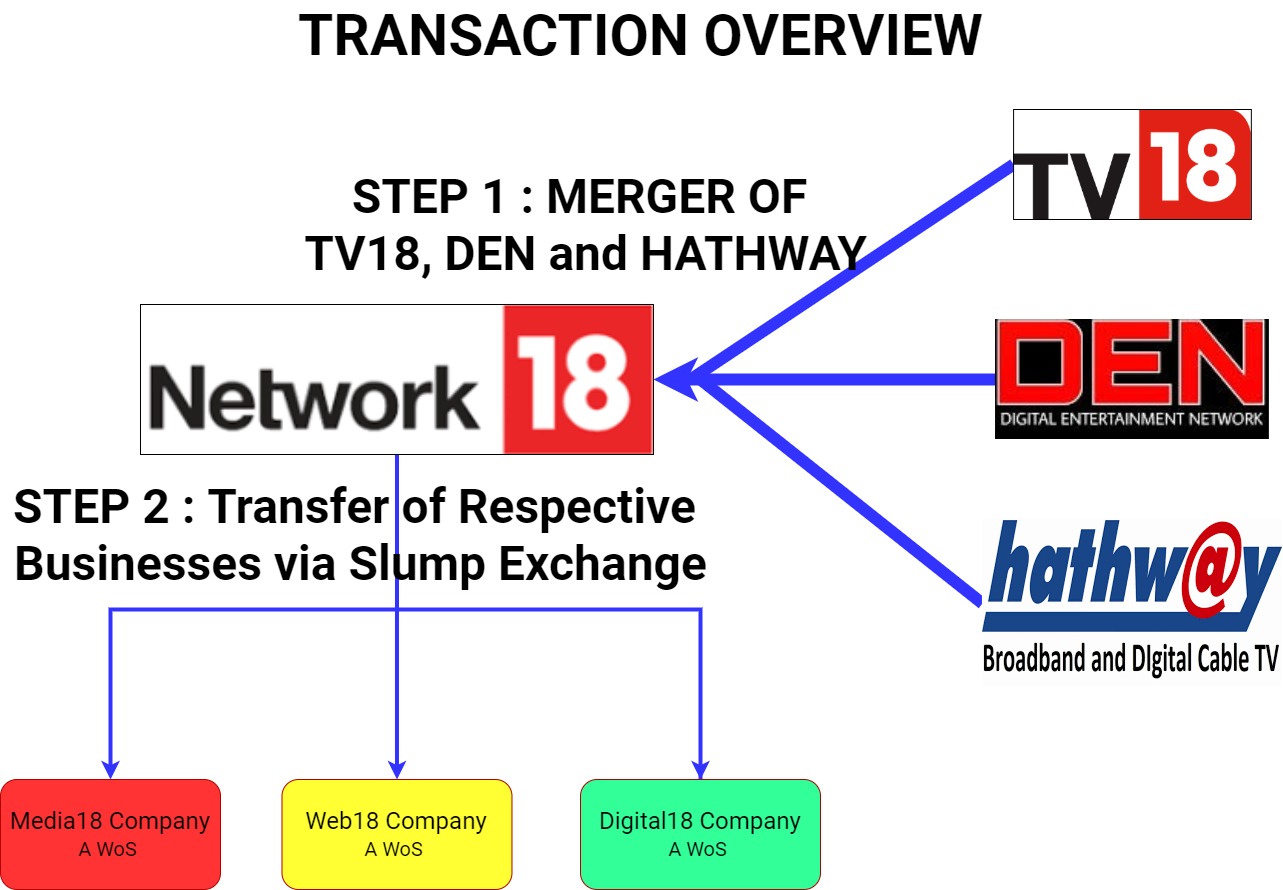

In a move to consolidate its media and distribution business spread across multiple entities and reduce the number of listed entities, Reliance Industries Limited (RIL) has announced Scheme of Arrangement (Scheme) whereby, TV18 Broadcast Limited, Hathway Cable & Datacom Limited and Den Network Limited will get merged (Amalgamation) into Network18 Media & Investment Limited.

Further, immediately after the Amalgamation, as a part of the same Scheme, the cable business undertaking, the ISP Business Undertaking and the Digital Business Undertaking of the amalgamated Network18 Media & Investment Limited will be transferred to the Wholly-Owned Subsidiaries (“WoS”) of the Network18 Media & Investment Limited.

