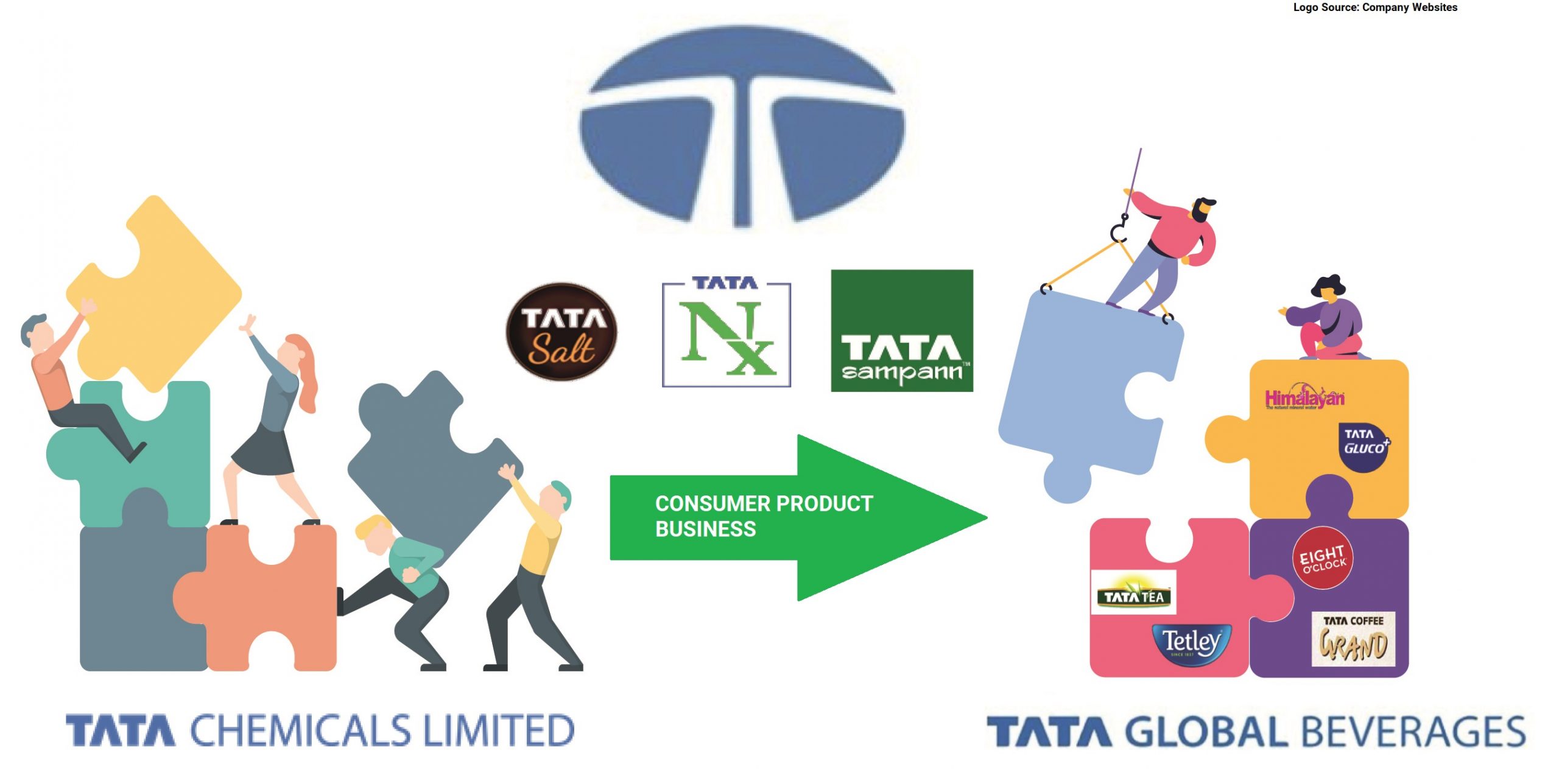

In a major corporate restructuring, Tata Global Beverages Ltd shall acquire all the branded consumer food businesses from Tata Chemicals Ltd. in an all-stock transaction that is aimed at creating a consumer business company. This will add TATA Salt and TATA Sampan brands as different product line of Salt and Staples along with its existing products in Tea, Coffee and other liquid beverages.

A long-term supply agreement in place, Tata Chemicals post existing the business shall still supply the products for both the brands and sales and distribution shall be taken care by Tata Global beverages leaving Tata Chemicals to focus on their core business of manufacturing and selling of basic chemistry and speciality chemicals.