Network18 Media & Investments Limited (Network18) has presence in several media and entertainment businesses directly and through its subsidiaries like general news channels in Hindi, English and other regional languages, business news channels in Hindi, English and Gujarati, general entertainment channels in Hindi, English and other regional languages, factual entertainment channels, business of printing and publishing magazines, digital business, content creation and production business. The equity shares of the company are listed on the BSE and the NSE.

Den Networks Limited (Den) is engaged in the business of (i) providing cable television services as multisystem operators; and (ii) broadband services through wholly-owned subsidiary. The equity shares of Den are listed on the BSE and the NSE.

Hathway Cable and Datacom Limited (Hathway) is in the business of (i) wired broadband services; (ii) cable television services through its subsidiaries and joint ventures; and (iii) distribution of over the top services. The equity shares of Hathway are listed on the BSE and the NSE.

TV18 Broadcast Limited (TV18) is engaged in the media business and it broadcasts general news channels in Hindi, English and other regional languages and business news channels in Hindi, English and Gujarati and also broadcasts, through its subsidiaries, general entertainment channels in Hindi, English and other regional languages as well as factual entertainment channels. The equity shares of TV 18 are listed on the BSE and the NSE.

Media18 Distribution Limited (Media18) is a wholly-owned subsidiary of Network18 and has been incorporated to carry on the business of setting up, acquiring, holding/investing in and/or promoting various ventures inter alia relating to cable television services encompassing distribution, relaying and transmission of signals.

Web18 Digital Services Limited (Web18) is a wholly-owned subsidiary of Network18 and has been incorporated to carry on the business of setting up, acquiring, holding/investing in and promoting various ventures inter alia relating to the business of operating internet services, broadband services, ISDN services, leased line services and VSAT services.

Digital18 Media Limited (Digital18) is a wholly-owned subsidiary of Network18 Media & Investments Limited and has been incorporated to carry on business of setting up, acquiring, holding/investing in and /or promoting various ventures inter alia relating to the business of broadcasting, telecasting, relaying, transmitting or distributing digitally or in any other manner, any audio, video or other programmes or software.

All three Media18, Web18 and Digital18 are newly established companies incorporated mainly for the execution of the transaction.

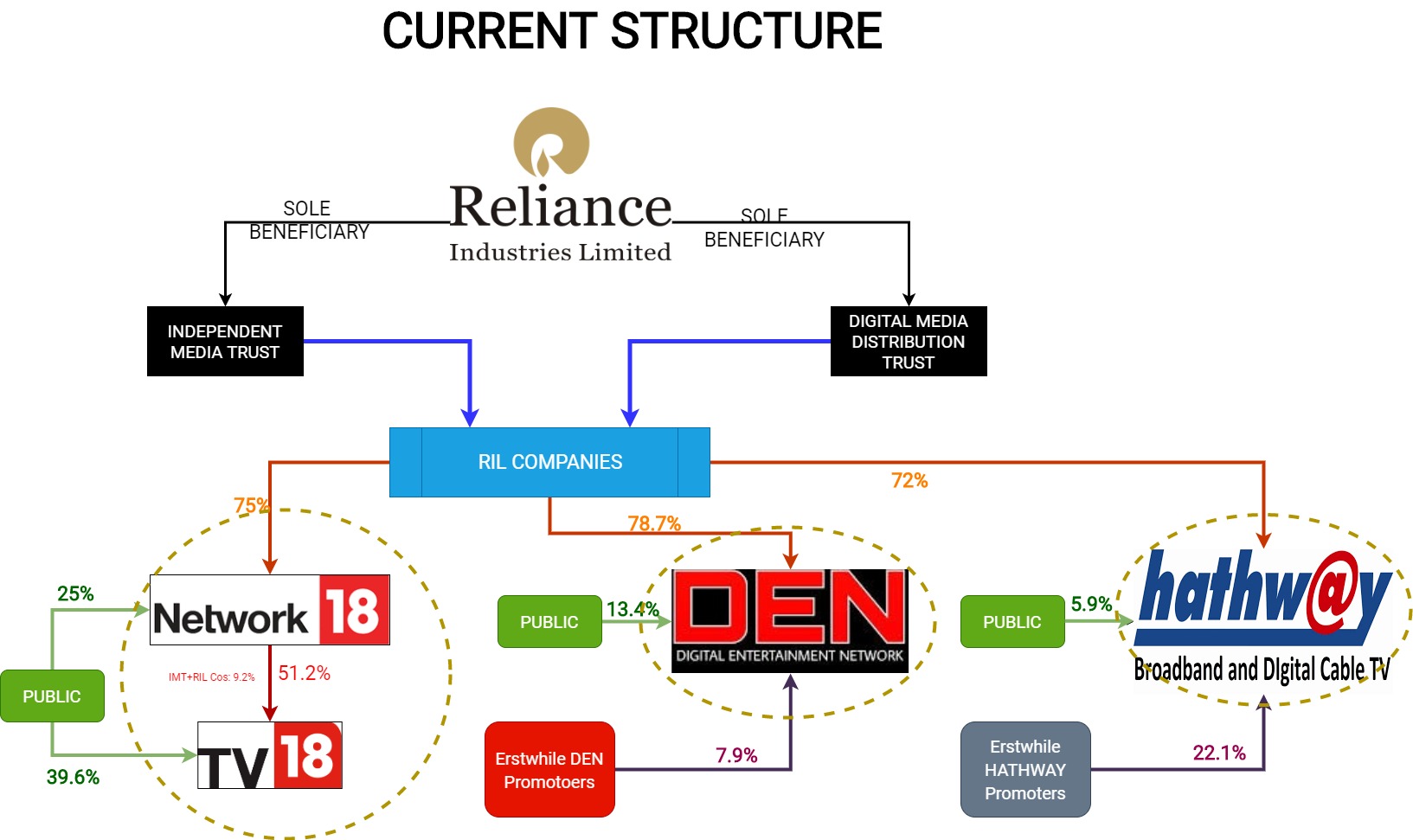

Current Structure

Previous Transaction

Acquisition of Network18

In one of the biggest ever deal in the Indian media sector, In 2014, Reliance Industries Ltd (RIL) acquired control in Network 18 Media & Investments Ltd, including its subsidiary TV18 Broadcast Ltd, for circa INR 4,000 crore.

For RIL, the takeover was a strategic move for its 4G telecom play in the country. The acquisition gave RIL access to all the content put out by Network18 group including in.com, IBNlive.com, Moneycontrol.com , Firstpost.com, bookmyshow.com and broadcast channels like Colors, CNBC, CNN-IBN etc.

Acquisition of Hathway

To expand cable & broadband sector, in 2018, Reliance Industries Limited made two strategic investments in Den & Hathway by acquiring the major stake in both the companies.

Current Transaction

After streamlining both acquisitions, RIL has now decided to consolidate its cable & broadband business through Scheme of Arrangement.

The Scheme inter alia provides for amalgamation of Den, Hathway and TV18 into Network18 and immediately later transfer of the cable, broadband/ISP and digital businesses in 3 (three) separate wholly-owned subsidiaries of the Company, namely Media18, Web18 and Digital18, respectively (“Business Transfers”) through Slump exchange. The consideration for Slump Exchange will be equal to the book value of the “Undertaking”.

As a result, all the cable business, ISP business and digital business will get merged with Network18. Immediately after the merger, Network18 will transfer the respective business to its wholly-owned subsidiaries through “Slump Exchange” for a consideration equal to the net worth of the respective businesses and thereby retaining 100% control over the respective businesses.

The consideration for business transfer shall be discharged by each of Media18, Web18 and Digital18 by issue of securities to the company.