Tata Chemical Limited (TCL), established in 1939, is a global chemicals company serving the needs of industry, consumers and the agricultural sector. The company manufactures inorganic chemicals, consumer products, crop protection and agriculture inputs, and nutritional solutions. It serves a varied set of customers across five continents with employees spread across four regions.

TCL is serving society through various product currently company having following portfolio of product

- Basic chemistry product (Soda ash, Sodium Bi-carbonate, Tata Salt)

- Speciality products (Agro Sciences, Nutritional Sciences, Material Sciences, Energy Sciences)

Tata Global Beverages Limited (TGBL), is a global beverage business; its brands have presence in over 40 countries. The company has significant interests in tea, coffee and water and is the world’s second largest tea company. Tetley is the most known brand of TGBL in the world.

Transaction

The Scheme provides for demerger of “Consumer Product Business”

“Consumer Product Business” of the Tata Chemicals Ltd. (demerged company) has been identified as the business of sourcing, packaging, marketing, distribution and sales of vacuum evaporated edible common salt for human consumption, spices, protein foods and certain other food and other products. Under the Scheme, the salt manufacturing facility, basic chemistry products and specialty products business of the Demerged Company are not proposed to be transferred to the Tata Global Beverages Ltd. (resulting company) and will continue to be owned by the demerged Company.

Consideration is 114 equity shares of the resulting company of ₹1 each fully paid up for every 100 equity shares held in the Demerged Company of ₹10 each fully paid up. The transaction value of consumer business of Tata Chemicals is around ₹5,800 crore i.e. three times the turnover of the consumer product business.

Note: Transaction will not impact subsidiary or associate or JV companies of TGBL – such as Tata Coffee, Tata Starbucks, Nourischo, KDHP and APPL or its international business.

The scheme provides for the change in the name of the resulting company to “Tata Consumers Products Limited”

Note: TGBL is also entered into a non-binding term sheet to acquire the branded tea business of Dhunseri Tea & Industries Limited, for an aggregate consideration of up to INR 101 crores.

Rationale for demerger

- Integrate the consumer products business activities undertaken by both, the demerged company and the resulting company, under single entity.

- Enable the Resulting Company to expand its product portfolio in fast moving consumer goods categories in India and abroad.

- Results in revenue and cost synergies including from supply chain opportunities, logistics alignment leading to economics of scale, creation of efficiencies and optimization of capital and operational expenditure.

- Enhance the financial profile with higher growth, margin expansion and increased cash flows which will provide further headroom for inorganic growth opportunities in India and abroad.

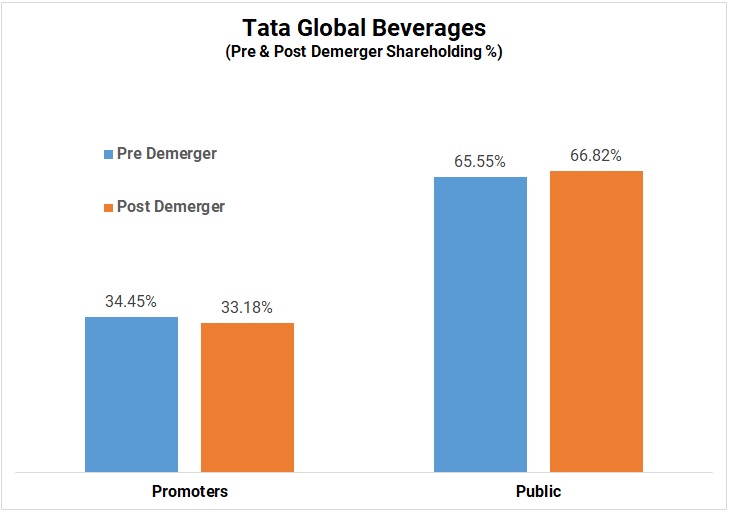

Shareholding Pattern:

There will no change in shareholding of Tata Chemicals Ltd. post demerger. TCL shareholders to own 31.4% of the combined entity post demerger.

Financials:

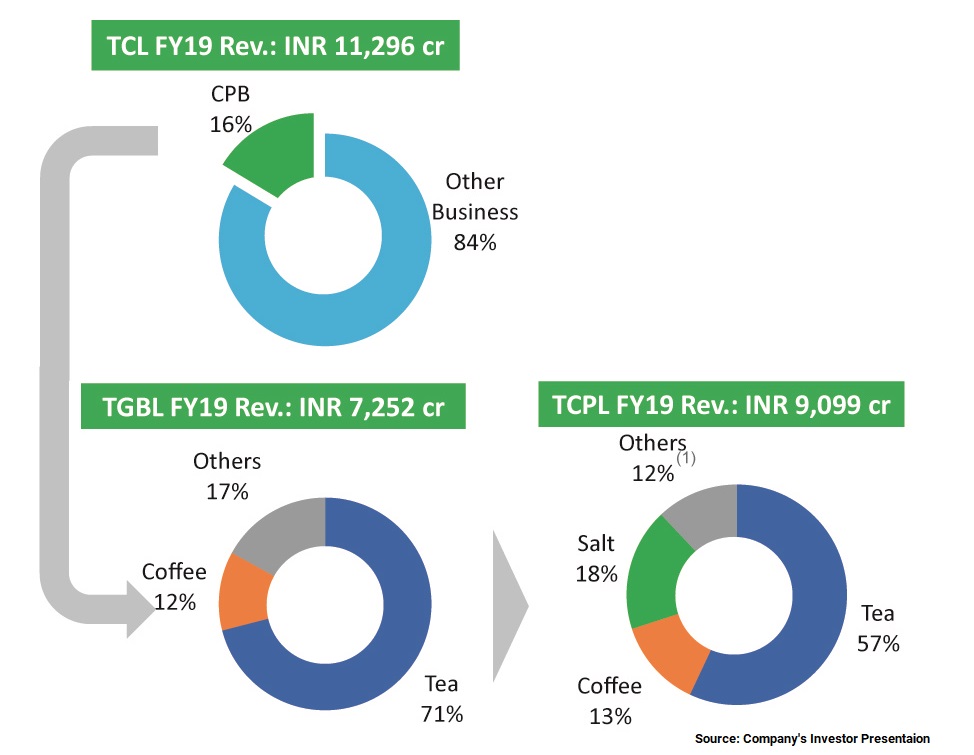

Turnover of demerged consumer product division as on March 31, 2019 was ₹1,847 crore which constituted ~16% of the consolidated revenue of Tata Chemicals and ~18% (₹314 Crores) contribution to profit before interest and taxes.

Table 1: Financials of Consumer Product Business of Tata Chemicals as on 31.3.2019 (All Figs in ₹ Crores)

| Particulars | Amount |

| Revenue | 1847.28 |

| Results | 313.89 |

| Assets | 220.44 |

| Liability | 181.69 |

This addition of business post demerger should slightly increase the EBITDA margins for Tata Global Beverages but slightly decreases margins for Tata Chemicals.

Table 2: Segment Wise Financials of TGBL pre and post Demerger (All Figs in ₹ Crores)

| Particulars | Tata Global Beverages Ltd. | Demerged Consumer Product Business | Post Transaction | |||||

| India Branded | Total | India Branded | Total | |||||

| Revenue | 3160 | 7252 | 1847 | 4978 | 9099 | |||

| EBITDA Margin | 15.50% | 11.60% | 17.10% | 16.10% | 13% | |||

| Net Profit | NA | 408 | 204 | NA | 612 | |||

| Net Cash/(Debt) | NA | 721 | NA | NA | 721 | |||

Table 3: Financials for TCL pre and post Demerger (All Figs in ₹ Crores)

| Particulars | Tata Chemical Ltd. | Consumer Products Business-Demerged | After Demerger |

| Total | Total | ||

| Revenue | 11296 | 1847 | 9449 |

| EBITDA Margin | 14.54% | 17.11% | 14.03% |

| Net Profit | 1386 | 204 | 1182 |

Conclusion

Recently we are seeing some consolidation in the consumer product business domestically as well as globally. We covered a couple of articles viz. on merger of GSK and HUL and Zydus’s acquisition of Kraft Heinz in our past issues.

Tata group, as well, recently are trying to consolidate businesses into one company, as a strategy so to make operations, future investments, growth strategy and scaling up in more focused manner with ease. The intention of demerging the consumer product business from Tata Chemicals doesn’t seem to be to create synergy as the product portfolio of Tata Global Beverages is currently not like the brands it shall add but mere consolidation to strengthen the Food and Beverages business in a single business entity.

Tata Chemicals is one the oldest companies amongst Tata group which is focused on manufacturing and selling of basic chemistry and specialty chemicals to various sectors which also included retail products like Tata Salt and Tata Sampan brands since inception. This demerger should enable to realign their focus on growth on the B2B side which currently constitutes almost 85% of its business. Even though the brands shall be a part of Tata Global Beverages, supply shall remain with TCL.

Addition of these retail brands shall help TGBL to transform into a broader player and give access to 200 million households over about five million retail points, making it one of the largest consumer footprints in the country. However, dilution of 50% for TGBL shareholders as paid up capital increases to ₹920 crores from ₹631 crores which may make it difficult to give reasonable returns to the shareholders in the short term unless and until there is substantial scaling up with improved EBITDA margins.

Add comment