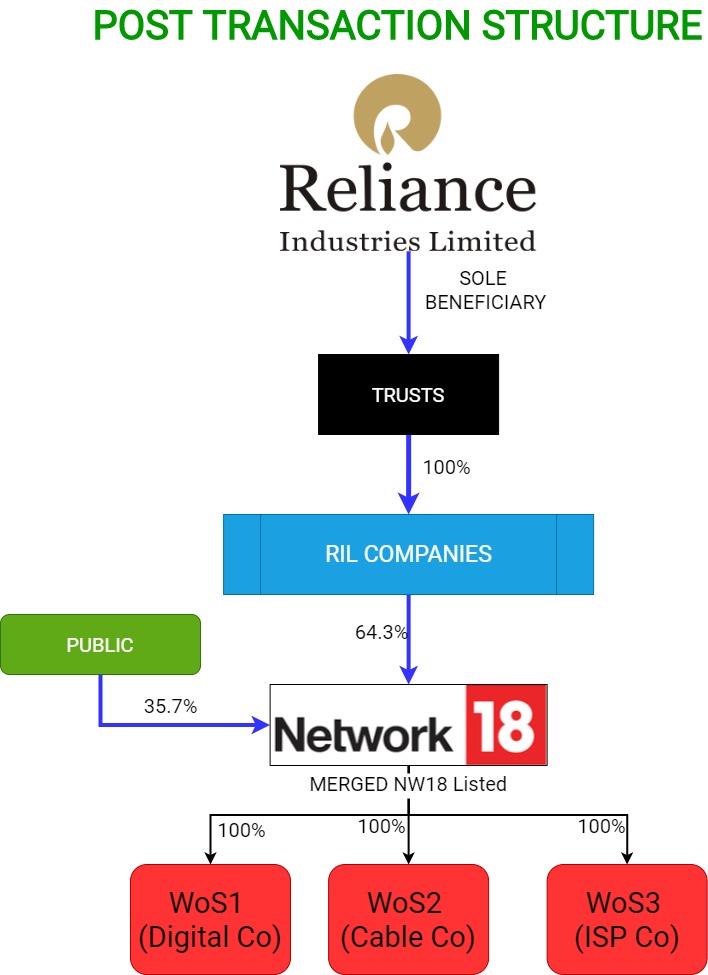

After the transaction, the group structure will look like:

Network18 is not engaged in Cable & ISP business. Cable Business Undertaking and ISP Business Undertaking are being transferred to the Network18 pursuant to the Amalgamation and simultaneously being transferred to wholly-owned subsidiaries under the Scheme. Network18 is having a presence in the Digital business and significant chunk of its revenue (more than 80% of the revenue) comes from it will get transferred as a part of Digital Undertaking. Further, DEN & Hathway both are engaged in cable & broadband business which after amalgamation, will be consolidated in the respective WoS.

The Appointed Date for the merger shall be February 1, 2020.

For the easy of transaction, DEN is in the process of transferring its register office from Delhi to Mumbai. The filling of the application and the petition pursuant to the scheme by DEN will be made in the jurisdiction of the NCLT of the new registered office of DEN i.e. Mumbai where other companies will make the application.

Rationale of the Scheme

The Scheme seeks to restructure the broadcasting, digital, media, broadband and cable distribution businesses of the scheme entities and achieve consolidation under a single publicly listed company. As a result of the “Slump Exchange” of respective businesses to WoS of the Network18, all the businesses will be housed under different entities while the control will remain with the company.

The Scheme shall also simplify the corporate structure of the group by reducing the number of listed entities.

The aggregation of a content powerhouse across news and entertainment (both linear and digital) and the country’s largest cable distribution network under the same umbrella shall boost efficiency and exploit synergies, creating value for all stakeholders.

The consolidation of cable businesses of Den and Hathway in one entity will leverage the combined strength of the ~27000 LCO partners who act as the touchpoints to around 15 mn households in India; delivering localised, people-friendly and ultra-fast customer services. The combined broadband entity will serve around 1 mn wireline broadband subscribers across the country.

Shareholders of all the four companies will benefit from streamlining of operations and strategy, focused management, and reduction of risk through consolidation.

After the recent acquisition of Hathway & DEN, RIL gave mandatory open offer to the public shareholders of those companies. As a result of the open offer, RIL’s stake increased substantially above the maximum stake allowed in the company. Eventually, it has become imperative for RIL to reduce its stake to 75% within allowed timeline. Now, as a result of the re-structuring, the same requirement will not be applicable. However, at the same time, RIL will likely to end up paying double stamp duty on the transaction.

Swap Ratio & Shareholding Pattern

The share exchange ratio for the merger will be:

- 92 shares of Network18 for every 100 shares of TV18

- 78 shares of Network18 for every 100 shares of Hathway

- 191 shares of Network18 for every 100 shares of Den

As on date, the shareholding pattern of the respective companies is:

| Particulars | Network18 | TV18 | DEN | Hathway |

| RIL | 75% | 9.2% | 78.5% | 72% |

| Network18 | NA | 51.2% | 0.1% | – |

| Den Erstwhile Promoters | – | – | 7.9% | – |

| Hathway Erstwhile Promoters | – | – | – | 22.1% |

| Total Promoter | 75% | 60.4% | 86.5% | 94.1% |

| Total Public | 25% | 39.6% | 13.5% | 5.9% |

As a result of the re-structuring, the revised shareholding pattern would be:

| Particulars | Network18 |

| RIL | 64.3% |

| Den Erstwhile Promoters | 1.8% |

| Hathway Erstwhile Promoters | 7.4% |

| Other Public Shareholders | 26.5% |

Paid-up Capital of each of the Companies Involved:

| Particulars | Network18 | TV18 | DEN | Hathway | Merged Entity |

| Paid-up Capital (In INR CRORES) | 104.69 | 171.44 | 47.72 | 177.01 | 410.71 |

The erstwhile promoters of Den & Hathway would be classified as public shareholders from current promoters. The share capital of the company will be increased from 104.69 crores to 410.71 crores. The existing public shareholding in Network18 will get decreased from 25% to circa 6.4%.

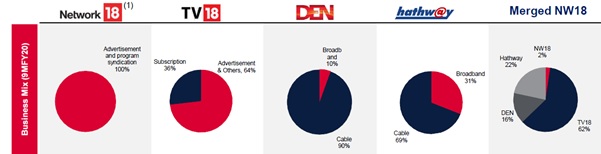

Financials

Key financials for nine months of FY 2020 of the companies involved as follow:

| Particulars | Network18 | TV18 | DEN | Hathway | Merged Entity |

| Revenue | 143 | 37 | 964 | 1343 | 6014 |

| EBITDA | -73 | 464 | 148 | 315 | 855 |

| EBITDA % | NA | 12.4% | 15.3% | 23.5% | 14.2% |

| PAT | -279 | 275 | 36 | 56 | 88 |

| Gross Debt | 1460 | 2103 | 208 | 2048 | 5817 |

| Cash | 93 | 210 | 2237 | 3309 | 5756 |

| Net Debt | 1367 | 1891 | -2029 | -1261 | 60 |

| Carry Forward Losses | 2720 | 752 | 1239 | 755 | 5466 |

Valuation

| Particulars | No. of Shares | Price Per Share (Rs.) | Valuation*(Rs. Crores) | MCAP**(Rs. Crores) |

| Network 18 | 1,04,69,48,519 | 28.1 | 2,942 | 1,760 |

| DEN | 47,72,23,845 | 53.7 | 2,563 | 1,310 |

| Hathway | 1,77,01,04,500 | 21.9 | 3,877 | 2,336 |

| TV18 | 1,71,43,60,160 | 25.8 | 4,423 | 2,360 |

*Valuation is as per Valuation Report

** As on 27th March 2020.

Income Tax Aspects of the Scheme

The merger of Den, Hathway and TV18 will be income tax neutral under section 47(vi) of the Income Tax Act, 1961. Further, the slump exchange from Network18 to respective WoS’ will be at a value equal to the net worth of the business. This is likely that there will not be any impact of Income Tax under Section 50B of the Income Tax Act, 1961.

Further, the carry forward losses available with DEN, Hathway & TV18 gest transferred to Network18 as result of the merger. However due to the Slump exchange of the respective loss making businesses also from the same appointed date to WoS is not in compliant of Sec 72A of the Income-tax Act, 1961, those Wos may not be able to claim those losses. The business of Network18 after transferring digital business will be minuscule & the remaining Network 18 will be left with large carry forward losses.

Conclusion

The Scheme inter-alia provides for the consolidation of RIL’s some of the acquired businesses in Telecommunication & Media sector in the past. The move will not only reduce the number of listed entities for RIL but also re-aligning the synergy among the businesses.

The transaction structure is designed in such a way that all the listed businesses will be housed under one entity and more importantly further Slump Exchange will effectively de-list those businesses without any implications of SEBI. The transaction will also pave the way for RIL to invite different strategic partners for Cable, ISP and Digital business in the future. Even substantial acquisition by those strategic partners in future will not trigger any requirement of SEBI Takeover Code.

The reorganization furthers the group strategy of building a media powerhouse that is agnostic across pipes, platforms and screens. Synergies is expected to generate huge value for all concerned and by giving minority stake to foreign partners, it will have enough cash to strengthen businesses for few years. Who knows in the next step all or some of the businesses housed under subsidiaries is transferred to Reliance Jio.

Add comment